Analyzing trades on Thursday

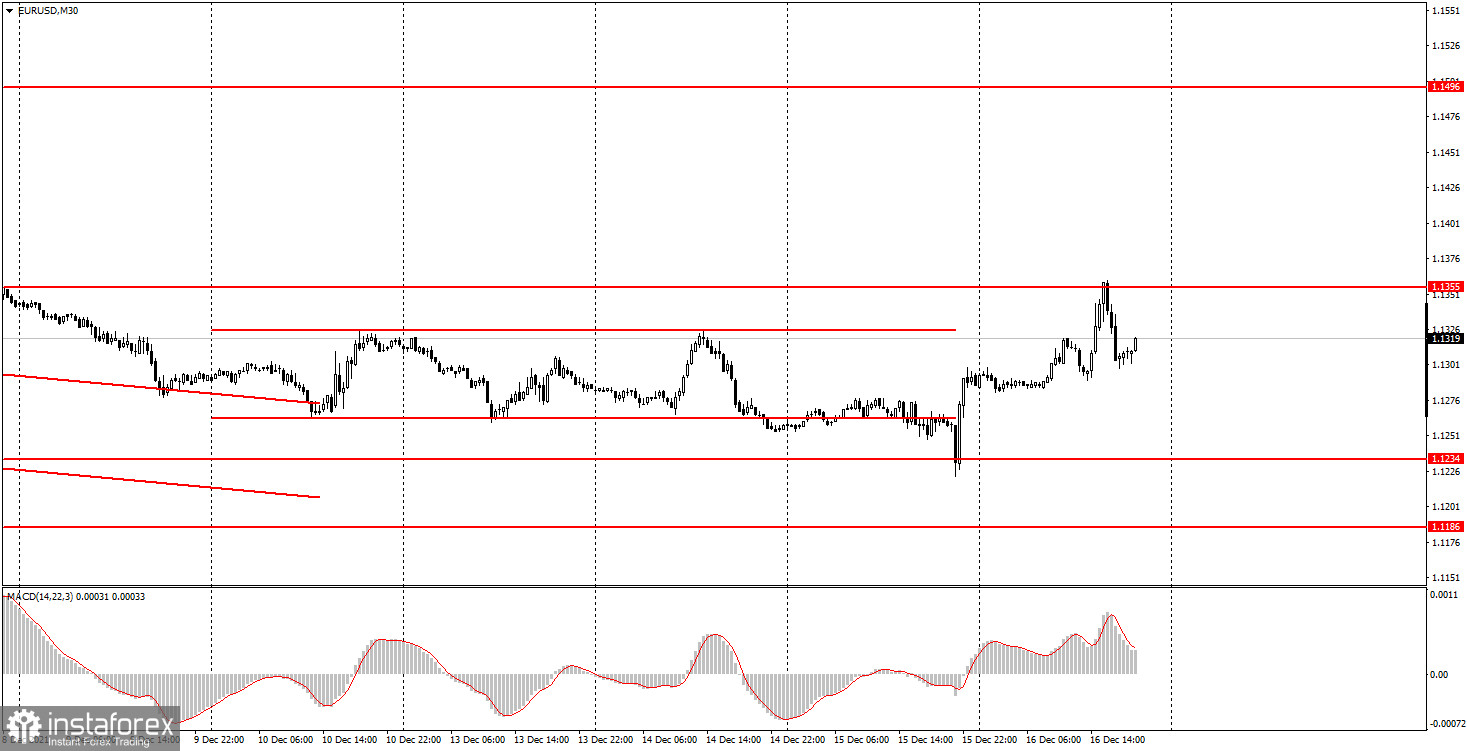

EUR/USD on 30M chart

EUR/USD was rather volatile on Thursday. This was hardly surprising given that the Fed and the ECB summed up the results of their December meetings last night. The European regulator did not announce anything that could surprise the markets. Yet, traders were still digesting the outcome of the Feds' meeting. Therefore, the pair movements were quite good in the morning, in the afternoon, and in the evening. On the 30-minute time frame, however, we could clearly see that the pair bounced off the level of 1.1234 and 1.1355. Thus, we can again define a sideways channel but this time with a broader range. As for the important events and publications that influenced the movement of the euro/dollar pair, the first tick in the illustration above appeared when the business activity index in the eurozone services sector was published. The indicator turned out to be much worse than expected. The second tick coincided with the publication of the results of the ECB meeting. The third one appeared along with the release of the economic data in the US which in fact had no effect on trading.

