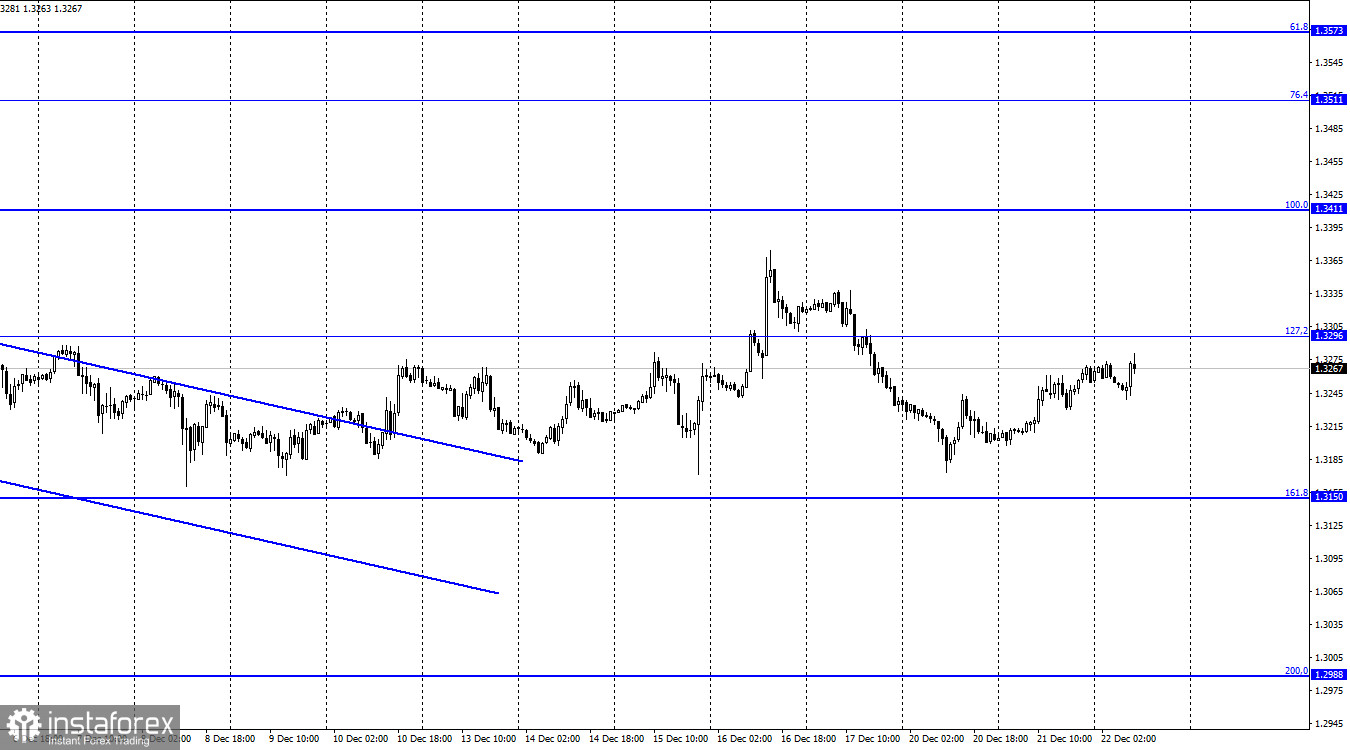

GBP/USD – 1H.

Hello, dear traders! On the hourly chart, the GBP/USD pair continued to rise on Tuesday, ignoring weak UK information background. The pair's quotations are further moving towards the 127.2% correctional level at 1.3296. I expect a pullback with reversal from this level in favor of the US currency. The reversal might occur earlier before it reaches the given level. If it is possible not to take into account the two days at the end of the past week, the pound continues to remain in the sideways channel between 1.3150 and 1.3296. Therefore, I believe it to move in approximately the same way as the EUR/USD pair. At the end of the year, when the information background weakens and traders start to demonstrate less activity, it makes no sense to expect a strong movement. Besides, when the pair enters the sideways corridor, it is hard to get out of it. As I mentioned before, the UK GDP report for the third quarter was released today. According to its new estimates, the rate declined to 1.1% q/q. The previous rate was 1.3% q/q. This means that the new Omicron variant, spreading in the UK, has already been deeply affecting the economy.

Covid-19 restrictions have already been slightly tightened in the UK. However, this fact may not have a negative impact. The UK has always been at the top of the list in the EU among morbidity and mortality rates caused by the Covid-19 pandemic. Therefore, the UK citizens can significantly affect the economy. Many of them are afraid of contracting the new variant, being taken to hospital, though the probability is low. However, when the Covid-19 pandemic reaches its peak, not all people treat it like Boris Johnson did last spring. Meanwhile, the UK government is further debating whether to tighten coronavirus restrictions. The parties are not unanimous in their views. Labor believes that a new lockdown will stop the spread of the new variant. Ignoring this fact, the health care system may not survive. The Conservatives, led by Boris Johnson, think a quarantine should not be imposed yet and want to cope with a new rise in disease by revaccination. However, the UK economy has already begun to slow down. Besides, a similar situation may be typical in many countries around the world this winter.

