The price of gold broke through the level of $ 1,800 for more than a day last week. Gold futures traded near Friday's daily high of $ 1,815.70, but it did not close above the key psychological level of $ 1,800.

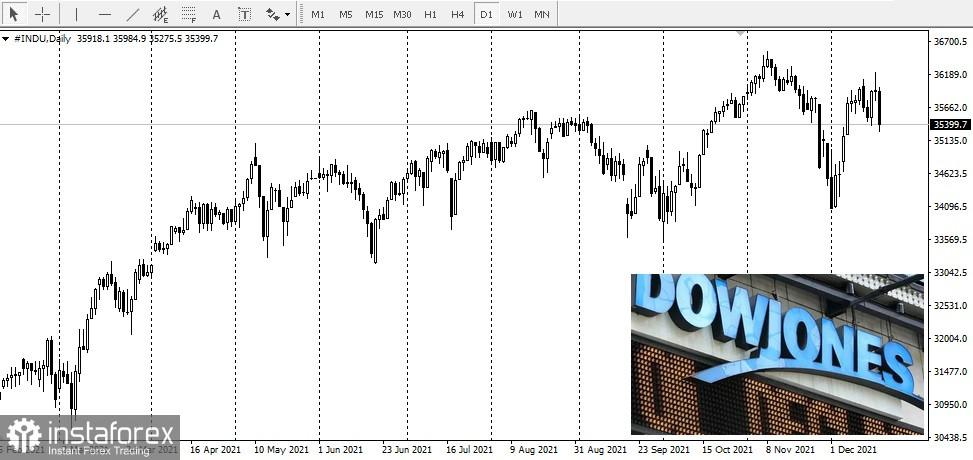

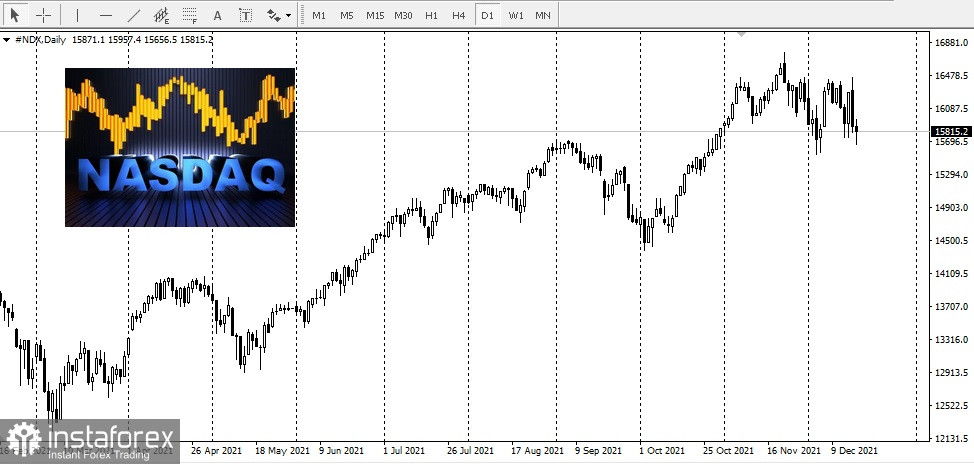

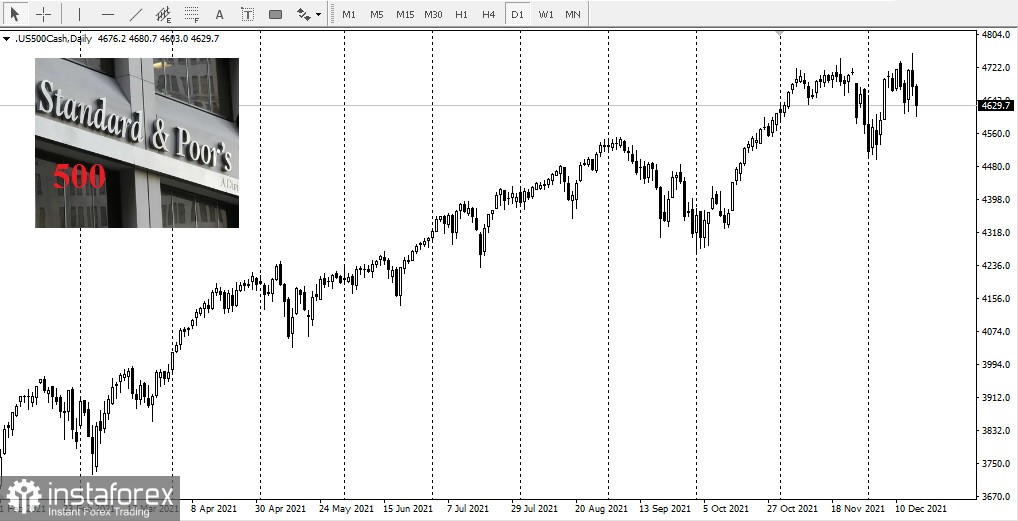

There are several factors currently supporting gold. First, the US stock market tends not to take risks. It is worth noting that all three major indices closed lower that day.

Dow Jones Industrial Average was down by 1.46%:

At the same time, the Nasdaq Composite index closed slightly at 0.07%:

Standard & Poor's 500 also plunged by 1.03%:

Standard & Poor's 500 also plunged by 1.03%:

Second, there is uncertainty about the economic downturn.

Third, there are concerns about inflation, which is still at its highest level in 40 years.

Colin Cieszynski, the chief market strategist at SIA Wealth Management, said that there are growing concerns about inflation, which was enough to push the Fed and the ECB to accelerate the decline in bond purchases. It can be recalled that England raised its interest rates.