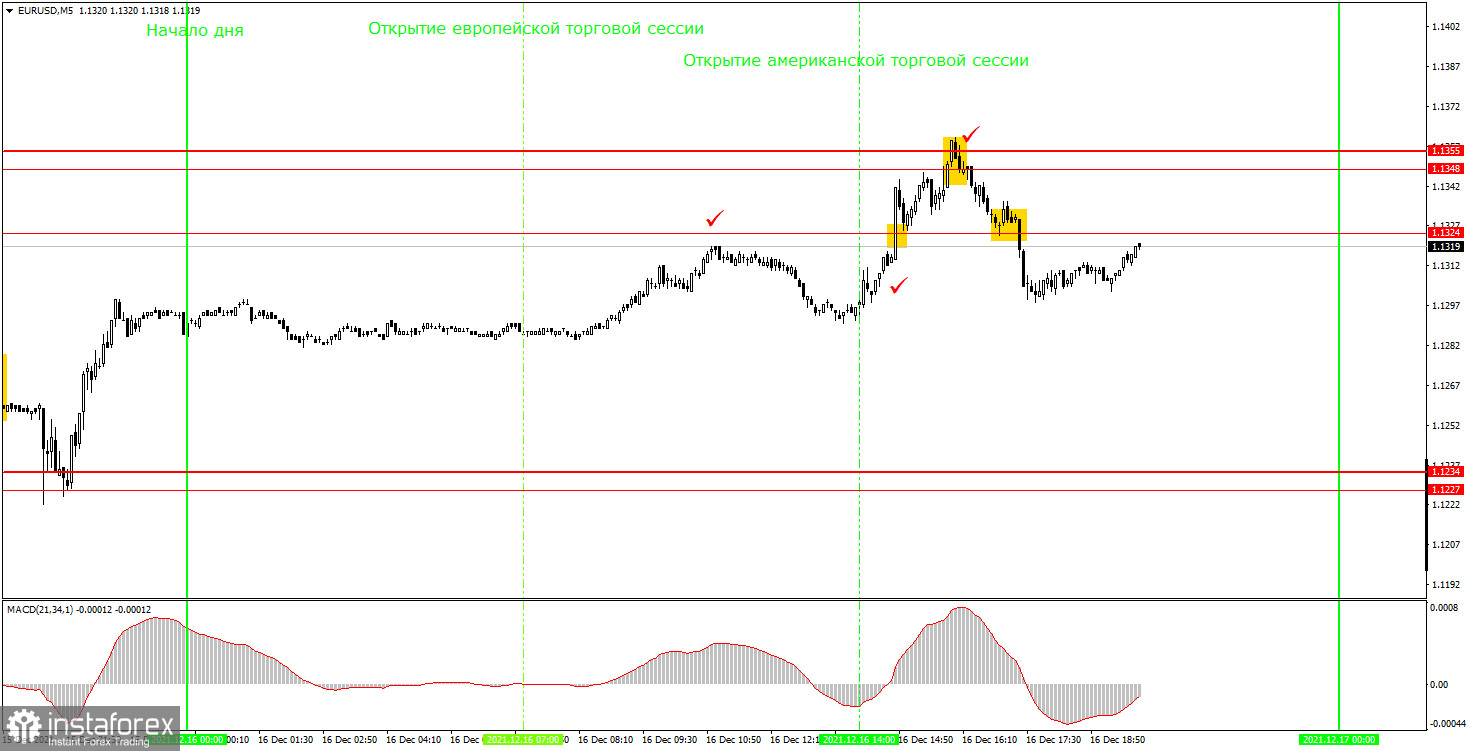

EUR/USD on 5M chart

On the 5-minute time frame, the movements were also strong. The first signal was formed too late and it should not have been used at all since the price crossed the level of 1.1324 exactly at the moment when the ECB meeting results were released. The market reaction could be unpredictable (as in the case with the Fed), so novice traders should have definitely avoided the risk. The next sell signal was formed when the pair pulled back from the resistance area of 1.1348 - 1.1355, and this signal could already be followed. As the signal was formed, the price went down by about 42 pips, so any Take Profit could be triggered. Also, beginners could close the sell position manually after breaking through the level of 1.1324. Even though only one trade was opened on Thursday, it turned out to be profitable, and newcomers avoided trading during a storm in the foreign exchange market.

Trading tips on Friday

On the 30-minute time frame, the EUR/USD pair is in the process of forming a new trend, but at the moment, it is still stuck in a sideways channel between 1.1234 and 1.1355. Moreover, the pair is unlikely to leave this channel in the coming days. Today, traders will most likely take a breather from the two central banks' meetings, so we do not expect to see strong movements. On the 5-minute time frame, the key levels for December 17 are 1.1227 - 1.1234, 1.1324, 1.1348-1.1355, and 1.1422. A Stop Loss should be placed to a breakeven point as soon as the price passes 15 pips in the right direction. On the M5 chart, the nearest level could serve as a target unless it is located too close or too far away. If it is, then you should act according to the situation or trade with a Take Profit. On Friday, the European Union will publish a report on inflation. However, this is its second estimate for November, so it is unlikely to provoke any reaction in the market. No important events are expected on Friday in the US. Therefore, traders will have to rely only on technical factors when making trading decisions.

Basic rules of the trading system

1) The strength of the signal is determined by the time the signal took to form (a bounce or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on false signals (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only given that volatility is strong and there is a clear trend that should be confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trend lines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.