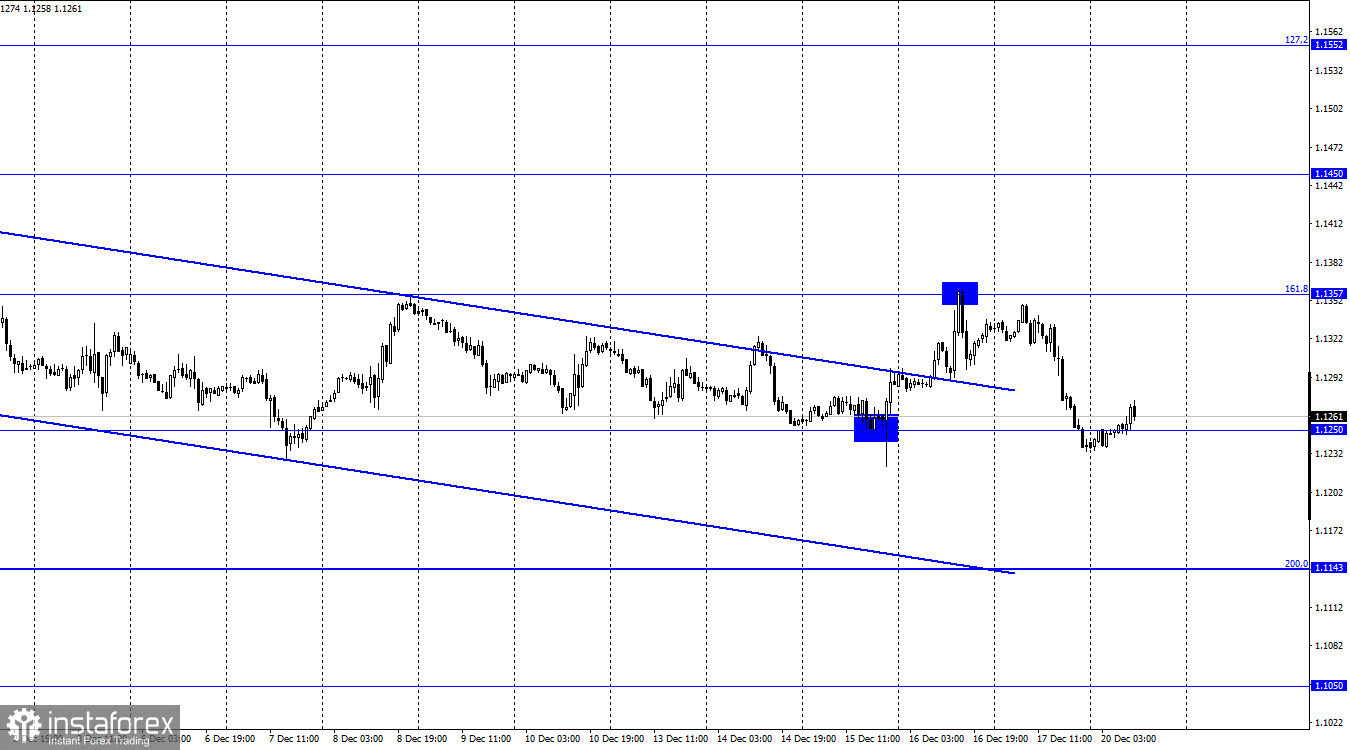

EUR/USD – 1H.

The EUR/USD pair on Friday performed a reversal in favor of the US currency and fell to the level of 1.1250, from which the pair began to grow on the day of the Fed meeting. Thus, a new pre-holiday week begins with the fact that the euro/dollar pair is in the same place as before the important meetings of the ECB and the Fed that took place last week. Thus, although at first traders bought the euro currency quite actively, which gave hopes for the end of the period of dollar growth, now I can draw the opposite conclusion: nothing has changed and the dollar still dominates the market. On the 4-hour chart, it is even better noticeable that the pair has been trading in a sideways corridor for a long time, but the US dollar still retains its advantage over the euro currency. What awaits traders this week? There will be an extremely small number of economic events and reports. Catholic Christmas will be celebrated on Friday, and most of the exchanges will be closed. And next week the New Year will be celebrated.

