Governing Council member Pierre Wunsch accused the European Central Bank of underestimating the threat posed by inflation. He said it is lagging too far behind global competitors in the fight against soaring prices.

But on the bright side, Wunsch noted that new forecasts perfectly reflect the whole picture. Latest data indicates that inflation will return to 1.8% in 2023 and 2024, which would mean that the 2% target has been met. "There's a lot of uncertainty about 2023 and 2024, but my take is that we're essentially at target," Wunsch said. "Whether you're at target or just a little bit below or a little bit above doesn't matter so much. What I'm a bit concerned about is the fact that we'd insist so much on still being below target, "he added. Wunsch also commented that he prefers a faster cut in bond purchases instead of the one currently underway.

The ECB decided to end the emergency bond purchase program in March next year, which is an acknowledgment that the measures adopted to prevent economic damage have exhausted their potential.

Experts deemed these steps as far less aggressive than elsewhere, especially since the Federal Reserve doubled its bond-buying cuts and the pace of economic stimulus. The Bank of England also raised its interest rates for the first time since the pandemic.

Recent data from the Euro area also hinted that consumer prices may rise to 3.2% in 2022.

But ECB President Christine Lagarde is firm that soft monetary policy is necessary "for inflation to stabilize at our 2% inflation target over the medium term." She also appeared to have managed to convince investors that a rate hike next year was unlikely, in part due to the threat brought by the omicron virus, which is now spreading rapidly throughout the eurozone. Now, the futures market is betting only on a 10 basis-point rate increase in early 2023.

Talking about the United States, the Fed announced the completion of its emergency bond buying program in March 2022, but this could cause financial pressure in the country if Democrats fail to save President Biden's new spending package.

The Economists said the curtailment of the program will not have a strong effect on economic growth, so Q4 will see a 7% increase or more.

It will also help keep inflation down, however, this will make the economy more vulnerable to shocks associated with a new outbreak. Recently, 43 states have reported infections with the new omicron strain, and this could cause damage to the economy later this year as consumers are already refraining from spending on travel, dining and other personal services.

The outbreak could also affect the plans of Fed Chairman Jerome Powell regarding rate hikes next year. There are currently a lot of variables and uncertainties on how the economy will grow in the first quarter of next year and how the coronavirus pandemic will affect consumers. How much this will slow down the labor market and how it will affect the rate of inflation is also a big question.

There are also problems with the implementation of Biden's $ 1.75 trillion program. Economists at Goldman Sachs said its failure would impose a certain risk in the expectations of rate hikes in March next year, that is why they lowered their forecasts for economic growth for the first quarter from 3% to 2%.

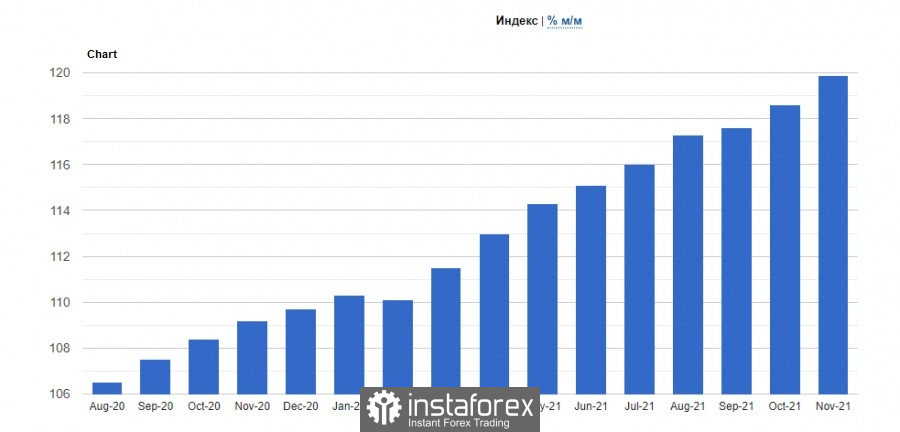

With regards to current macro statistics, the Conference Board recently reported that business cycles in the US rose in November, suggesting that the economy continued to grow later this year. According to the data, the Leading Economic Index increased by 1.1% to 119.9 points, thanks to gains in eight out of ten components.

In the six months to November, the leading economic index rose 4.6%, with seven out of ten components improving.

There was also a report on the balance of industrial orders from the Confederation of British Industry (CBI). It indicated that demand continued to decline because of the new omicron coronavirus strain and ongoing labor shortages. The order balance in the December CBI Industrial Trends survey fell to 24 points, from 26 points in November. But the data is higher than the forecast of economists, who had expected the indicator at 20 points.

All this did not add confidence to the market, so bulls have to protect the lower border of the side channel to provoke growth to the upper limit. The quote must also consolidate above the base of the 13th figure for EUR/USD to rise to 1.1335 and 1.1355. But if pressure returns on the pair, it will fall to 1.1265 and 1.1235.

With regards to GBP/USD, a lot depends on 1.3240 because a breakout will lead to a jump to 1.3270 and to the 33rd figure. But if the bears manage to push the quote below 1.3205, the pair will dip to 1.3170, 1.3110 and 1.3060.