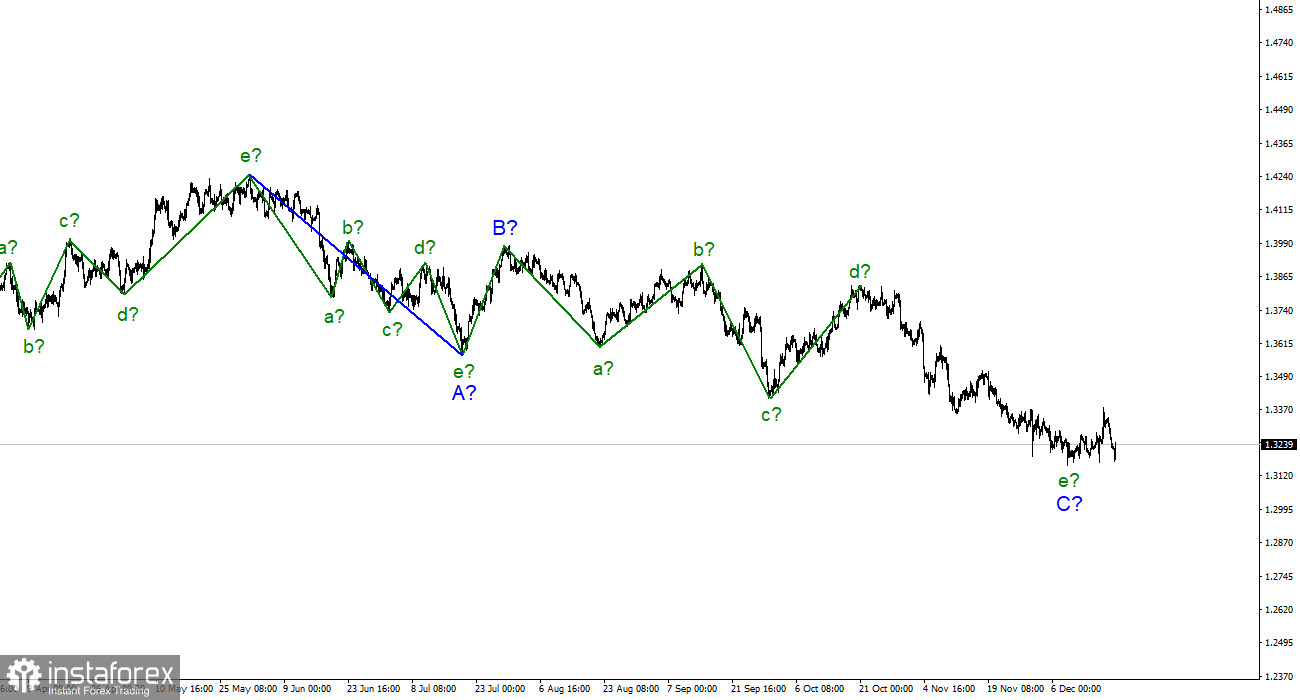

The wave pattern for the Pound/Dollar instrument continues to look quite convincing, but it may still require additions. If the current wave pattern is correct, then the construction of the last wave in C has now been completed. The increase in the quotes of the instrument allowed me to assume that the entire downward section of the trend has completed its construction, but the decline on Friday and Monday allows that the entire downward trend will take a longer form.

Until the moment when the low of wave e in C is updated, I still believe that a new upward trend section has begun its construction, which may also turn out to be corrective in nature. The increase in quotes could also begin within the framework of the global wave D, after which a new decline will begin within the framework of wave E.

In general, the situation with the waves has been simplified a little thanks to the meetings of the Bank of England and the Fed, but at the same time, the corrective essence of the movements in 2021 leaves a fairly large number of possible scenarios. However, there is no reason to assume the implementation of alternative scenarios yet.

David Frost left due to disagreement with Boris Johnson's policy

The exchange rate of the Pound/Dollar instrument decreased by 60 basis points on Monday and then increased by the same amount. The information background was not strong, but it was still there. On Monday, it became known that David Frost, who was responsible for negotiations with the European Union on all issues related to Brexit, is leaving his post. It is reported that initially, Frost was going to leave in January, but information about his departure leaked to the media and the minister decided not to wait for the next month.

