The USD/CAD pair crashed in the last hours as the Dollar Index plunged and erased today's gains. The currency pair was trading at 1.3669 at the time of writing and it seems very heavy. Still, after its massive drop, the rate could try to rebound.

Still, if the DXY continues to drop, the USD could lose more ground versus its rivals. Fundamentally, the CAD received a helping hand from the Canadian Retail Sales indicator which reported a 0.7% growth compared to the 0.2% expected, and from Core Retail Sales, the indicator surged by 0.7% exceeding the 0.3% growth expected.

As you already know, the USD depreciated also after Japan intervened in the FX market today.

USD/CAD Range Pattern!

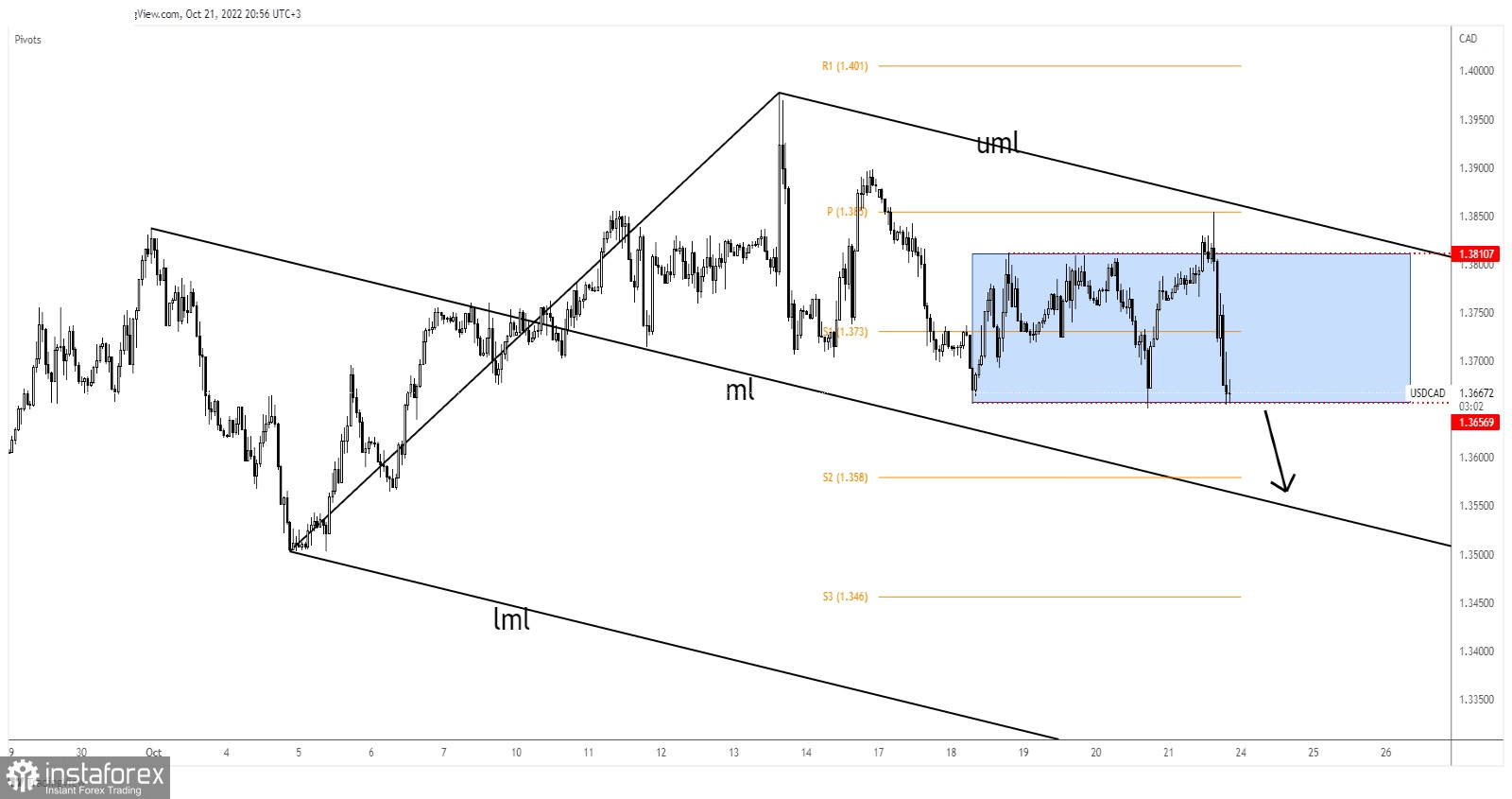

As you can see on the H1 chart, the USD/CAD pair registered only a false breakout through 1.3810 and now it is challenging the range's support of 1.3656. The upper median line (uml) of the descending pitchfork stands as a dynamic resistance.

As long as it stays under it, the USD/CAD pair could drop deeper. Escaping from this range could bring us new opportunities.

USD/CAD Forecast!

Its false upside breakout may signal a downside breakout. So, dropping and closing below 1.3656 activates more declines and bring new selling opportunities. The median line (ml) could still attract the rate as long as it stays within the pitchfork's body.