If we rely on the macroeconomic statistics published on Friday, then everything started quite calmly for the single European currency. The final data on inflation completely coincided with the preliminary estimate, which showed its growth from 4.1% to 4.9%. Although this news itself can hardly be called optimistic, market participants have long put this unpleasant fact in the exchange rate of the single European currency. So this data could not somehow affect the situation. In general, the euro grew by momentum. Not much, but still. But closer to the opening of the US trading session, strange things began to happen. For a while, the euro simply froze in place, and after a while it began to steadily decline. At the same time, the movement itself had a recoilless character.

Inflation (Europe):

All this makes no sense, and contradicts the published data. Moreover, no macroeconomic data has been published in the United States. It feels like investors have gradually come to their senses after a whole series of meetings of the boards of central banks, and finally decided to compare not only the decisions taken by the monetary authorities, but also the announced plans for the coming year. And in the end, everyone came to the conclusion with horror that as a result, the disparity of interest rates will grow even more in favor of the dollar. It is noteworthy that as a result of Friday's fall, the market returned to the values at which it was even before the meeting of the Federal Open Market Committee. That is, the market simply zeroed out the achievements of both the Bank of England and the European Central Bank meetings.

What will happen next? Considering that the market has returned to its original positions, it seems that anything can happen now. However, do not forget that the pre-Christmas week begins. Activity in the markets will steadily decline, and the macroeconomic calendar is virtually empty. And not only today, but also in the following days. It is most likely that the market will go into pronounced stagnation.

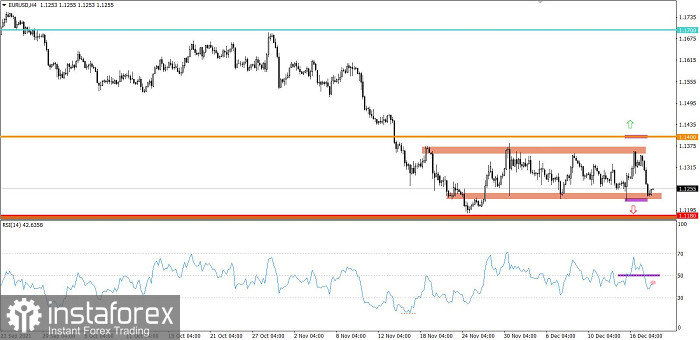

Speculation in the EURUSD pair ended last week with a rapid downward move. This led to a convergence with the lower boundary of the horizontal channel, where there was a reduction in the volume of short positions and, as a result, a slowdown in the downward cycle. The RSI technical instrument crossed the 50 line from top to bottom in the four-hour period, but the oversold zone was not reached.

Expectations and prospects:

In this situation, all attention is focused on the horizontal channel at 1.1225/1.1355, since the slowdown within the lower boundary may well go into the rebound stage. This will lead to the subsequent construction of the flat.

A comprehensive indicator analysis gives a buy signal based on a short-term period due to the initial price rebound. Technical indicators in the intraday and medium-term periods signal a short position due to a downward cycle.