GBP/USD – 4H.

US and UK economic news calendar:

UK - GDP volume change (07-00 UTC).

US - GDP volume change for quarter (13-30 UTC).

US - Consumer Confidence Index (15-00 UTC).

On Wednesday, the UK single report has already been released, and the same report in the US will be issued later. Traders did not react to the first report. The similar situation may be with the second report as well. I believe the information background is going to be weak today.

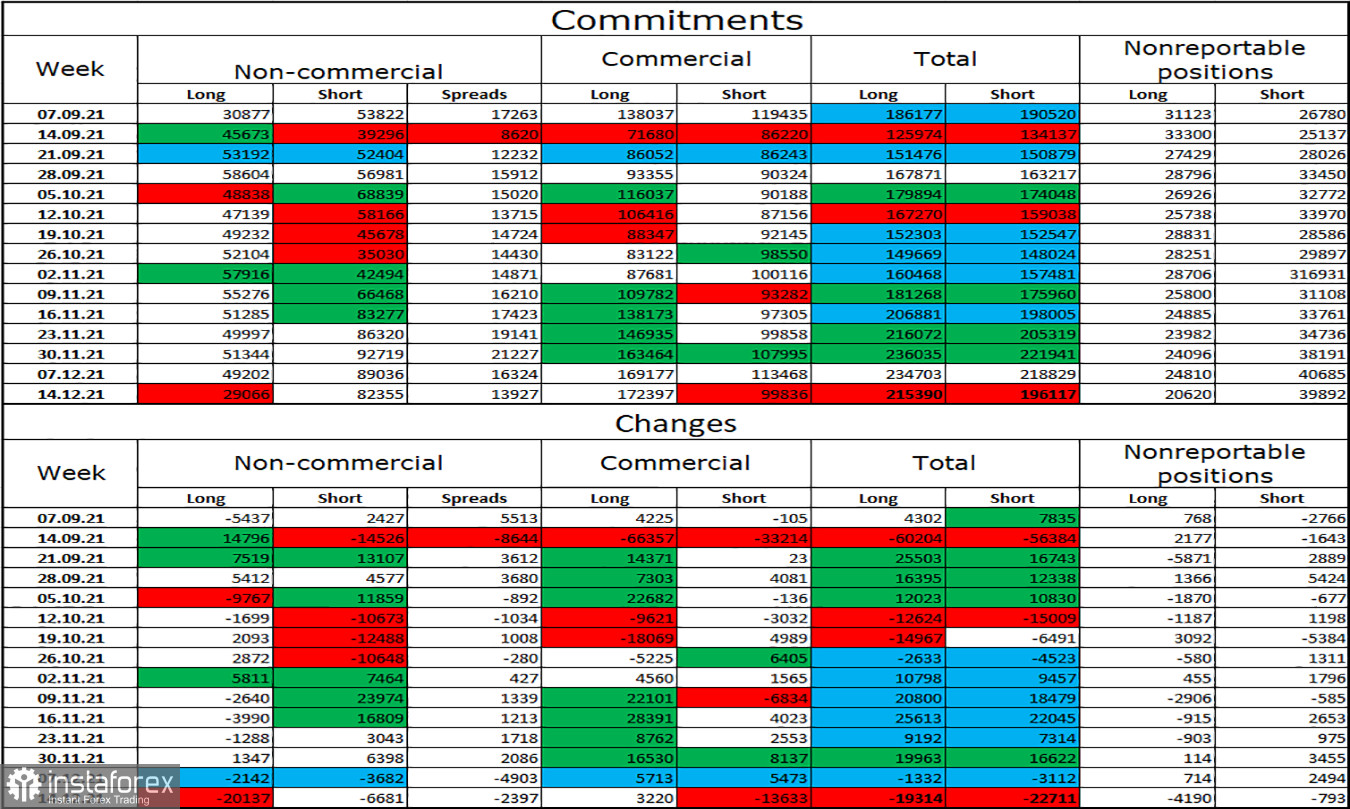

COT (Commitments of traders) report:

The latest COT report on the British pound for December 14 showed that the sentiment of major players has changed significantly. To be more precise, it has become much more bearish as non-commercial traders closed 20,000 long contracts immediately. Currently, the trend of increasing bearish sentiment has been observed for two months. During the reporting week, speculators also closed 6,681 short contracts. The total number of short contracts of non-commercial traders is now more than twice as high as the number of long contracts: 82,000 against 29,000. Thus, according to the outcome of the latest week and the latest COT report I conclude that the pound's position has not improved. It may still continue falling.

GBP/USD outlook and recommendations for traders:

I recommended buying the pound if a rebound is performed from 1.3171 with a target of 1.3296 on the hourly chart. These trades should be kept open at the moment. I recommend selling if there is a pullback from 1.3296 with a target of 1.3173.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant impact on the price.