The price of gold seems undecided in the short term. It was trading at 1,654 at the time of writing. Technically, the price action signaled exhausted sellers but it's premature to talk about a new leg higher as long as it stays under strong upside obstacles.

Fundamentally, the US released Industrial Production and Capacity Utilization Rate indicators which came in better than expected. The economic data could be bad for the XAU/USD in the short term.

In my opinion, Gold could continue to move sideways in the short term as the UK and Canada are to release the inflation figures tomorrow. The CPI and Core CPI represent high-impact events and could really shake the price.

XAU/USD Downside Seems Over!

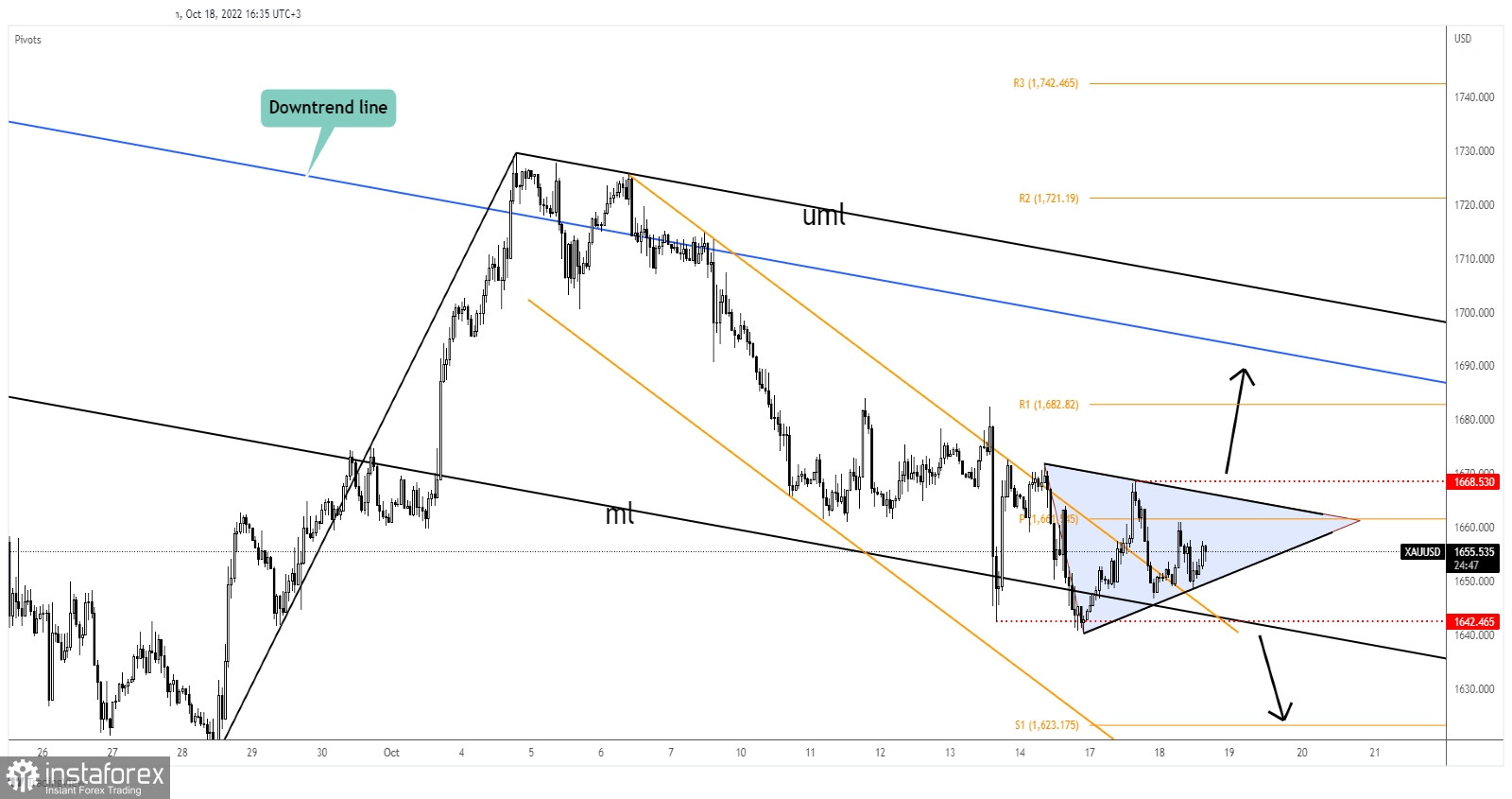

Technically, the rate found support right below the median line (ml) and now it has escaped from the down channel pattern signaling a potential upside movement. Now, it has developed a triangle pattern.

Escaping from this pattern and from the current range movement could bring new opportunities as the XAU/USD should register a strong move.

XAU/USD Prediction!

Staying above 1,642 and above the median line (ml) and making a valid upside breakout from the current triangle, a new higher high, jumping, and closing above 1,668 activates further growth towards the major downtrend line. This scenario could be seen as a buying opportunity.