In his letter to British Prime Minister Boris Johnson, Frost stated that he did not agree with the direction in which the country was moving at the current time, although he had no disagreements with the government on Brexit and relations between the UK and the European Union.

Frost pointed out that he did not consider it right to strengthen quarantine restrictions caused by the increase in the number of coronavirus diseases. He believes that Britain needs to learn to live with the virus. He also recalled that in the summer, the Prime Minister had already made such a decision, canceling all restrictions, but "unfortunately, this decision was not irrevocable."

According to Frost, the country urgently needs to return to its usual life, not to pay attention to the virus, and not to take an example from some other countries that have introduced strict anti-epidemic measures.

In the last few days, the UK has been experiencing the highest levels of morbidity for the entire time of the pandemic, but at the same time, mortality rates remain very low. However, Boris Johnson decided to tighten social rules last week to suspend the spread of the Omicron strain. It should also be noted that not everyone in the government supports Frost's opinion. Many believe that the country may even need a new lockdown this winter.

General conclusions

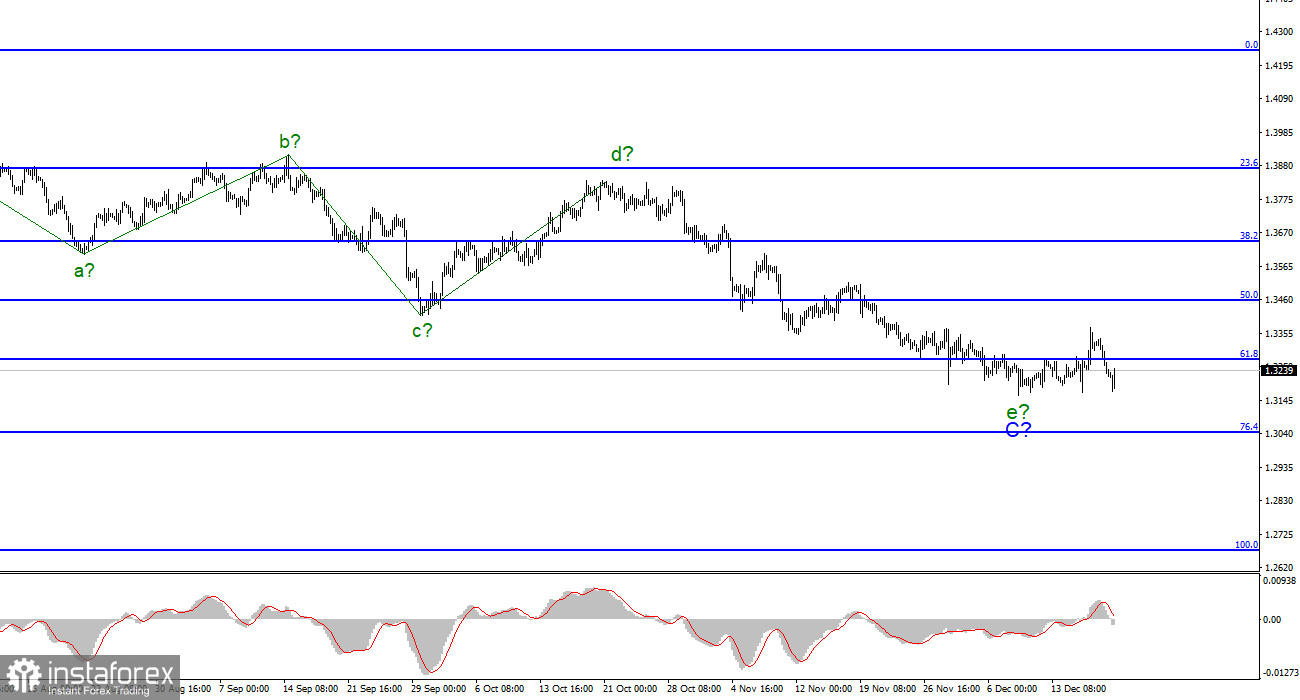

The wave pattern of the Pound/Dollar instrument looks quite convincing now. The supposed wave e could complete its construction. Thus, now I would advise buying the instrument with targets located near the estimated mark of 1.3457, which corresponds to 50.0% Fibonacci level, for each MACD signal "up."

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, the entire downward section of the trend may lengthen and take the five-wave form A-B-C-D-E.