I believe that these two events will greatly affect the activity of traders. As we can see, now the results of the ECB and Fed meetings have not affected the general mood of traders too much. And certainly, the European currency did not receive support. Thus, all roads to further growth are still open to the dollar. If so, then ordinary economic statistics are unlikely to hinder this movement. This week and next week, traders may not actively buy the dollar, since it's still the holidays, but since January, the fall of the euro/dollar pair may resume. And how long it will last, it is extremely difficult to guess now. It will depend, from my point of view, on when the Fed starts raising the interest rate. The faster, the more chances there are for further growth of the dollar paired with the euro currency. The ECB may slow down this process, but so far it is clearly not in the mood to tighten monetary policy. If the PEPP program can end in March, then the rates will not be increased next year with a 99% probability.

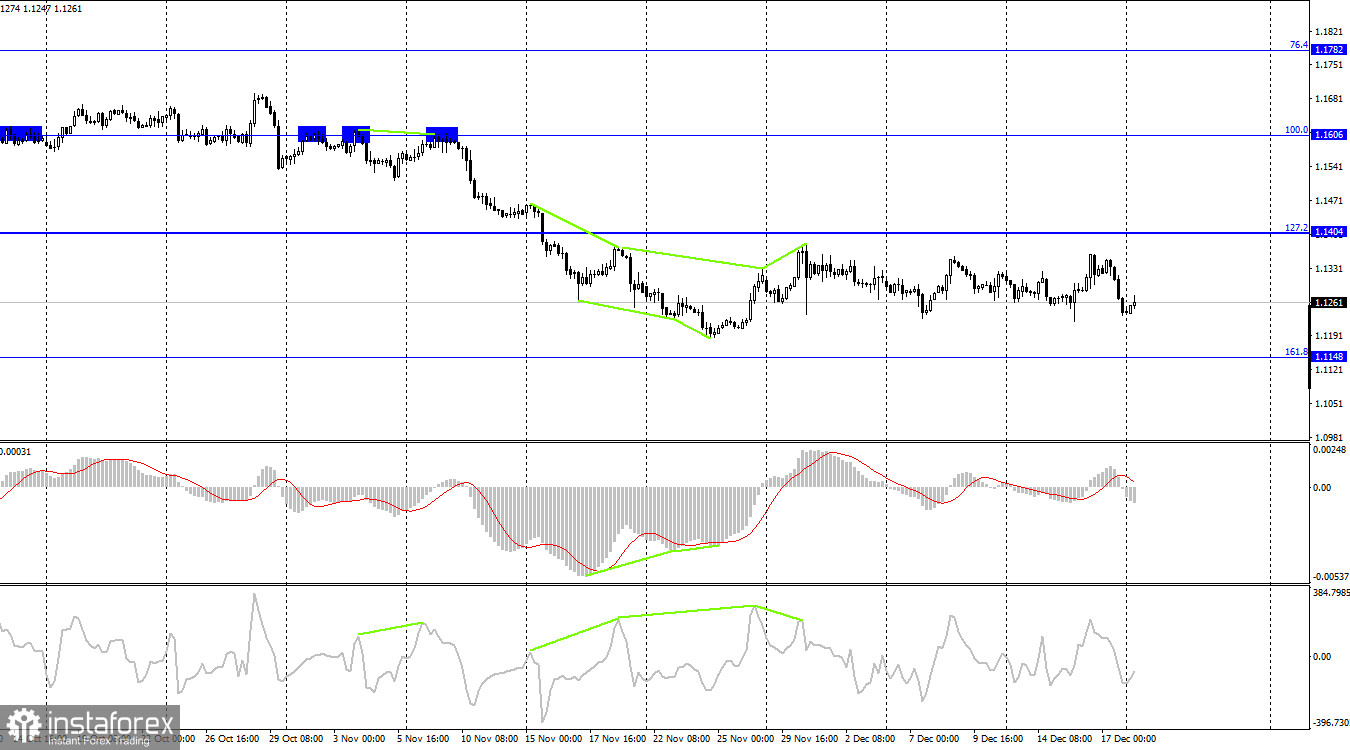

EUR/USD – 4H

On the 4-hour chart, the pair performed a new reversal in favor of the US currency and began a new process of falling towards the corrective level of 161.8% (1.1148). However, in general, the pair continues to trade between the levels of 1.1148 and 1.1404, that is, inside the side corridor. I think that now we still need to pay more attention to the hourly chart, where the graphic picture is more informative. Brewing divergences are not observed in any indicator today.