Friday's pressure on gold led to the US dollar's sharp growth. The dollar index gained 60 points (0.62%) and is now fixed at 96.51.

Despite the fact that the net profit on gold was $ 11.20, the strength of the US dollar more than offset Friday's gains, causing gold to lose $ 12.20 in value.

Despite the fact that the net profit on gold was $ 11.20, the strength of the US dollar more than offset Friday's gains, causing gold to lose $ 12.20 in value.

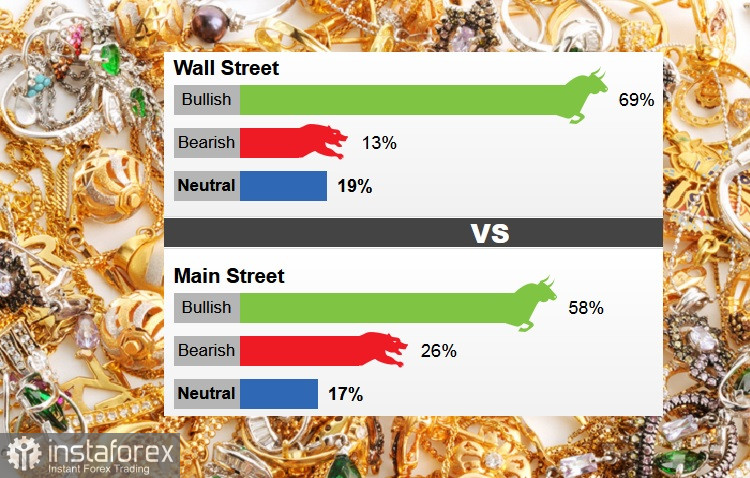

Nevertheless, 16 Wall Street analysts took part in the gold survey. Among the participants, 11 analysts, or 69%, voted for the price increase this week. Two analysts, or 13%, voted for the price reduction, and three analysts, or 19%, were neutral.

1,027 votes were cast in online polls on Main Street. Of these, 593 respondents, or 58%, expected an increase in gold prices. Another 263 voters, or 26%, replied that they think a price reduction is likely. Lastly, 171 voters, or 17%, were neutral.