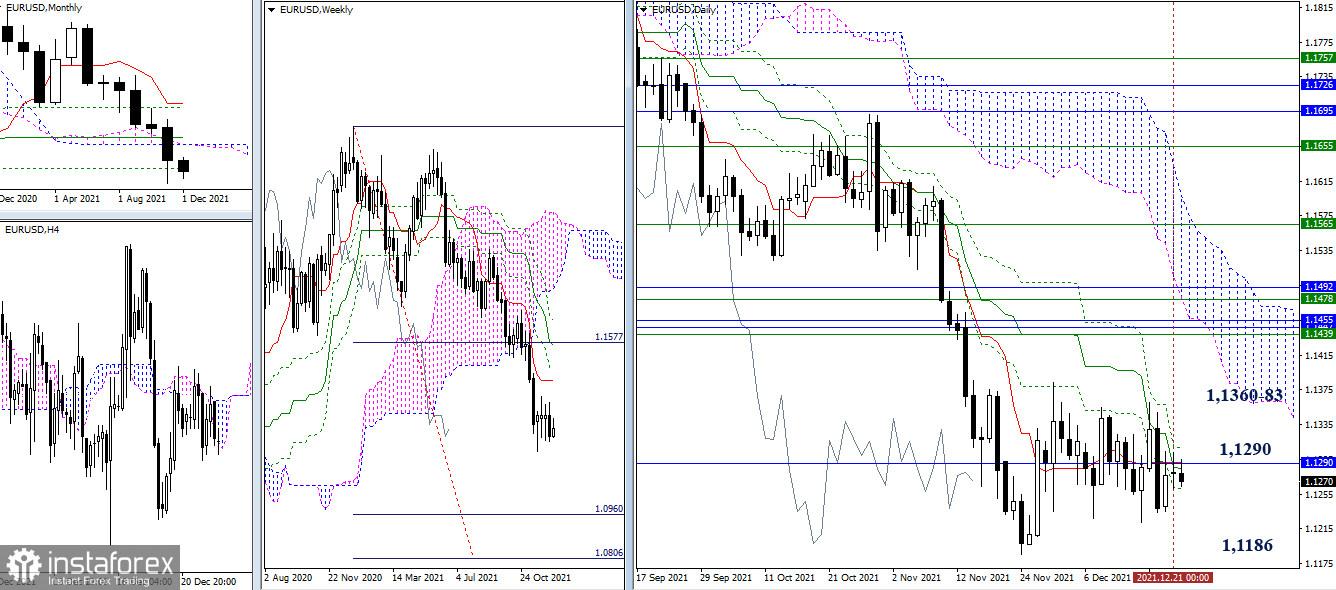

EUR/USD

The confrontation continues. The euro continues to trade in the consolidation zone, the center of attraction of which is the monthly Fibo Kijun (1.1290). Now, the daily cross has also descended to the influence zone of 1.1290. To change the situation, the euro should depart from the borders of the consolidation zone, securely consolidating outside. Therefore, the nearest important pivot points for the bulls are the highs (1.1360-83). As for the bears, the minimum extremum (1.1186) is important.

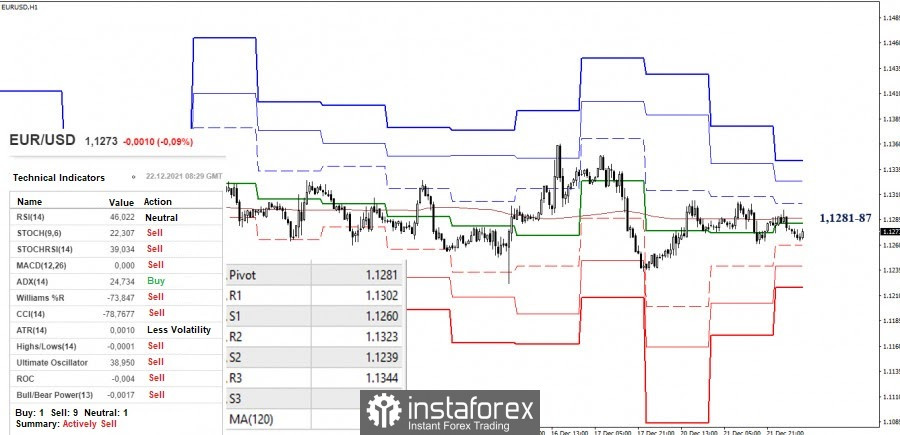

There is still uncertainty even at the hourly chart, where the key levels (1.1281 central pivot level + 1.1287 weekly long-term trend) fell to the limits of the center of attraction in the higher timeframes (1.1290). The classic pivot levels serve as pivot points for the intraday movement. Today, the resistances of the classic pivot levels are set at 1.1302 - 1.1323 - 1.1344, while the supports are at 1.1260 - 1.1239 - 1.1218.

