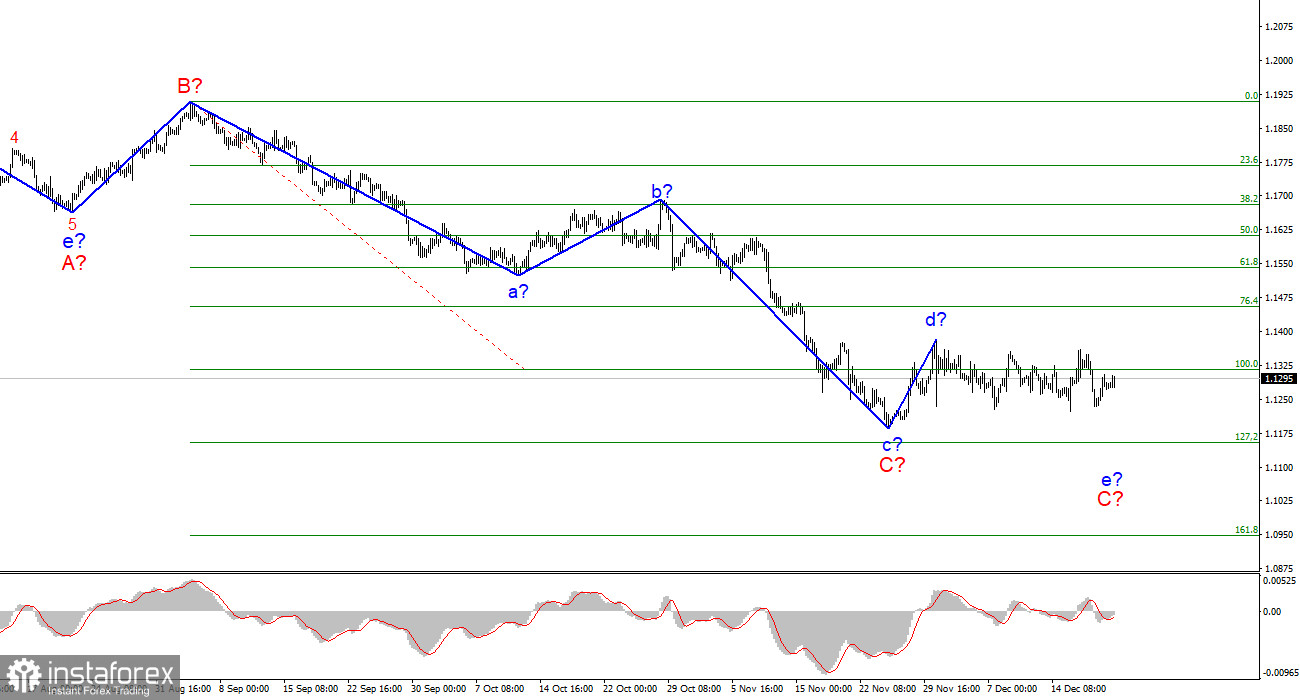

The wave layout for EUR/USD on the 4-hour chart remains complete and does not require any changes. It is still not clear whether the formation of the descending wave e in C will continue although markets have tried to resume the downtrend several times. If this wave does not continue its construction, the C wave should be recognized as complete with a three-wave structure. However, I think that it should take a five-wave form. The wave that was initiated on November 30 cannot be attributed to either wave C or the first wave of a new uptrend section. In fact, neither the high of the wave d in C nor the low of the wave c in C has been broken through over the past few weeks. The pair is moving in a flat channel, and we need to wait in order to see the future direction of the price. The supposed wave e (or it may be a more complex wave d) can take a very extended, horizontal form which will make the entire current wave layout more complicated.

