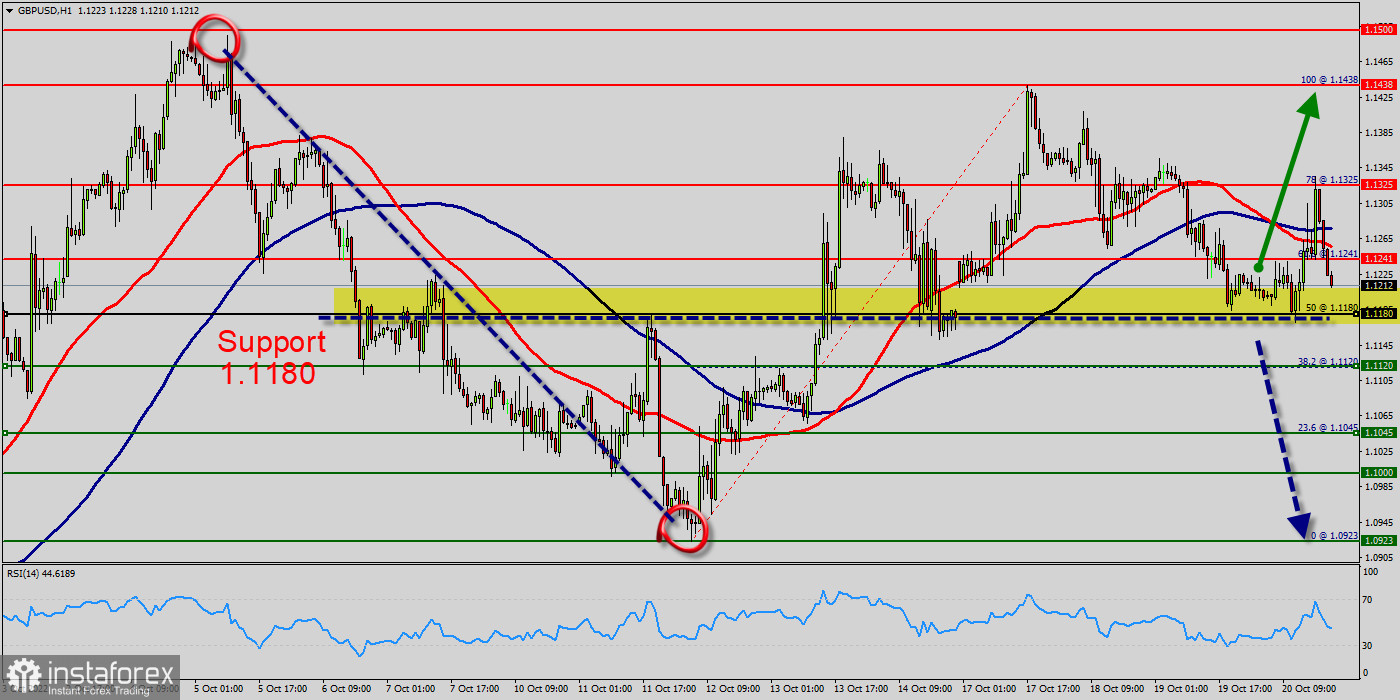

The resistance of GBP/USD pair has broken; it turned to support around the price of 1.1180 this week. Thereby, forming a strong support at 1.1180. The direction of the GBP/USD pair into the close this week is likely to be determined by trader reaction to 1.1180 and 1.1325.

The GBP/USD pair climbed above the level of 1.1180 before it started a downside correction. The GBP/USD pair set above strong support at the level of 1.1180, which coincides with the 50% Fibonacci retracement level. This support has been rejected for three times confirming uptrend veracity.

Today, the GBP/USD pair has broken resistance at the level of 1.1180 which acts as support now. Thus, the pair has already formed minor support at 1.1180. The strong support is seen at the level of 1.1120 because it represents the weekly support 1.

Hence, major support is seen at the level of 1.1120 because the trend is still showing strength above it. The level of 1.1120 coincides with the golden ratio (38.2% of Fibonacci retracement) which is acting as major support today.

Another thought: the Relative Strength Index (RSI) is considered overbought because it is above 40. At the same time, the RSI is still signaling an upward trend, as the trend is still showing strong above the moving average (100), this suggests the pair will probably go up in coming hours.

Technical readings in the daily chart favor a bullish continuation, as indicators maintain their firmly bullish slopes within positive levels, while the 100 MA heads firmly higher below the current level. Equally important, the RSI and the moving average (100) are still calling for an uptrend. Therefore, the market indicates a bullish opportunity at the level of 1.0265 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend.

Accordingly, the market will probably show the signs of a bullish trend. This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend.

In other words, buy orders are recommended above 1.1180 level with their first target at the level of 1.1241. From this point, the pair is likely to begin an ascending movement to the point of 1.1241 and further to the level of 1.1325. The price of 1.1435 will act as a strong resistance and the double top has already set at the point of 1.1435.

On the other hand, if a break happens at the support of 1.1120, then this scenario may become invalidated.