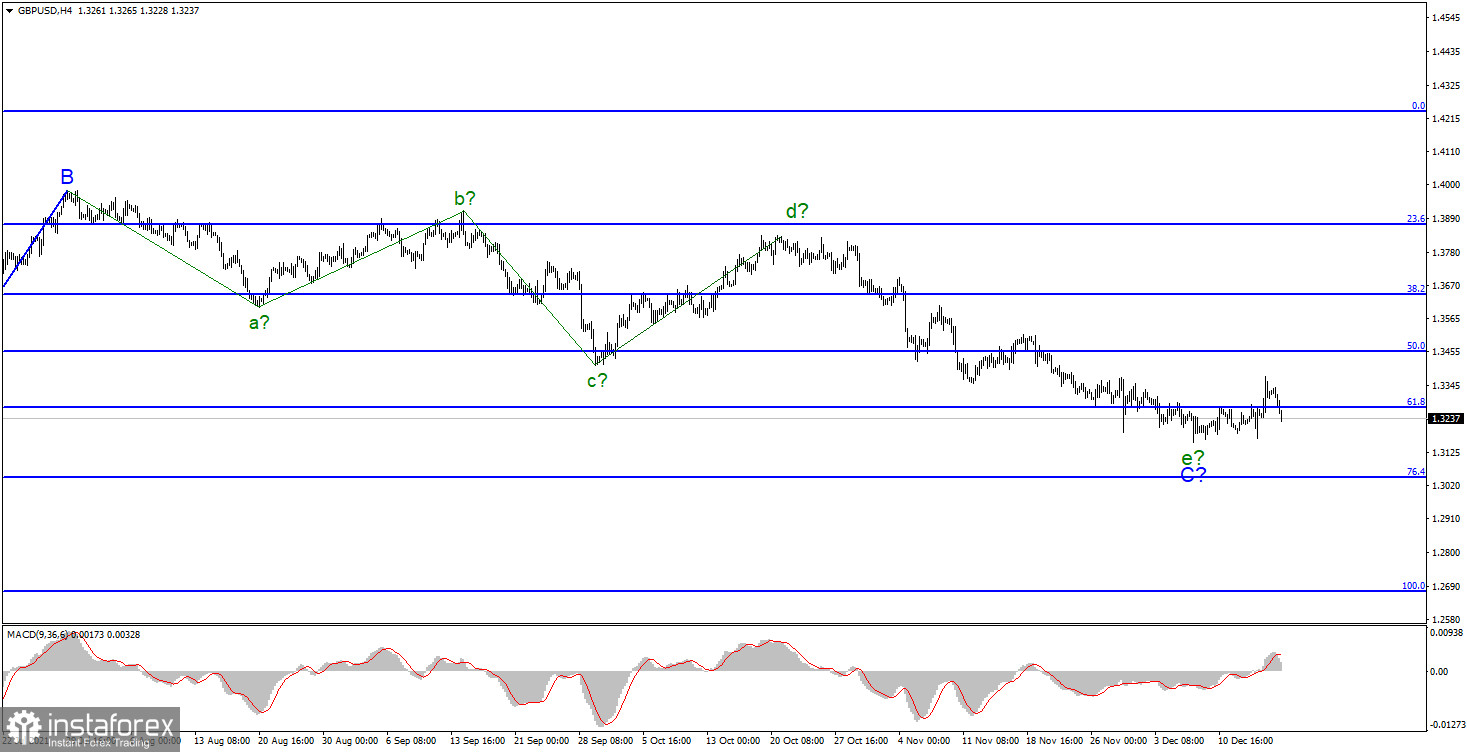

For the pound/dollar instrument, the wave markup continues to look quite convincing. If the current wave pattern is correct, then the construction of the last wave C has now been completed. An increase in the quotes of the instrument in recent days may mean that the entire downward section of the trend has completed its construction. If this is indeed the case, then at this time, a new upward trend section begins its construction, which may also turn out to be corrective. Also, the increase in quotes could begin within the global wave D, after which a new decline will begin within wave E. In general, the situation with the waves has become a little clearer thanks to the meetings of the Bank of England and the Fed, but at the same time, the corrective essence of the movements in 2021 leaves a fairly large number of possible scenarios. However, we will not think about alternative scenarios yet. So far, the construction of an upward wave has begun, which means that it should be worked out.

The pound experienced a surge of optimism, but on Friday began to decline.

