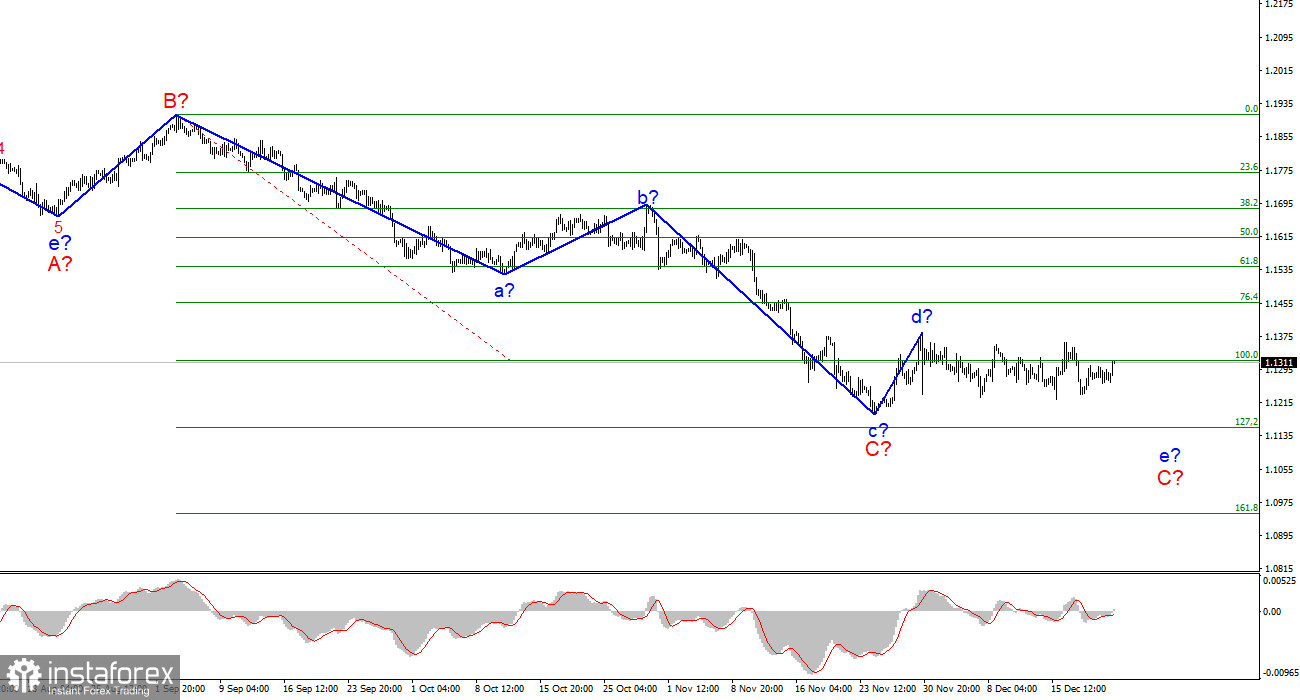

The wave marking of the 4H chart for the euro/dollar pair continues to remain integral and does not require adjustments. The construction of a downward wave e in C is still questionable, although the pair makes attempts to resume the downward movement quite often. If this wave does not continue its construction, then wave C may turn into a complete three-wave. Although I believe that it should take a five-wave form. The wave that originated on November 30 cannot be attributed now either to wave C or to the first wave of a new upward trend segment as neither the peak of wave d in C nor the low of wave c in C has been broken over the past few weeks. The movement of the pair is almost sideways. Now, it is better to wait for the development of the situation. The supposed wave e (or possibly complicated d) may take a very extended, horizontal form, which will only complicate the entire current wave marking.