News calendar for the USA and the European Union:

On December 20, the calendars of economic events of the European Union and the United States are completely empty. The information background today will not have any effect on the mood of traders.

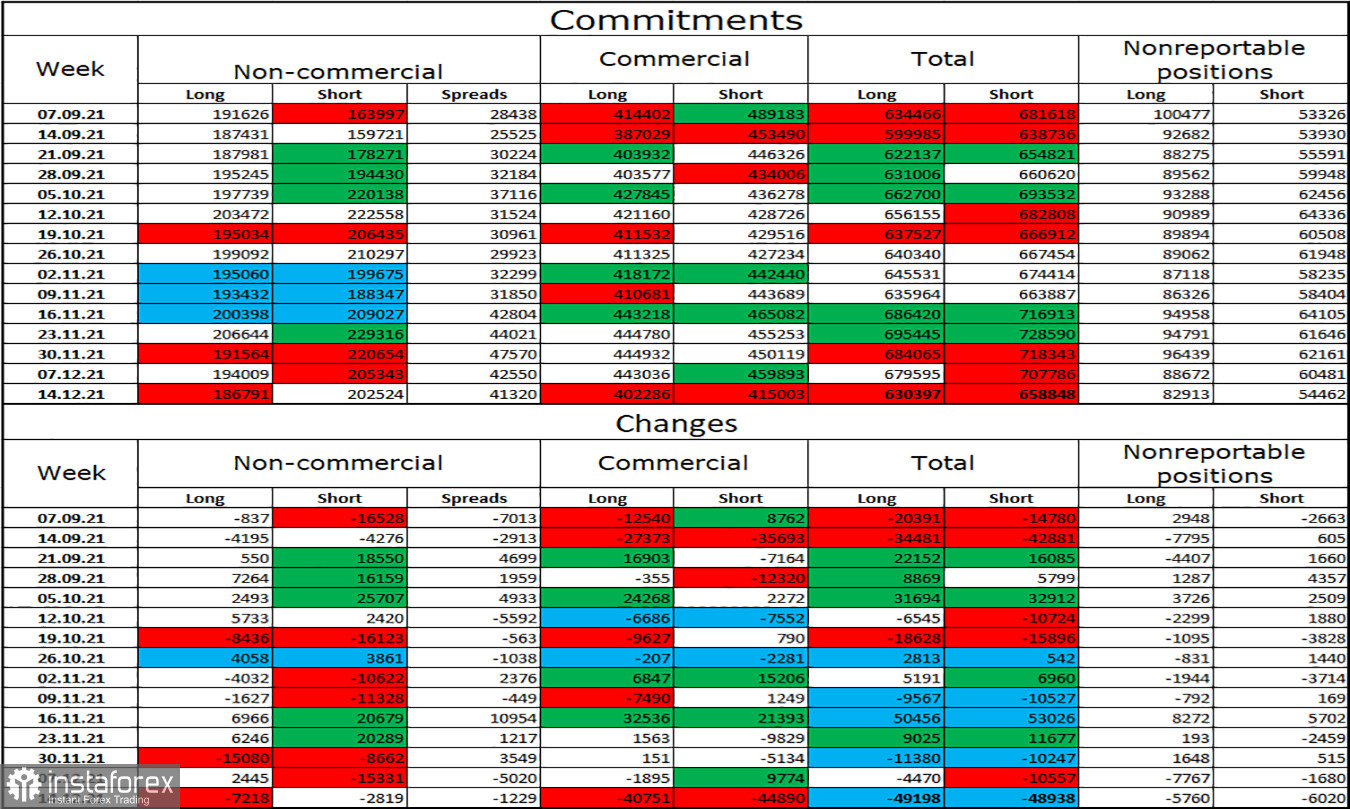

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more "bearish". Speculators got rid of both longs and shorts. In total, 7218 long contracts on the euro currency and 2819 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 186 thousand, and the total number of short contracts - to 202 thousand. The "bearish" mood among the most important category of traders remains. The most interesting changes were observed among traders of the "Commercial" category, who closed 40-45 thousand contracts of both types. In total, during the reporting week, about 100 thousand contracts on the euro currency were closed.

EUR/USD forecast and recommendations to traders:

The pair's sales should have been closed around the level of 1.1250. New sales will be possible after closing at 1.1230 with a target of 1.1143. I recommend buying the euro currency when rebounding from the level of 1.1250 with a target of 1.1357.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.