4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

On Tuesday, the EUR/USD currency pair continued to move inside the side channel between the Murray levels "0/8" - 1.1230 and "2/8" - 1.1353. If earlier the price at least tried to work out the lower or upper limit of the channel, then on Tuesday, the volatility of the pair decreased, the movement weakened, and the trend was not observed even inside the day, that is, inside the same side channel. However, this does not surprise us at all, since, with the approach of Christmas and New Year, the market activity often decreases. In the New Year, few people want to trade, and not celebrate or be on vacation. Thus, we expect that in the next two weeks the pair will spend exactly in the designated side channel. What will happen next, it doesn't even make sense to say now. First, you need to end the holidays. Although this year the holidays may be purely formal. However, we will talk about this below. The main thing is that at the moment the technical picture does not change, and what it will be at the beginning of next year, is extremely difficult to assume now. It is noteworthy that the pair continues to remain near its annual lows. The bears do not want to continue the downward movement, and the bulls do not seek to buy the euro currency. Thus, the pair ends the year in a very strange movement.

Omicron continues to capture EU and US countries.

Unfortunately, in the last days of the outgoing year, we are not talking about the results of this year, not about positive changes, not about future victories and improvements, but a pandemic. In the last few weeks, the omicron strain has gained momentum around the world and the situation is only getting worse day by day. Interestingly, the strain itself, despite its contagiousness, is not more dangerous than the same "delta strain". It makes people much less likely to go to hospitals. However, a much larger number of people around the world are infected with it. What is the problem then? The problem is that even if a person has a "mild form", he still cannot work, he still requires medical examination and treatment. Even if all the sick will carry the disease easily, there simply won't be enough doctors and hospitals to cope with the influx of patients. Moreover, if a person is sick, then he does not work. How many companies, factories, and enterprises will stop if all or most of them get sick? This is exactly what is feared now in the EU countries. Recall that Austria and several other countries went into quarantine a few weeks ago. Now "lockdown" has been introduced in the Netherlands. Germany and France are considering similar measures. And, in principle, quarantine restrictions have already begun to tighten throughout the European Union. This threatens that everyone will celebrate the holidays at home and there will be no parties.

But this is not the worst thing in the current conditions. The worst thing is that the economy will slow down again or, moreover, shrink. If omicron provokes new lockdowns, this will lead to the need to resume monetary stimulus. And the Fed and the ECB have just announced that they are ready to abandon it. Thus, before the PEPP program is fully completed, the European Union may well extend its validity and expand its volumes. And this situation is not only in the EU. In the States where omicron is also spreading at breakneck speed, the Fed may also suspend the process of normalizing monetary policy. At the moment, new vaccination points are being opened in the United States and everyone is being urged to get a third dose of the vaccine. Although studies show that people are infected with the new virus with both two doses of the vaccine and three. Thus, at the end of 2021, humanity faced the fourth or fifth "wave" of the pandemic. The vaccines that were designed to stop the epidemic are not working as expected of them. The whole world can survive a few more "lockdowns". And the recovery may take several more years. So far, the euro/dollar pair is practically not responding to these events, but it may start if the epidemiological situation continues to deteriorate.

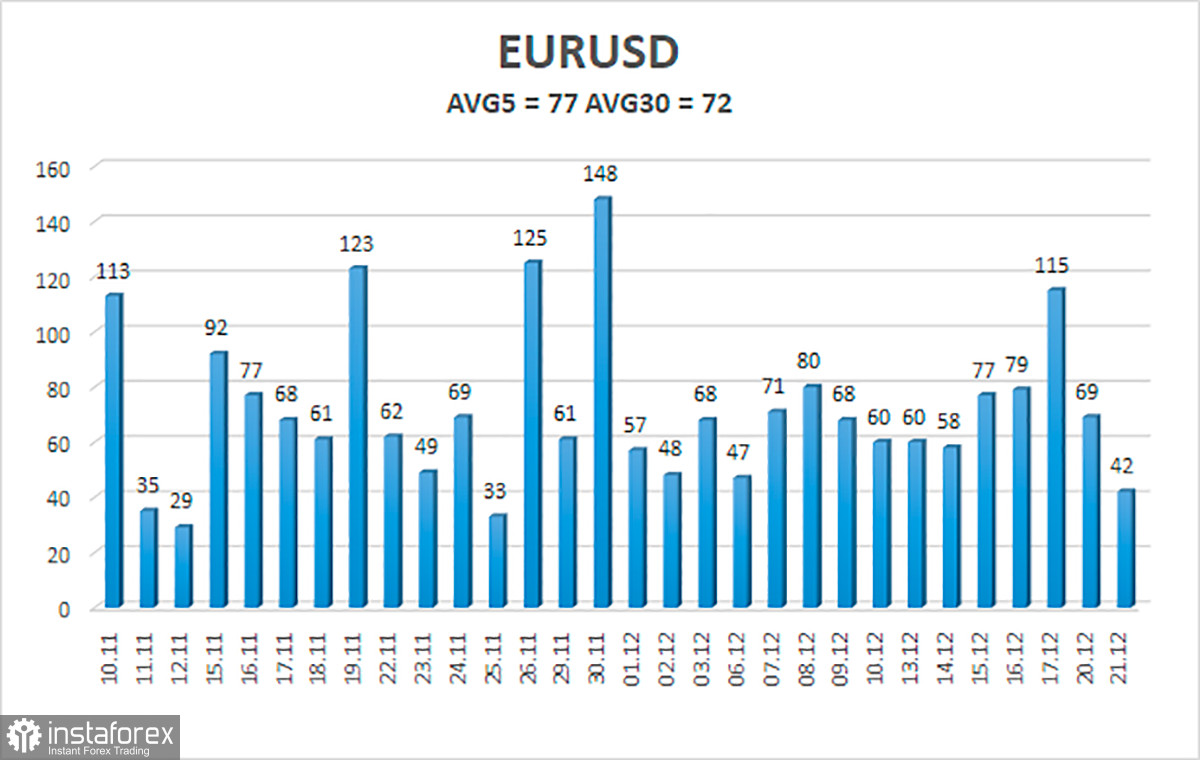

The volatility of the euro/dollar currency pair as of December 22 is 77 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1192 and 1.1347. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement in the side channel 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230-1.1353 side channel. Thus, you can continue to trade for a rebound from the upper or lower border of this channel. However, it should be remembered that we are talking about a flat, and volatility may decrease with the approach of the holidays.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.