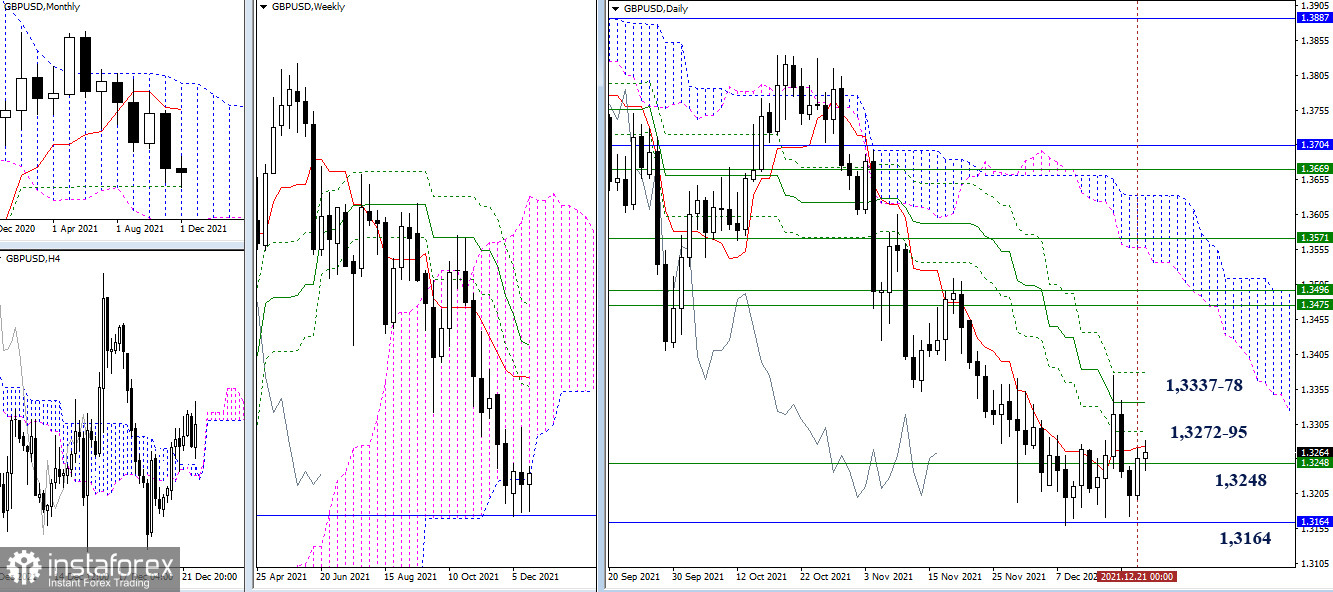

GBP/USD

The monthly support level of 1.3164 is trying to induce the bulls to form a rebound and to effectively restore positions. The last attempt was only implemented as an upward correction, which was stopped by the resistance levels of the Ichimoku daily cross. Now, the pair managed to close on the daily timeframe above the lower limit of the weekly cloud (1.3248), but there is still the same daily dead Ichimoku cross ahead, with its resistances at 1.3272 - 1.3295 - 1.3337 - 1.3378. Perhaps, the next result of interaction with the daily cross will be able to contribute to changing the current situation, as well as become a reason for the emergence of new prospects in the development of the further movement.

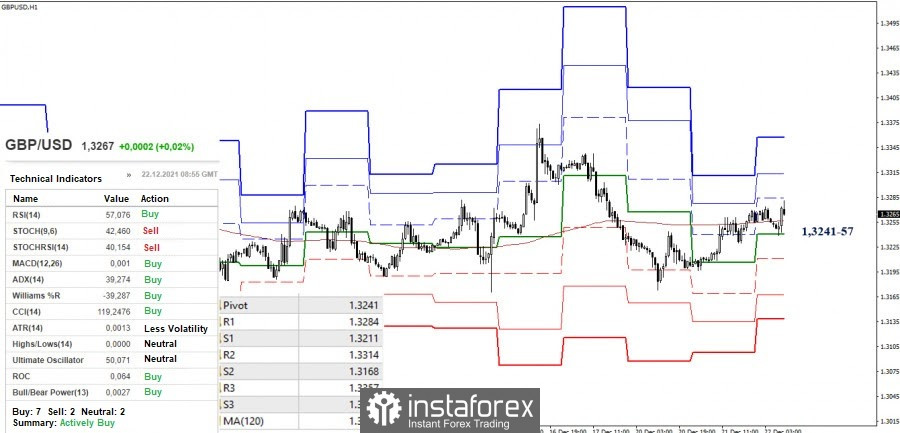

The bulls continue to fight for the key levels in the smaller timeframes, trying to turn them into support levels. Today, the key levels are maintaining their positions at 1.3241 (central pivot level) and 1.3257 (weekly long-term trend). Trading above the levels favors the bulls. The intraday upward targets are 1.3284 - 1.3314 - 1.3387 (resistances of the classic pivot levels). On the contrary, trading below the key levels (1.3241-57) will change the situation in favor of the bears. The support of the classic pivot levels seen at 1.3211 - 1.3168 - 1.3138 will be considered as downward targets.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.