If earlier, it was believed in the markets that it was the Fed that would become the initiator of raising interest rates among world central banks, the Bank of England unexpectedly took the lead, being concerned about the strong growth of inflation and, as a result, its negative impact on the UK economy.

On Thursday, the Bank of England showed determination and raised the key interest rate by 0.15%, that is, from 0.10% to 0.25%. This news strongly affect the rate of the pound, which sharply increased against the main currencies, but then pulled back. It was only paired with the US dollar that it managed to maintain its positions before the start of European trading on Friday. Stabilization is marked on the currency markets against the background of yesterday's events related to the final decisions of the world's largest Central Banks – SNB, ECB, Bank of England, and this morning, the Central Bank of Japan. By the end of Thursday's trading, the dollar index corrected to the level of 96.00 and is still consolidating there in a narrow range.

Trading in Europe began on the stock markets in the negative zone, with the exception of the British FTSE 100, which is gaining slightly. Crude oil prices also remain in the negative zone for the time being.

Why is the market sentiment deteriorating?

We believe that after the topics of the results of the meetings of the central banks were played out, investors fully switched to topics about COVID-19. Reports about the continuation of the process of infection of the population of economically developed countries with Omicron have again plunged financial markets into despondency. The example of the reaction of the British government in the form of a lockdown is hovering again and forces market players to fear that the pandemic may dominate again, as it was in 2020.

In this regard, the question of the possibility of a full-fledged Christmas rally in the stock markets is raised again. We believe that a lot, if not everything, will depend on American investors. If they move away from the topic of coronavirus infection, then the rally will take place. If they remain under the influence of negative media headlines, then this will not happen. But do not despair yet. If last year, the rally took place during the acute phase of the COVID-19 pandemic, although not in such a large volume, then most likely, it will also please investors this year, allowing them to earn before the new year.

Forecast of the day:

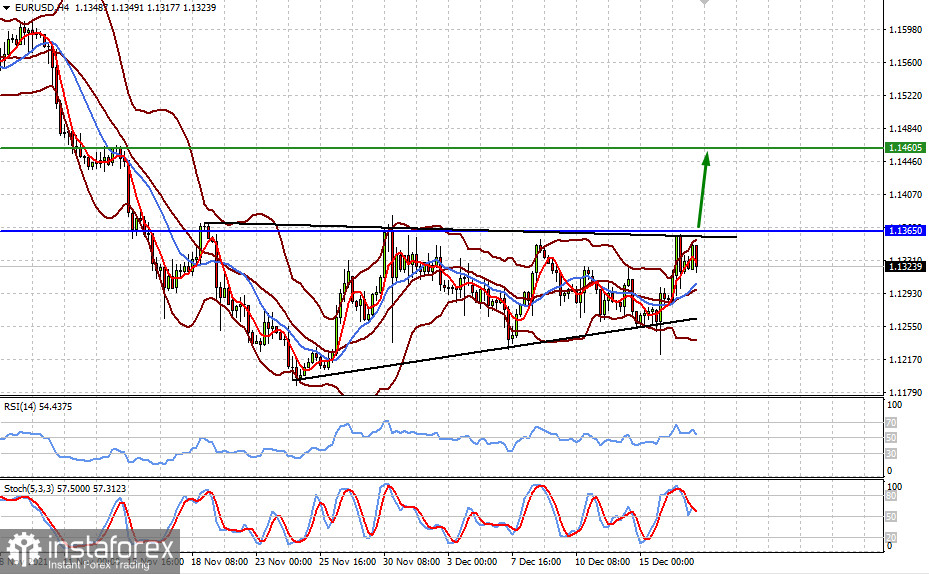

The EUR/USD pair is trading below the level of 1.1365. If the mood in the market changes from negative to positive as a result of the demand for risky assets, the pair's local growth to the target level of 1.1460, after breaking the level of 1.1365, can be expected.

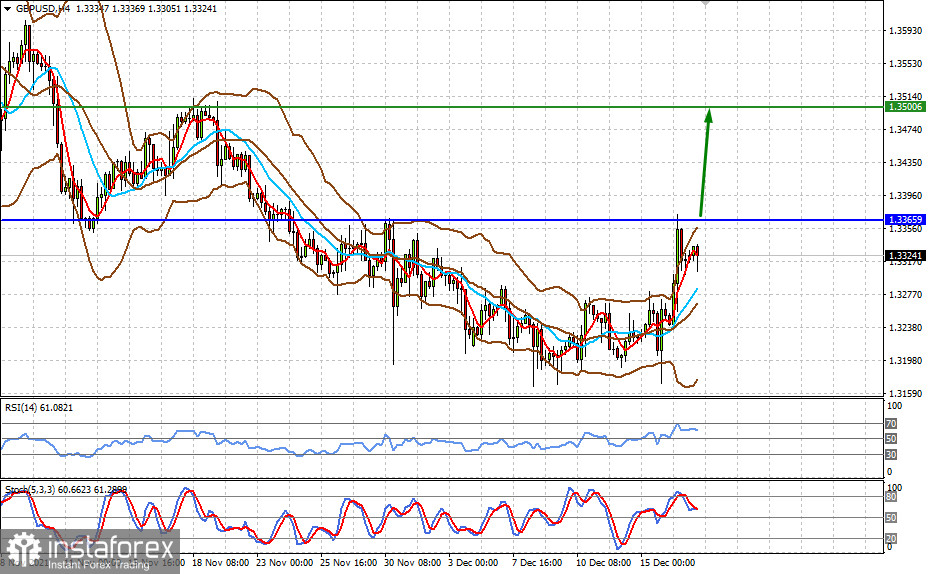

The GBP/USD pair may also receive support in the wake of an increase in demand for risky assets, which traditionally puts pressure on the dollar exchange rate. In this case, the breakdown of the 1.3365 level may open the way for the pair to further increase to 1.3500.