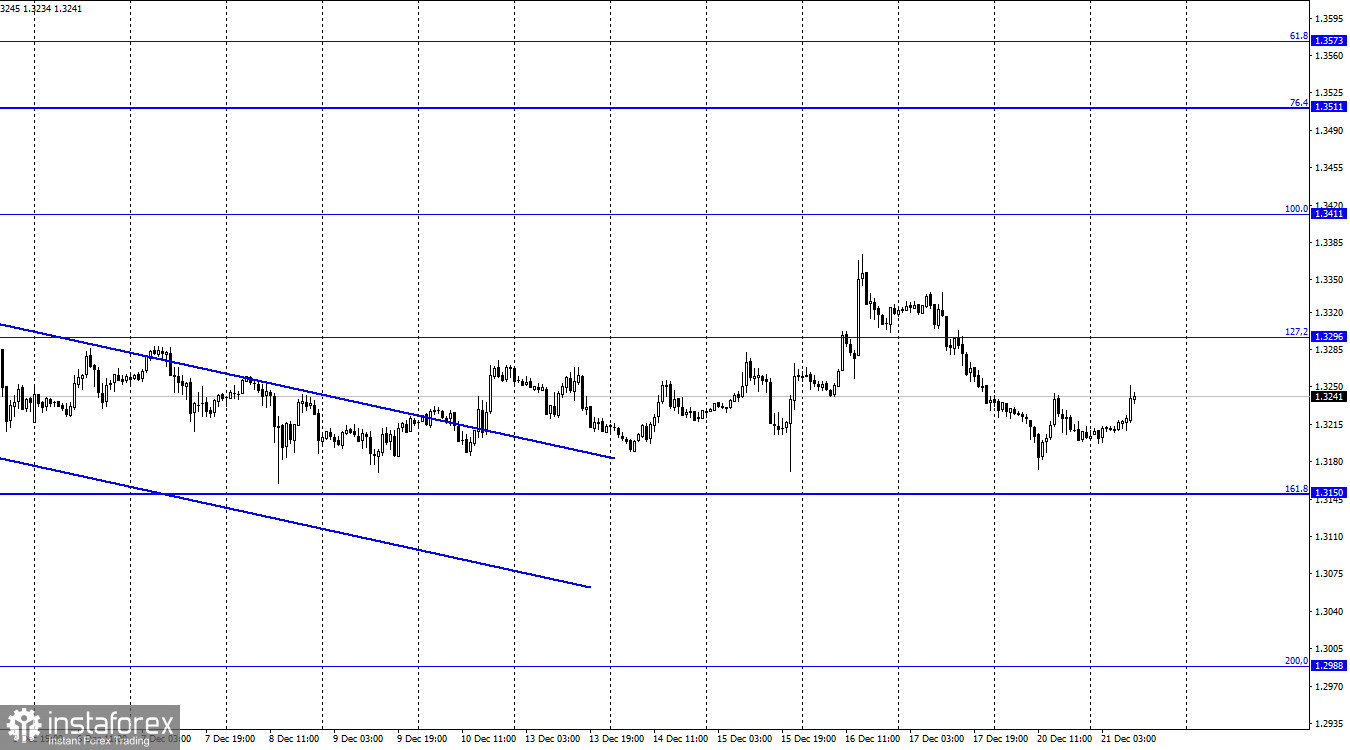

GBP/USD – 1H

Hello, dear traders! On Monday, the pound/dollar pair showed a decline to 1.3171 on the one-hour chart. After that, the pair reversed and began rising to the 127.2% correctional level located at 1.3296. Thus, like the euro the British pound continues hovering within a narrow range. Notably, the pound sterling has a very strong support level at 1.3171 that could be clearly seen on the four-hour chart. The pair has rebounded from this level several times already. At the moment, traders are not showing a firm intention to buy or sell the pound sterling. There is no economic news that may shape the market sentiment. Meanwhile, the epidemiological situation in the UK is rather dramatic. Boris Johnson has already tightened the quarantine measures. There are rumors that the UK authorities may even introduce a new lockdown, but there is no official information about this issue. As we can see, the British pound is not falling amid the spread of the new virus strain. I think that a new decline will take place only amid weak macroeconomic reports. Notably, UK macroeconomic indicators should slide faster than in the US.

Traders also ignored David Frost's resignation as Brexit minister. This happened yesterday. A new minister is likely to have the same approach towards the negotiations with Brussels. There are rumors that London's position could become even tougher. However, it is hardly possible since London needs an agreement and not a new conflict, trade war or sanctions. The parties always reach consensus. That is why there are no reasons for concern.

GBP/USD – 4H

On the four-hour chart, the pound/dollar pair slid to 1.3171, rebounded from this level and began climbing to the 50.0% correctional level located at 1.3457. Although there is no sideways channel on the four-hour chart, the British pound has been trading in a narrow range for the last several weeks. If the price fixes below 1.3171, it may resume falling towards the 76.4% correctional level of 1.3044.

