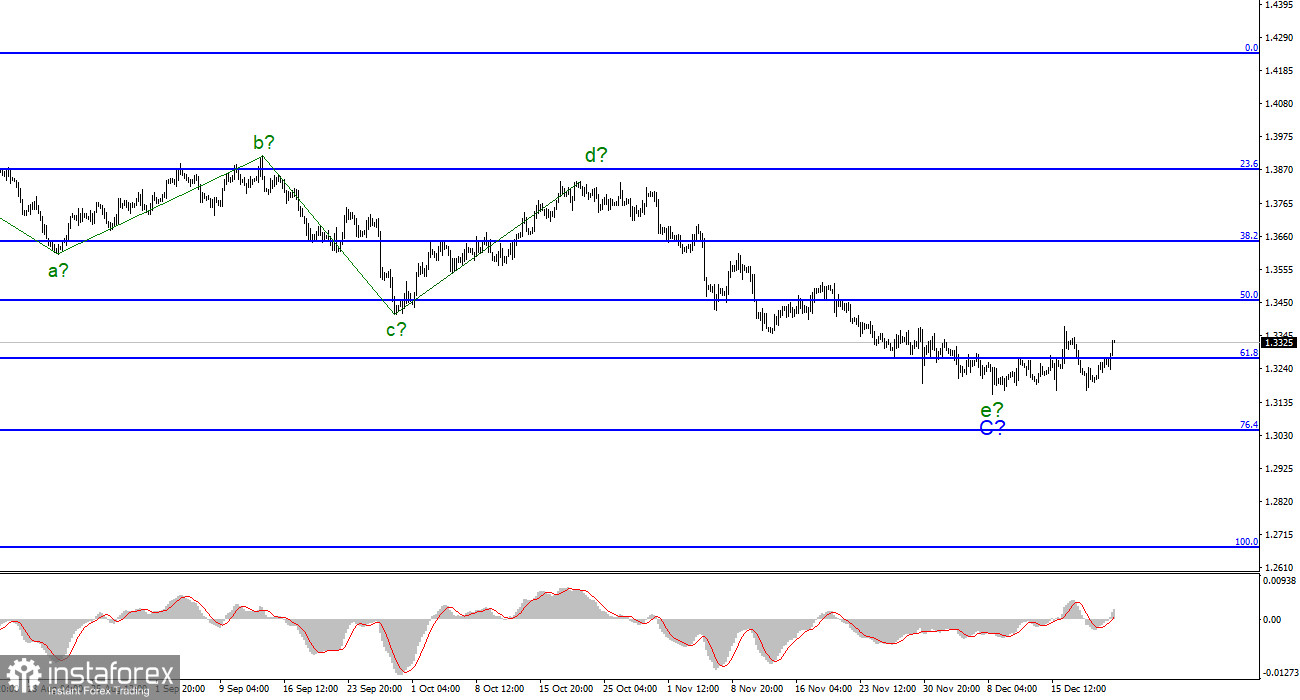

For the pound/dollar instrument, the wave markup continues to look quite convincing, but it may still require additions. At this time, the construction of the last internal wave in the composition of C is presumably completed. The increase in quotes last week allowed me to assume that the construction of a new upward trend segment (at least a corrective one) has begun, but the decline on Friday and Monday allows that the entire downward trend will take a longer form. However, until the low of the wave e-C is updated, I still believe that a new upward trend section has begun its construction. The increase in quotes could also begin within the global wave D, after which the decline of the instrument will resume within wave E. In general, the situation with the waves has been simplified a little thanks to the meetings of the Bank of England and the Fed last week, but at the same time, the corrective essence of the movements in 2021 leaves a fairly large number of possible scenarios.

Boris Johnson got into a bad quarantine story again.

