EUR/USD

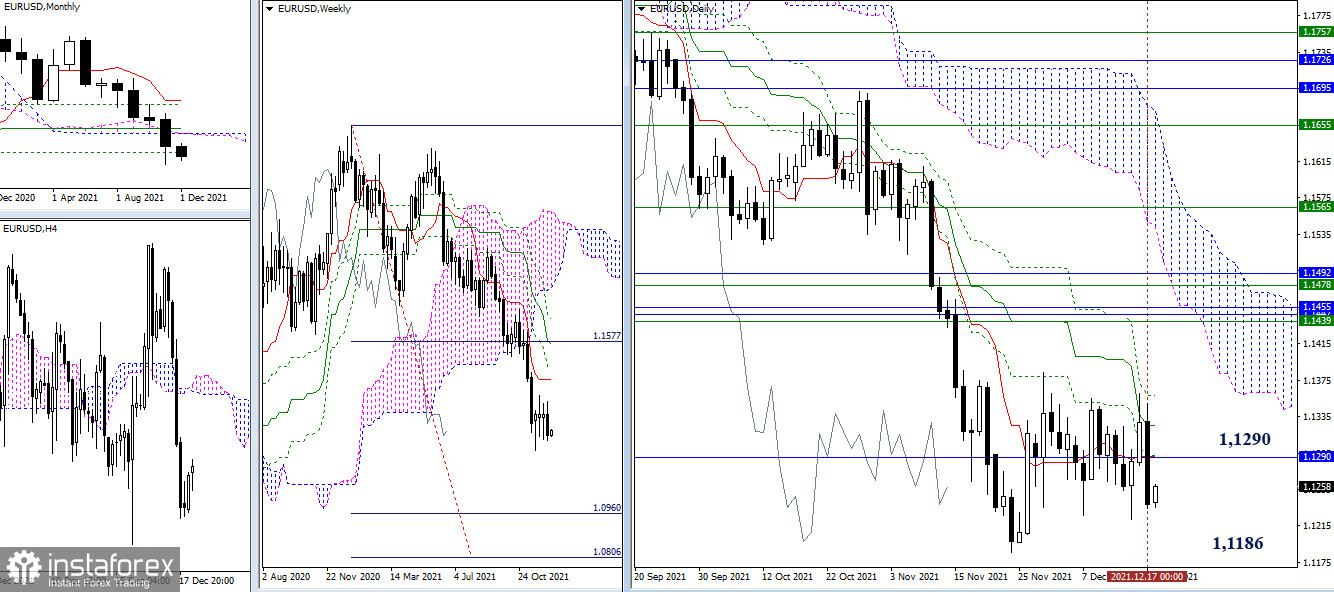

The bears showed activity last Friday, which allowed them to close the week with a bearish advantage. However, it should be noted that the pair failed to leave the attraction and consolidation zone, formed below the influence of the monthly Fibo Kijun (1.1290). Therefore, it is too early to talk about the return of bearish advantages. It will be possible to consider the downward prospects only after the minimum extremum (1.1186) has been updated and sharply consolidated below. The combination of the monthly level and the daily short-term trend in the area of 1.1290 now retains its significance and influence on the current situation.

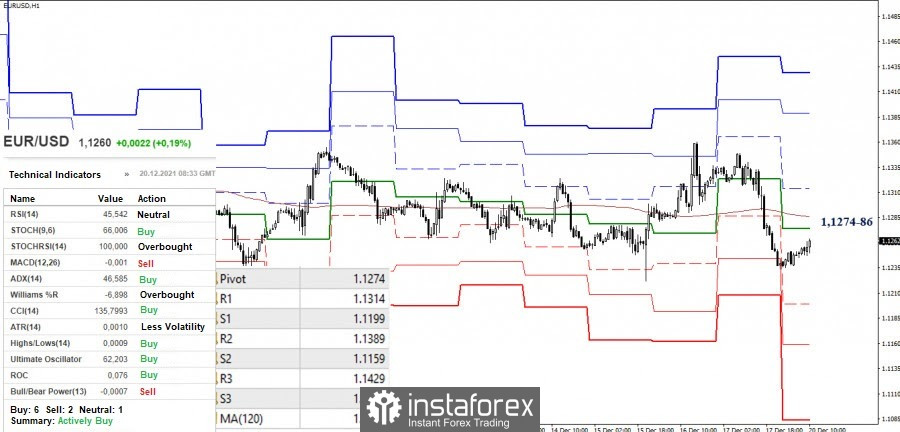

At the moment, there is growth in the smaller timeframe, whose purpose may be to retest the key levels broken the day before (central pivot level 1.1274 + weekly long-term trend 1.1286). These levels determine the distribution of forces on the hourly chart. The retest, the formation of a rebound from 1.1274-86 and the continuation of the decline will maintain bearish advantages. This will serve to strengthen the bearish sentiment. Today, intraday downward targets are set at 1.1199 - 1.1159 - 1.1084 (support for classic pivot levels).

