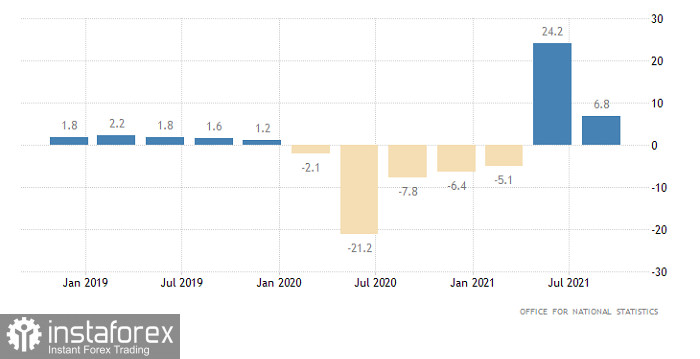

The final UK GDP data for the third quarter was actually slightly worse than expected. It seems that everything is just the opposite at first glance because they expected a slowdown in economic growth to 6.6%, but the actual figure turned out to be 6.8%. However, looking at the quarterly data, the economy grew by 1.1%, against the expected growth of 1.3%. So how did the annual data turn out to be better than the forecast? It's all about the previous data, which has been revised up. Earlier, it was assumed that the economic growth rate in the second quarter was 23.6%, but yesterday, it was raised to 24.2%. Due to this revision, the scale of the slowdown in economic growth turned out to be even somewhat larger. Nevertheless, the pound gradually increased.

GDP Change (UK):

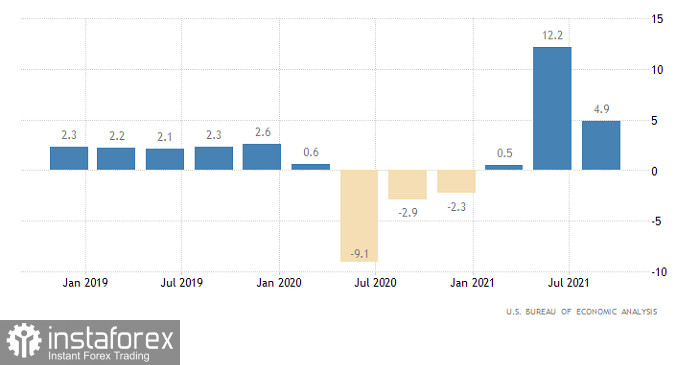

The same thing happened with the Euro currency. Its growth continued during the American trading session when the final data on US GDP were published. This indicator fully corresponded to preliminary estimates – economic growth in the third quarter slowed down from 12.2% to 4.9%. Considering that investors took this fact into account long ago, the GDP data could not influence the market in any way.

GDP Change (United States):

Nevertheless, nothing has actually changed. After all, both the pound and the euro have simply risen to the upper border of a fairly wide range, wherein they have been from the very beginning of December. We can say that all these movements are quite technical, while ignoring any macroeconomic statistics. If this is indeed the case, then we should observe the opposite movement today. That is, the US dollar will grow and can be quite large-scale. The formal reason for this will clearly be the US macroeconomic statistics, particularly the data on applications for unemployment benefits. Here, the number of repeated applications is likely to decrease by 63 thousand, although the number of initial applications should increase by 1 thousand. Therefore, the situation in the labor market continues to improve.

In addition, the volume of orders for durable goods could rise by 1.1%, which looks great. It should be noted that these are changes on a monthly basis. In general, expectations for the US statistics are purely optimistic, which will be an excellent background for the growth of the US currency.

Durable Goods Orders (United States):

Despite periodic price fluctuations, the EUR/USD pair is still moving in the sideways range of 1.1225/1.1355, consistently working out the set borders. Based on the fact that the quote is marking time at the upper border, it can be assumed that market participants are not yet ready for a breakdown. This may well lead to a natural price rebound towards the level of 1.1290.

The GBP/USD pair demonstrates strong speculative interest in the market, which resulted in a V-shaped pattern. Based on the fact that the quote hit a local high on December 16, the volume of long positions fell. This led to a slowdown, and subsequently, a partial recovery of the relatively recent impulse may occur.