The pound is in a depressed state again. Paired with the dollar, the British currency returned to the area of the 31st figure, having lost most of the positions won. The hawkish fuse that was observed last week has completely come to naught. As soon as the pair rises a couple of dozen points up, it immediately falls under a wave of short positions. The pound was not helped even by the Bank of England, which last Thursday raised the interest rate by 15 basis points. This decision was unexpected, which is why GBP/USD instantly soared by 150 points. But the bulls could not keep the peak taken. An array of political issues is pulling the pair to the bottom, to the price lows of the year. Ironically, the pound is getting cheaper against the backdrop of record inflation growth, the recovery of the labor market and the tightening of monetary policy parameters. Despite such a hawkish rear, the downward trend of GBP/USD is still in force.

As you know, the main "headache" of the pair's bulls is Brexit. The UK and the European Union are "divorcing" hard: the Northern Irish problem and the notorious "fish issue" have been pressing on the pound for six months. The parties are negotiating, coming to some intermediate compromises (for example, Britain has increased the number of licenses issued to European fishermen), but in general, "who is still there." This weekend, the situation was further aggravated by the fact that the closest ally of British Prime Minister Boris Johnson, Brexit Minister David Frost, resigned. Formally– not because of the problems with Brexit, but for other political reasons. In particular, Frost expressed disagreement with the tightening of quarantine restrictions. Let me remind you that London, in fact, played ahead of the curve – even before the spread of Omicron in the country, it returned the "remote control" and introduced the 3G rule, according to which any visit to mass events (clubs, cinemas, theaters, etc.) is allowed only to vaccinated, who have had coronavirus or passed a Covid test.

However, in the context of the GBP/USD pair, it is not so important for what reason Frost left his post. Rather, the consequences of this step are important here, which should be viewed both through the prism of British-European negotiations and through the prism of British domestic political processes. According to rumors, Boris Johnson may toughen his position in negotiations – both with Brussels and with Paris. Therefore, he can offer a person with more conservative and categorical views for the post of chief negotiator. By and large, Johnson's premiership is at stake now, in light of recent political defeats. In particular, last week, the Johnson-led Conservative Party lost the election in a by-election in the North Shropshire constituency with a bang. Moreover, the Conservatives, figuratively speaking, lost "on their own field": this district has long been considered a stronghold of the "Tories" (the first defeat of the party in the last 200 years).

This is a wake-up call for Johnson, and far from the first. According to the YouGov sociological institute, only 23% of the British respondents have a positive attitude towards the current prime minister, while 67% do not trust him. Johnson's ratings have collapsed in almost all regions of the UK. The election results in North Shropshire only eloquently illustrated the latest trends. It is obvious that the prospects for political instability are putting significant pressure on the pound.

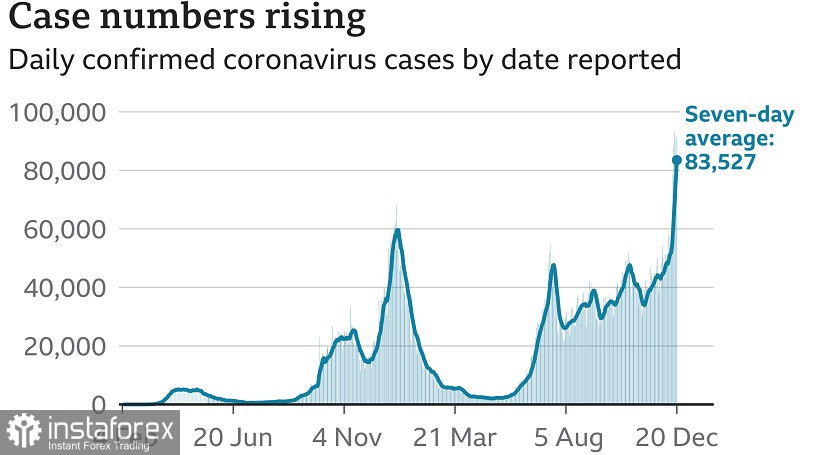

The situation with coronavirus in the UK is ambiguous. On the one hand, at the end of last week, the country registered new records in the number of new infections. For example, on Friday, the daily increase in the number of Covid patients reached 83,000. This is an absolute anti-record. On the other hand, the number of deaths remains at a fairly low level (compared to the previous peak periods of the pandemic). This is a good sign that confirms the assumption that Omicron is more easily tolerated and leads to hospitalization and/or death much less often.

On the third hand, traders react primarily to the response of the authorities. And in this case, the reaction of Downing Street is not in favor of the British currency. London has partially restored the strict quarantine regime in the country, thereby exerting background pressure on the pound. Moreover, today there is a high probability of repeated lockdown. According to the British press, such a scenario can be implemented either in January or as early as next week, on New Year's Eve. Expert recommendations to the British government were recently published in the press. According to the experts involved, without a "significant strengthening of restrictions", a wave of an epidemic of "unprecedented proportions" awaits the country. According to a number of observers, Boris Johnson will decide to tighten the quarantine either this week or immediately after Christmas.

Here again, the political component of the issue is important. According to British journalists, the rating of Conservatives was "knocked down" by Covid – or to be more precise, the inconsistent and uncertain steps of the Johnson government to counter the spread of the virus in the country. Against the background of another outbreak of the disease, the prime minister found himself under fire - both from the opposition and from many of his associates, who, according to some reports, are preparing a "riot" for him in the form of a vote of no confidence. There are still unconfirmed rumors in the press that in January the so-called 1922 Committee will collect 55 signatures of MPs and put on the agenda the question of Johnson's removal from office (similarly, MPs dismissed Theresa May).

Thus, the pound is "encircled by anchors" that pull it to the bottom – including paired with the US dollar, which strengthens its position due to the hawkish attitude of the Federal Reserve. The pound found itself under an array of political problems. All this indicates the priority of short positions on the pair. From a technical point of view, the pair on the D1 timeframe is located between the middle and lower lines of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku indicator. The support level (the target of the downward movement) is the 1.3160 mark – this is the lower line of the Bollinger Bands on the same timeframe.