The exchange rate of the pound/dollar instrument decreased by 50-60 basis points during Friday. The information background of today was not strong, but it was still there. In the morning, a retail trade report was released in the UK. Taking into account fuel sales in November, the indicator increased by 1.4% m/m with market expectations of +0.8% m/m. Excluding fuel, retail sales increased by 1.1% m/m with expectations of +0.8% m/m. Thus, the pound had a good opportunity to continue the increase in the morning. However, despite the reasons provided by the wave marking, it is still very difficult for the pound to grow. At the moment, the instrument has managed to move away from the lows of this week by only 130-140 basis points. This is enough to start a new wave, for example, D, but not enough to unambiguously conclude that a new upward trend segment has begun. If the demand for the British remains not too high even after the Bank of England has raised the interest rate, then it is very difficult to say what can increase the demand for it at all. In fairness, it should be noted that the results of the Fed meeting cannot be called "dovish". This means that the US currency has reasons for further increase. Thus, I am still waiting for the construction of an upward wave, and as it develops, conclusions will be drawn about the prospects for building not only a wave but also an upward trend section. Next week, the information background will not be the strongest for the instrument, and the approach of the New Year can only reduce the activity of the markets. It is possible that by the end of the year the British dollar will be in a narrow range and even horizontal movement, as the euro currency is already now.

General conclusions.

The wave pattern of the pound/dollar instrument looks quite convincing now. The supposed wave e could complete its construction. Thus, now I would advise buying a tool with targets located near the estimated mark of 1.3457, which corresponds to 50.0% Fibonacci, since the attempt to break through the 61.8% Fibonacci level was successful, for each MACD signal "up".

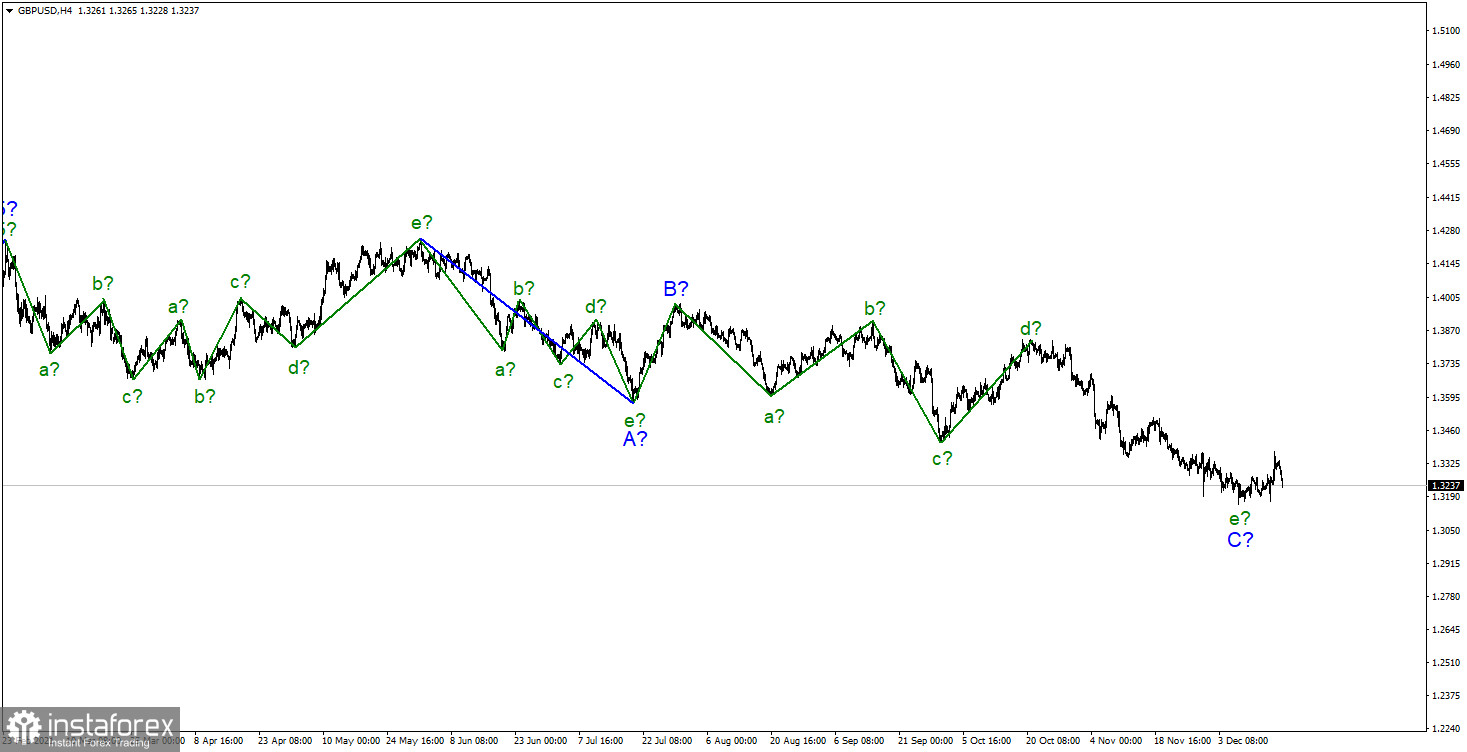

Senior chart.

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, the entire downward section of the trend may lengthen and take the five-wave form A-B-C-D-E.