Macroeconomic calendar for the UK and the US

The macroeconomic calendar for the UK and the US is absolutely empty. Thus, the news flow will hardly affect traders' sentiment today.

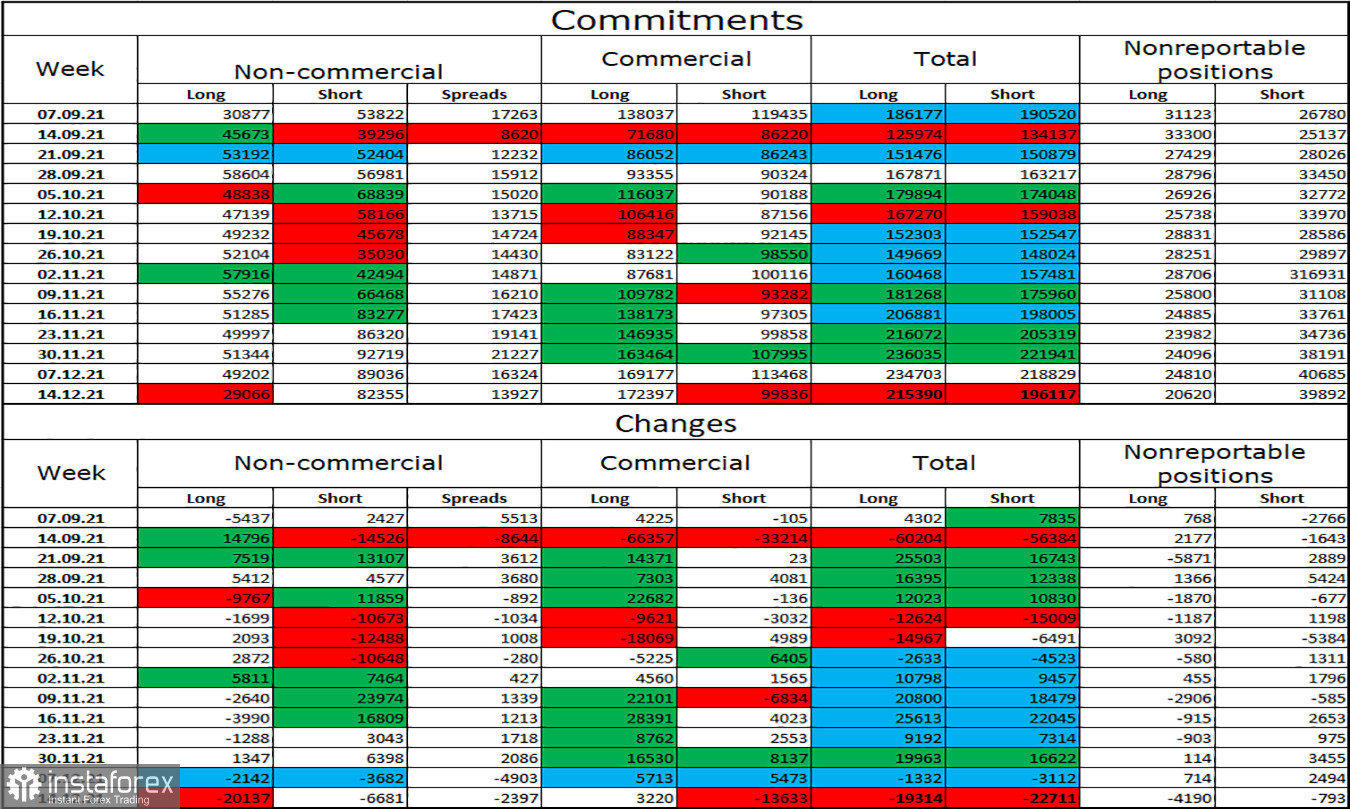

Commitments of traders report

The latest COT report on the British pound from December 14 showed that the mood of the major players has changed a lot. The market sentiment has become much more bearish, since non-commercial traders immediately closed 20 thousand long positions. Bears have been gaining control over the market for two months already. In the given period, speculators also closed 6,681 short positions. The total number of short positions opened by non-commercial traders is now more than twice as high as the number of long positions: 82 thousand versus 29 thousand. Thus, I cannot say that market conditions for the pound sterling have become more favorable. It is likely to go on falling.

Outlook for GBP/USD and trading recommendations

Buy positions on the British pound could be opened after it rebounds from the level of 1.3171 towards 1.3296. Sell orders could be initiated if the price closes below 1.3150 with the target of 1.2988.

TERMS:

Non-commercial traders are major market players: banks, hedge funds, investment funds, private, large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

Non-reportable positions are performed by small traders who do not have a significant impact on the price.