Trading activity is rather sluggish ahead of the Christmas holiday

On Wednesday, the economic calendar was almost empty for EUR/USD. The only important report was US GDP data for the third quarter. Instead of the expected growth of 2.1% QoQ, it grew by 2.3% QoQ. However, this did not affect market sentiment. The greenback kept rising moderately following the release of the report. It added 25 pips, which was not too high but still it was more than yesterday. Overall, there is nothing interesting happening On Forex. Market participants are now discussing the Omicron strain simply because there is nothing more to talk about right now. The new strain turned out to be much more contagious than all the previous ones. However, it is also not as dangerous as any other. People rarely die from it even though vaccines are not so efficient against infection. Thus, the situation with the coronavirus this winter may be severe again but the mortality rate will be lower than in previous waves of the epidemic. Bedsides, now, there are many vaccines. This is why traders react very cautiously to all news. They understand that the situation may worsen and the consequences for the economy may again be negative. However, it is too early to draw conclusions.

Conclusion

Judging by the analysis, I conclude that the construction of the descending wave C can be completed. However, the internal wave structure of this wave still allows the construction of another downward, internal wave. Thus, I recommend opening short positions on the pair for each MACD downward signal until it breaks the peak of wave d. The target level is located around the 1.1152 mark.

Large timeframe

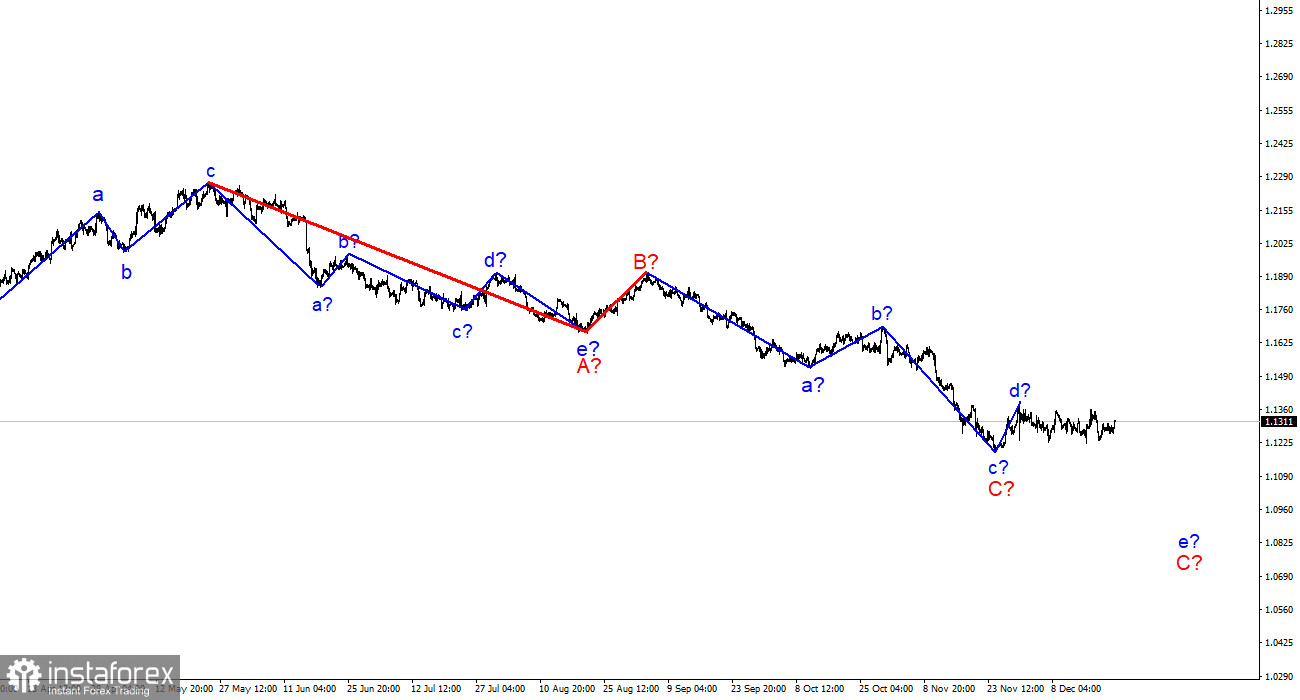

The wave marking of the large timeframe looks quite comprehensive. The decline in quotes continues. Now, the downward section of the trend, which originated on May 25, takes the form of a three-wave correction structure A-B-C. Thus, the downward movement may continue for several more weeks until wave C is fully completed (it should take a five-wave form).