The exchange rate of the pound/dollar instrument increased by 70 basis points during Wednesday. As I said yesterday, the pound does not leave the room before the holidays and tries to move more or less actively. For the third day in a row, the demand for the British is increasing, which gives hope that the formation of a new upward trend section will still begin. At the same time, the nature of the news coming from the UK allows us to expect the maximum construction of a corrective wave. The situation with Omicron is getting worse day by day, Boris Johnson refuses to introduce a lockdown, and there is absolutely no positive news. In addition, the Prime Minister, who must set an example to the population in another difficult period for the country and instill confidence in the future and calmness, on the contrary, for the second time in the last month gets into a "quarantine scandal". At first, it became known that in December last year, a whole series of parties took place at 10 Downing Street while the whole country was in quarantine and Britons were forbidden even to visit relatives. When this story became public, a ton of criticism poured out on Boris Johnson, and one of the members of Parliament who was filmed at that party on video had to resign. And a few days ago, a photo appeared in which Boris Johnson, along with his wife and assistants, are resting and relaxing with wine in their residence. Everything would be fine, only this photo was taken in May 2020, when the whole country was also in a hard lockdown, and the British were again forbidden to go out and see their relatives. Thus, confidence in the British government is falling, which is confirmed by various ratings.

General conclusions.

The wave pattern of the pound/dollar instrument looks quite convincing now. The supposed wave e could complete its construction. Thus, now I would advise buying a tool with targets located near the estimated mark of 1.3457, which corresponds to 50.0% Fibonacci, for each MACD signal "up". Even if the instrument is located within the framework of the construction of wave D, and not a new upward section of the trend, then the instrument can reach the 1.3457 mark.

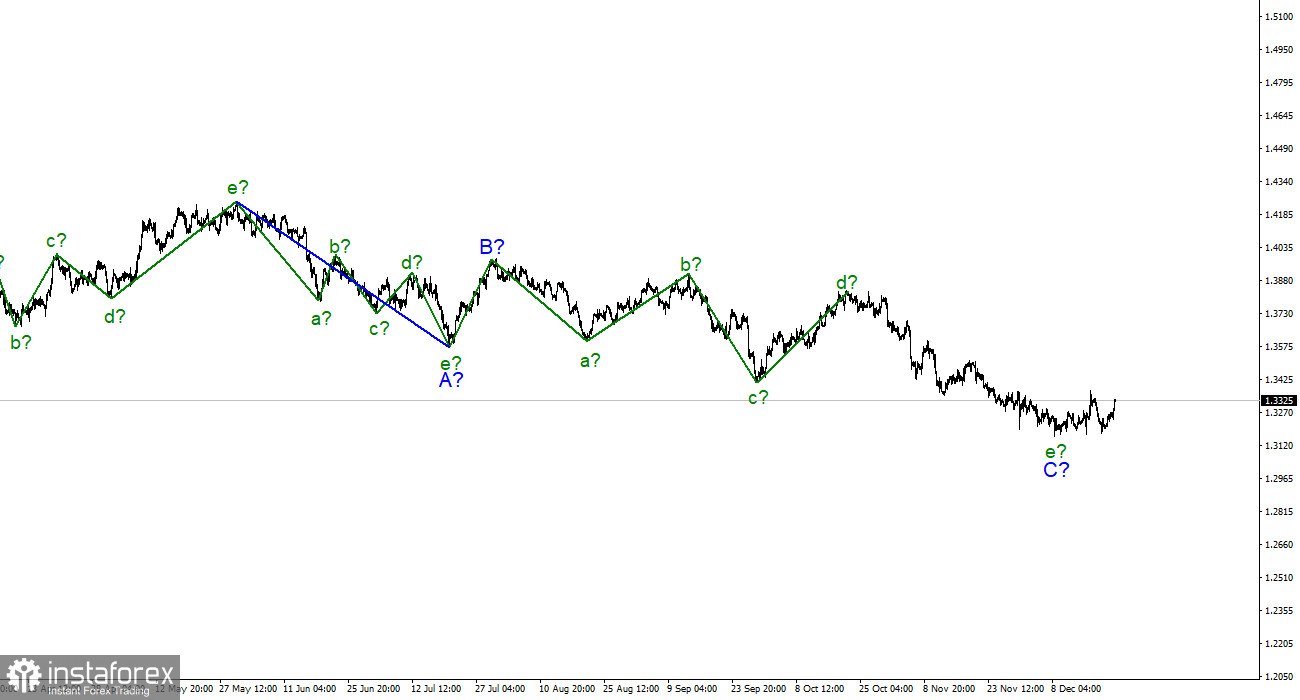

Senior schedule.

Starting from January 6, the construction of a downward trend section continues, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, the entire downward section of the trend may lengthen and take the five-wave form A-B-C-D-E.