On the contrary, the breakdown of 1.1274-86 and consolidation above will change the balance of forces acting on H1, which may lead to the recovery of bullish positions. Here, the levels of 1.1314 - 1.1389 - 1.1429 (the resistance of the classic pivot levels) can serve as upward pivot points.

GBP/USD

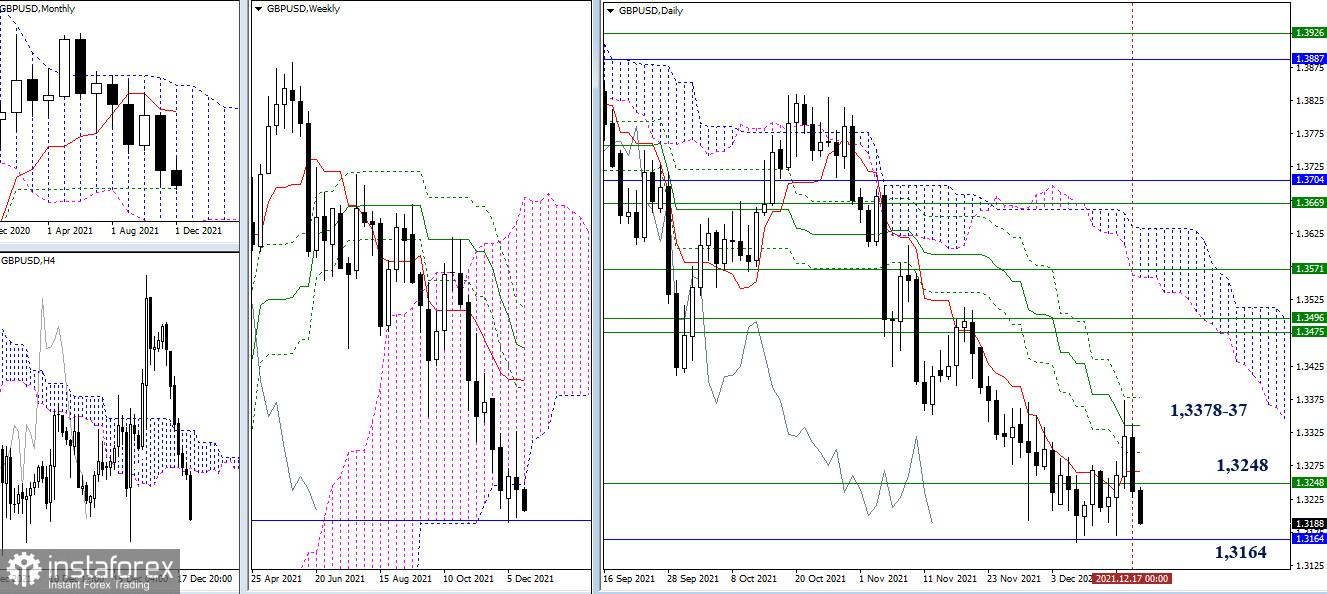

The levels of the daily dead cross (1.3378-37) were able to stop the upward correction last week. A rebound was formed from the encountered resistance. The main support for this area is the monthly Fibo Kijun (1.3164), the breakdown of which will allow us to consider new downward prospects. At the moment, there is another important level – 1.3248 (the lower border of the weekly cloud). The level now serves as the center of the attraction and consolidation zone, so for new opportunities to appear, it is important to get rid of its influence.

The benefit in the smaller timeframes is currently on the side of the bears. We are currently seeing the continuation of the decline. The pound is testing the first support for the classic pivot levels (1.3197). The next pivot points are located at 1.3158 (S2) and 1.3087 (S3). The key levels in the same timeframes are joining forces in the 1.3268-54 area (central pivot level + weekly long-term trend) and are gaining from the higher timeframes (1.3248). As a result, a consolidation above 1.3268-54 will change the current balance of forces and require a new assessment of the situation.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.