Bitcoin rose on Wednesday and Thursday, but a new downward movement is expected by experts.

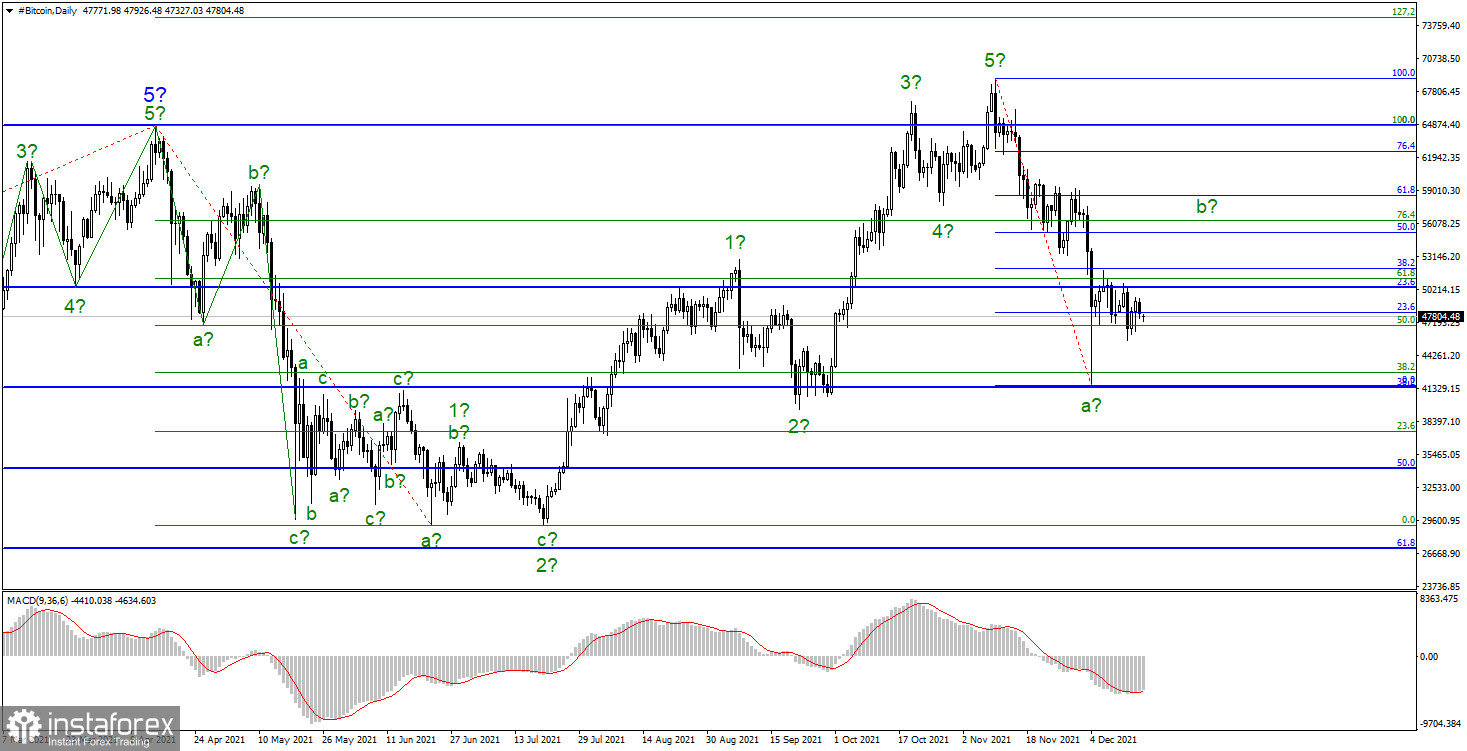

Last December 14 and 15, the main cryptocurrency managed to increase by $ 2,200 and continues to be in the phase of forming a downward wave, presumably a. Since there has been no increase in quotes for the last few weeks, a correctional wave b or its counterpart on the chart cannot be observed. Based on this, it can be concluded that wave a continues, and the cryptocurrency may resume its decline within its framework. At the same time, the assumed wave b can take a three-wave form and bring the instrument to $ 55,295, which equates to 50.0% Fibonacci. But after this ends, a new decline should follow, since the corrective structure can be at least three waves.

The news background for Bitcoin has been quite weak in recent days. Despite the fact that the meetings of the Fed, the ECB, and the Bank of England ended yesterday and the day before yesterday, all this news had an indirect impact on the cryptocurrency segment. However, analysts still believe that Bitcoin will not be able to ignore the fact that all central banks in the world are curtailing incentive programs. Yesterday, the Fed announced a reduction in its QE program by $ 30 billion, and today, the ECB announced that it will reduce the volume of asset purchases under the PEPP program in the first quarter of 2022. Both banks will complete their programs in March 2022.

The Fed's monetary infusions can collapse the stock and cryptocurrency markets.

The main idea behind Bitcoin's decline is now the refusal of central banks to stimulate the economy. In this regard, inflation will decline over time, and bitcoin has been viewed by investors exclusively as a means against inflation in recent years. If inflation continues to fall, then investors will no longer rush looking for funds against it. In addition, the demand for bitcoin may decline. At the same time, the number of investments in Bitcoin will also decline due to the decline in QE, PEPP programs, and their counterparts at other central banks. Analysts also argue that a reduction in QE and a Fed rate hike could bring down the stock market, which has been growing over the past year due to large technology companies, while many small companies are experiencing problems and could collapse if monetary policy starts to tighten. And the stock market can pull down the cryptocurrency sector, which is a high-risk segment. In this case, there are several reasons to expect a further decline in Bitcoin quotes at once, and they are all tied to the Fed and other central banks that have taken up their monetary policies in an attempt to normalize them. From here, we can say that Bitcoin may decline for several more months. By mid-2022, most analysts agree that it will be able to restore the upward trend. But it's too early to talk about it yet.

The trend's upward section in its internal structure does not cause any doubts and looks complete. If this is really the case, then the formation of a descending set of waves has begun and continues. So far, it cannot be concluded that even the first wave of a new downward trend has ended. Thus, wave a can take on an even stronger and extended form. It can be recalled that Bitcoin is very dependent on the news background, as well as on the mood of the market. If the market decides to sell Bitcoin, then nothing prevents the first wave from acquiring a much more extended form. Since the attempt to break through the 23.6% Fibonacci level was unsuccessful, the decline may continue with targets located around $ 42,731 and $ 41,394, which corresponds to 38.2% and 38.2% Fibonacci. There is also an option with an increase within wave b to $ 55,295, from which a decline can be expected.