Market activity low during Christmas week

There was no news background for EUR/USD on Tuesday. Markets keep discussing the new Omicron strain which continues to spread around the globe. However, I believe that this news does no longer interest traders as they cannot use it to win back their losses. The situation in the European Union is complicated, just like in the US. So, neither the euro nor the US dollar can benefit from the Omicron spread. Moreover, the symptoms of the new virus are less severe than that of Delta. This does not mean that global economies will avoid the impact of this virus. Many countries worldwide are reporting a daily increase in the number of new coronavirus cases. Vaccines appear to be ineffective against the new strain. Some countries have tightened quarantine restrictions while others have introduced lockdowns. Some hope to live through the new coronavirus wave without tough restrictions. In any case, Omicron can be a problem for the global economy. It is still too early to talk about this as there is simply no other news background for now. Today, the consumer sentiment index was published in Germany and came fully in line with expectations of a drop to -6.8 points. The consumer confidence indicator in the euro area also turned out to be negative. But this is quite natural amid a new wave of the pandemic. Moreover, these reports have never been of great importance to market participants. Therefore, I expect the pair to maintain its daily volatility in the range of 20 base points or less and continue the flat movement.

Conclusion

Based on the analysis above, I can conclude that the formation of the descending wave C is likely to be completed. However, the internal structure of this wave suggests that another descending wave may start to form soon. Thus, I advise selling the pair with the targets around 1.1152 for every sell signal of the MACD indicator until the price successfully breaks through the high of the d wave.

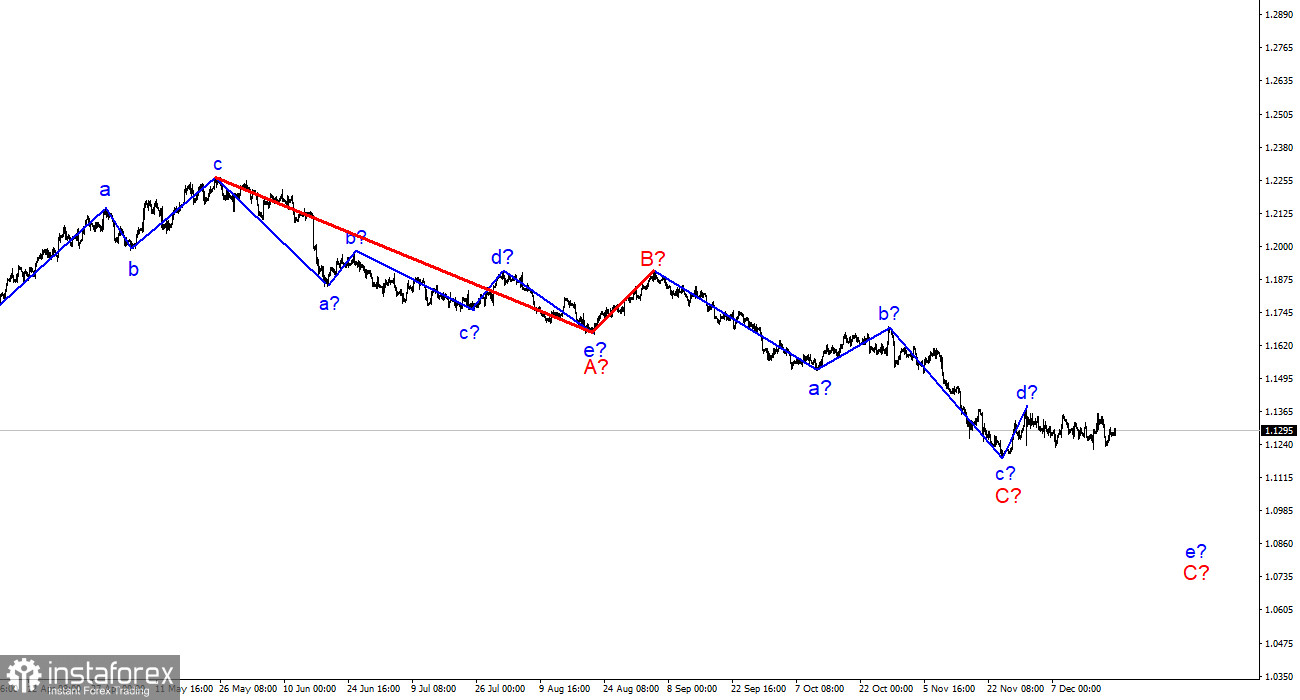

Higher time frame

The wave layout on the higher time frame looks quite convincing. The quotes continue to move lower. The descending section of the trend that was initiated on May 25 takes the form of a three-wave correctional pattern A-B-C. This means that the downtrend may continue for several more weeks until the C wave is fully formed. It should take a five-wave structure in this case.