GBP/USD – 1H.

Good afternoon, dear traders! On the 1H chart, the GBP/USD pair on Wednesday dropped to the yearly low near the correction level of 161.8% - 1.3150. In the evening, after the announcement of the results of the FOMC meeting, it made an upward reversal to the Fibonacci retracement level of 127.2% - 1.3296. The greenback may also gain momentum after a rebound of the pound sterling. However, within the next half hour, the Bank of England will end its meeting and announce its results. Thus, traders should be ready to digest lots of news. Yesterday, the Fed announced a reduction in the quantitative stimulus program by $ 30 billion. Today, the Bank of England will unveil the results of the Monetary Policy Committee's vote on the key rate and the volume of asset purchases. If the BoE makes some changes in the parameters of monetary policy, it is sure to affect the trajectory of the British currency. The UK also revealed its Manufacturing and Services PMI indexes. The first one decreased slightly to 57.6, while the second one dropped significantly to 53.2.

Therefore, a slight drop in the pounds sterling the last few hours was due to fundamental factors. The US will unveil these indexes today. however, traders may ignore these reports as they are more interested in the results of the Bank of England meeting. The pound sterling rose to the level of 1.3296 with great difficulty. It managed to move away from the yearly low by 100 pips. Last night and tonight, it is unlikely to grow as the Fed's stance on monetary policy was quite hawkish. Additionally, the pound sterling is facing pressure due to a new wave of the epidemic and the high risks associated with the omicron strain. Boris Johnson has already called on all residents of the UK to get a third vaccine shot in the near future. The government has also introduced quarantine restrictions in all public places. UK residents are required to wear masks and, if possible, switch to work from home. This is why the pound sterling is lacking drivers for further growth.

GBP/USD – 4H.

On the 4H chart, the pair returned to the correction level of 61.8% - 1.3274. If the pair again rebounds from this level, the US dollar may rise. The pair is likely to decline to the Fibonacci retracement level of 76.4% - 1.3044. If the pair consolidates above the level of 61.8%, it may touch the next Fibo level of 50.0% - 1.3457. There are no trading divergences today.

Economic calendar for EU and US:

UK- Manufacturing PMI Index (09:30 UTC).

UK- Services PMI Index (09:30 UTC).

UK- BoE's key rate decision (12:00 UTC).

UK - BoE's decision on asset purchases (12:00 UTC).

US – Initial jobless claims report (13:30 UTC).

US – Industrial production (14:15 UTC).

US – Manufacturing PMI Index (14:45 UTC).

US– Services PMI Index (14:45 UTC).

The UK published its PMI indexes reports on Thursday. The results of the Bank of England meeting will be announced today. A little later there will be a batch of reports from the US. So, macroeconomic statistics are sure to have an impact on market sentiment.

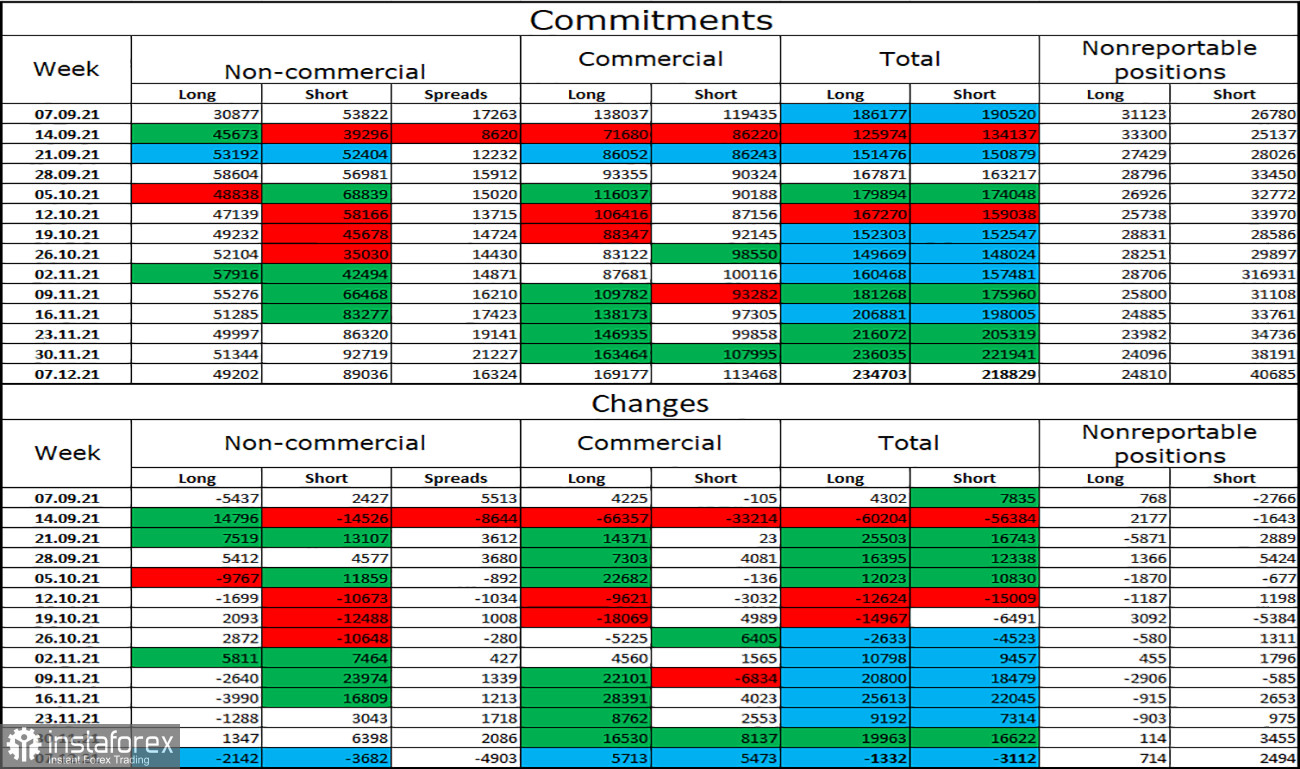

COT report (Commitments of traders):

The latest COT report published on December 7 showed that the mood of major market players has not changed much. The bearish bias has remained strong for 5 weeks. In the reporting week, speculators closed 2,142 long contracts and 3,682 short contracts. However, the total number of short contracts in the "Non-commercial" category of traders is now almost twice as high as the number of Long contracts. Thus, judging by the weekly results and the COT report, the pound sterling lacks the strength to resume an upward movement. So, it is likely to keep declining.

Outlook for GBP/USD:

I recommend opening long positions on the pound sterling if it closes above the level of 1.3274 on the 4H chart with the target levels of 1.3296 and 1.3411. It is better to refrain from opening short positions.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, and large investors.

"Commercial" - commercial enterprises, firms, banks, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.