Important news for today:

Eurozone's consumer price index will be published today at 10:00 Universal time. How will it affect the EUR/USD pair? What does the currency pair form according to the wave analysis? Let's consider them below.

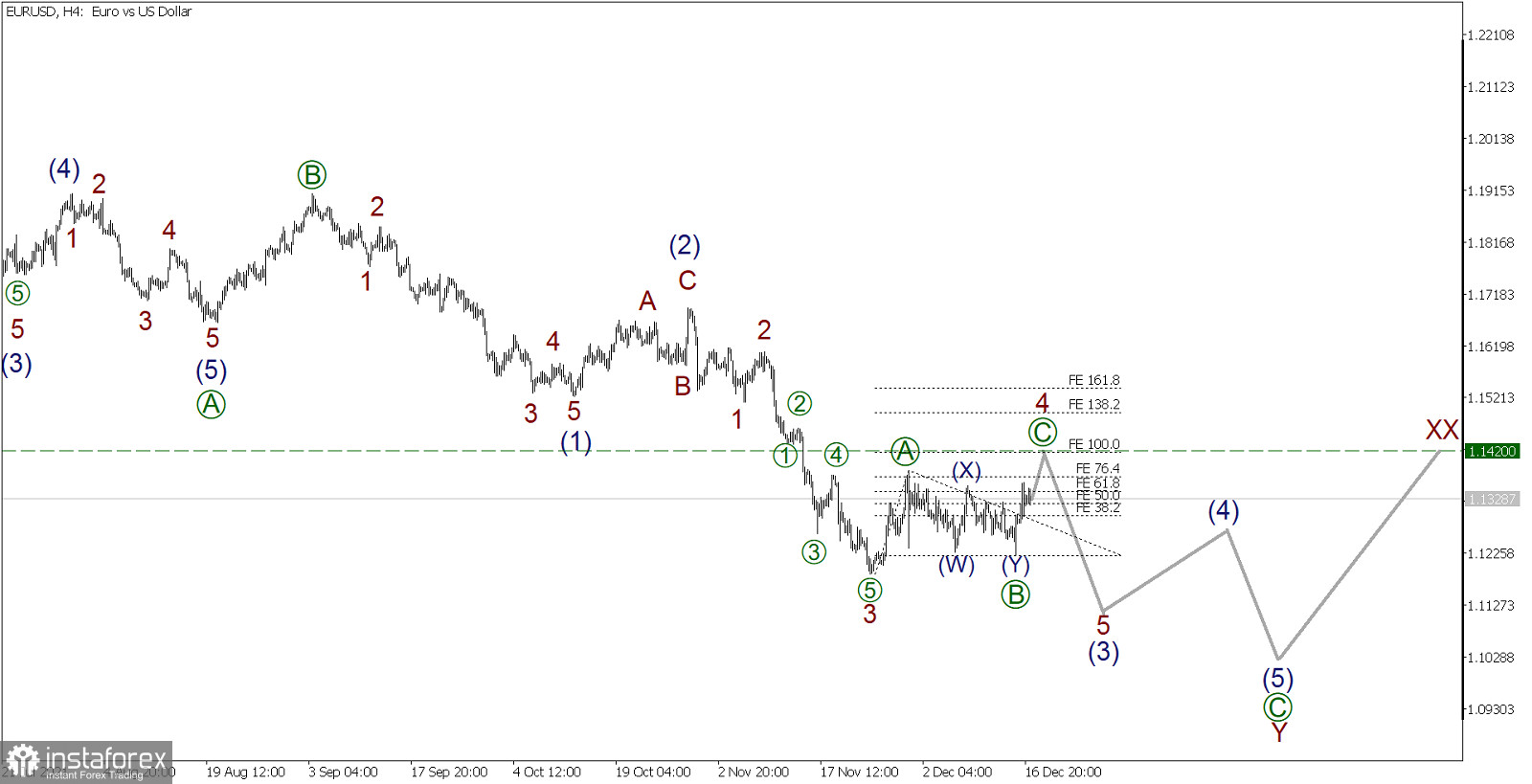

EUR/USD, H4 timeframe:

The EUR/USD pair continues to build a major corrective trend, which may take the form of a triple zigzag W-X-Y-XX-Z. On a four-hour timeframe, we see the internal structure of the middle part of this triple combination, that is, the sub-wave Y.

Wave Y hints at a simple zigzag [A]-[B]-[C], which can be completely completed in the medium term, after which the price can begin to rise in wave XX, as shown on the chart. For the full completion of wave Y, an impulse wave [C] is needed. It is very possible that wave [C] is only half completed, so the price may continue to decline in the impulse sub-wave (3) in the near future. However, if one looks at the lower wave level, it can be seen that the correction wave 4, which is part of the impulse (3), has not yet been completed.

Therefore, we can expect the price to rise in the final part of correction 4 anytime soon, which takes the form of a zigzag [A]-[B]-[C] to the level of 1.1420. At this level, the magnitude of the impulse sub-wave [C] will be equal to the impulse wave [A].

Currently, opening buy deals can be considered.

Trading recommendations:

It is recommended to buy from the current level and take profit at 1.1420.