The currency market practically stood still before the new year, which is on the one hand, amid the Christmas rally that has begun, and on the other, remaining under the impression of two important factors – a new wave of the coronavirus pandemic due to the Omicron strain and the upcoming change in monetary policies of the three largest world Central Banks: FRS, ECB, and Bank of England. In fact, the latter has already taken a step in this direction, raising interest rates at the last December meeting.

Following the actions of the Bank of England, markets' attention is drawn to the Fed, primarily to when it really starts to fulfill its promise – to raise interest rates next year. It can be recalled that J. Powell said at a press conference after the last meeting that the regulator is ready to do this three times next year. To understand when to expect the first rate increase, the US economic statistics published today, the data on the basic price index of personal consumption expenditure for the third quarter, as well as the consumer confidence index from the CB, will play an important role.

According to the forecast, the basic price index for personal consumption should maintain a growth rate of 4.5%. If the value turns out to be higher or lower than expected, then this could set the US dollar in motion in the financial market. Let's consider two scenarios:

First, if the indicator rises, this will confirm the Fed's fears that inflationary pressures will only intensify. And since this indicator is a composite inflation indicator of consumer inflation, then this may cause the US dollar to strengthen due to the growing expectations of an earlier increase in interest rates.

Second, if the value turns out to be slightly lower, then this may lead to the weakening of the US dollar and lower expectations of an early rate hike by the Fed. Another option is also possible. If the data turn out to be in line with expectations, it is hardly worth expecting a noticeable change in the dynamics of the US currency.

Another important piece of data to be released today will be the Conference Board (CB) America Consumer Confidence Index. It is assumed that this indicator will show an increase to the level of 110.8 points in December against 109.5 points in November. If the numbers turn out to be no worse than expected or even slightly higher, this will lead to an increase in demand for stocks in the US, in Europe, and then in Asia, i.e. they can support the Christmas rally. In this situation, widespread optimism should not be expected to strengthen the US dollar.

But when will the US dollar finally start to rise in the currency market?

We believe that only the continuation of inflation growth will force the Fed to really start raising interest rates next year. Apparently, the regulator does not want to do this yet, although there are plans. There is still a glimmer of hope in the depths of this organization that the growth of inflation will stop. In any case, an important indicator – the dynamics of Treasury yields clearly indicates this. Bond traders still doubt that rates will really start to rise in the near future. That is why we observe the indecision of the US dollar, which is actually near the level of 96.00 points on the ICE index. Once again, only an increase in inflationary pressure will provoke the Fed to take quick measures, but if it does, then only next year.

Forecast of the day:

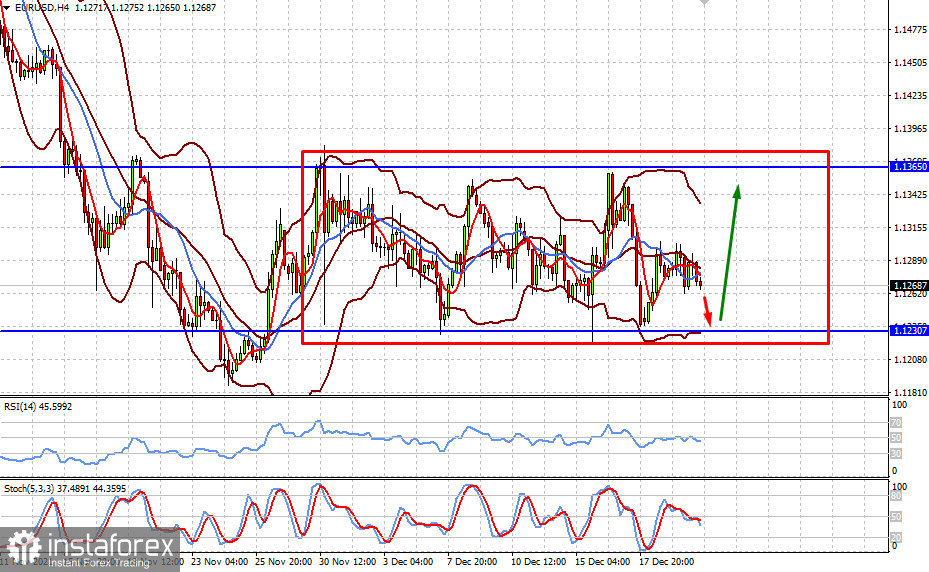

The EUR/USD pair is likely to continue trading in the range of 1.1230-1.1365 this week.

The price of gold has returned to the range of 1762-1794.20 again, where it may remain until the end of this week.