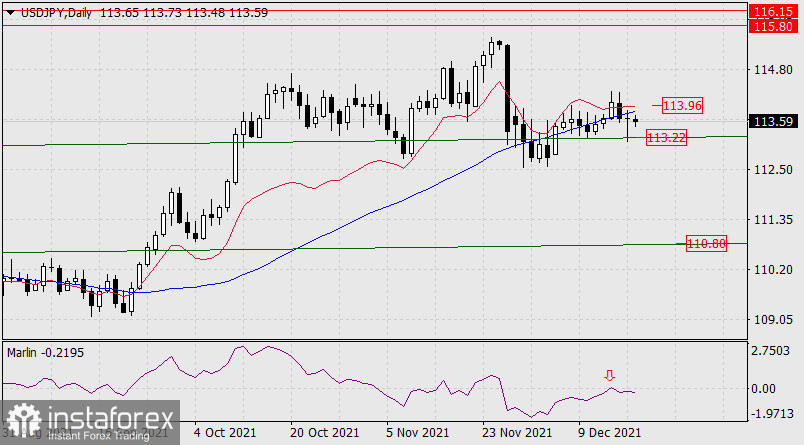

The yen traded in a moderately wide range on Friday, but the day closed at the opening level, and the price settled below the MACD indicator line. The Marlin Oscillator is moving horizontally in the negative zone. At the same time, we note that Marlin tried to enter the positive area on the 15th, but its turn from the border with the growth territory occurred (arrow).

A further decline in the USD/JPY pair is planned for today's Asian session, and consolidating below the trend line of the price channel (113.22) will open the way for a further decline to 110.80.

This basic plan may be violated if the price exceeds the signal level of 113.96, which will reopen the target at 115.80-116.15.

On the four-hour scale, the price develops above the MACD line, which, on the one hand, contributes to further growth after a hypothetical false departure under this MACD line on Friday, and on the other hand, there might be a second attempt at this line by today or tomorrow, with a departure below the level of 113.22. The advantage of just such a downward scenario is given by the Marlin Oscillator, which turns down in the negative zone.