Analysis of transactions in the GBP / USD pair

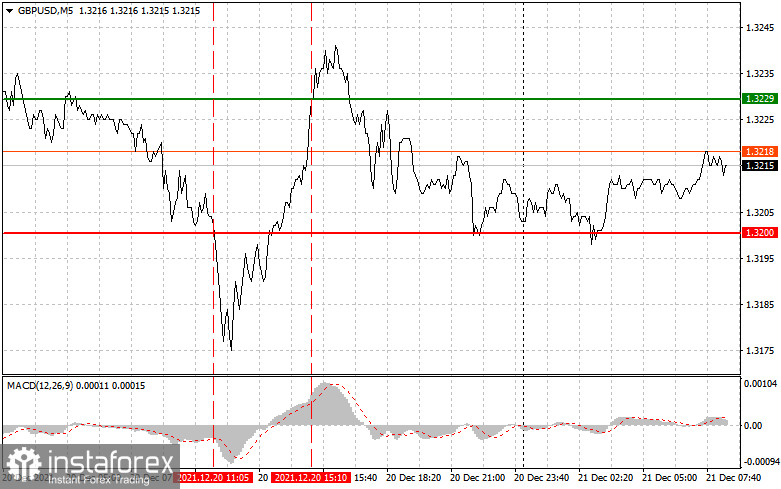

Market signals on Monday said to sell GBP / USD, however, the MACD line was far from zero so the decrease was very limited. At most, the downward movement was 25 pips.

A similar scenario happened in the afternoon, but this time it is about a signal to buy. The MACD line was far above zero that time, so the upside potential is limited. No other signal appeared for the rest of the day.

The unexpected rate hike by the Bank of England did not push GBP / USD up. Instead, it was the report on the balance of industrial orders from the Confederation of British Industry (CBI) that raised the rate up. According to the data, demand continued to decline because of the new omicron coronavirus strain and ongoing labor shortages. That is why the order balance in the December CBI Industrial Trends survey fell to 24 points, from 26 points in November. The data is higher than the forecast of economists, who had expected the indicator at 20 points.

Meanwhile, the Conference Board recently reported that business cycles in the US rose in November. This suggests that the economy continued to grow later this year, with the Leading Economic Index increasing by 1.1% to 119.9 points, thanks to gains in eight out of ten components.

Most likely, GBP / USD will continue to decline today because retail sales in the UK is expected to be low. That could induce another drop to monthly lows. But if the data turns out better than expected, a sharp rebound may take place.

In the afternoon, the US will release data on the balance of payments, but it is unlikely to affect the markets. Another thing is how the situation with the omicron strain develops further, as according to the latest data, 70% of new cases in the country are attributable to the new strain. This complicates the situation in the economy.

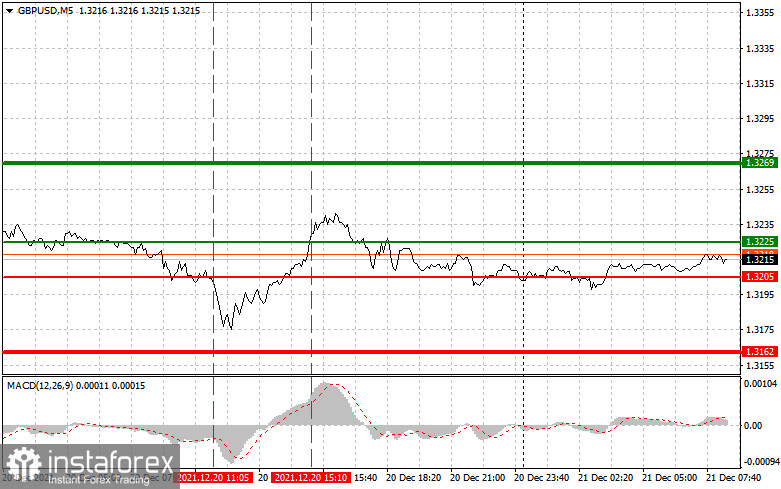

For long positions:

Buy pound when the quote reaches 1.3225 (green line on the chart) and take profit at the price of 1.3269 (thicker green line on the chart). Growth will be observed if data in the Euro area exceed expectations and if the situation with coronavirus improves.

Before buying, make sure that the MACD line is above zero, or is starting to rise from it. It is also possible to buy at 1.3205, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.3225 and 1.3269.

For short positions:

Sell pound when the quote reaches 1.3205 (red line on the chart) and take profit at the price of 1.3162. Bears will control the market, so it is best to bet on a decline, especially after an unsuccessful rise above 1.3225.

Before selling, make sure that the MACD line is below zero, or is starting to move down from it. Pound can also be sold at 1.3225, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.3205 and 1.3162.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.