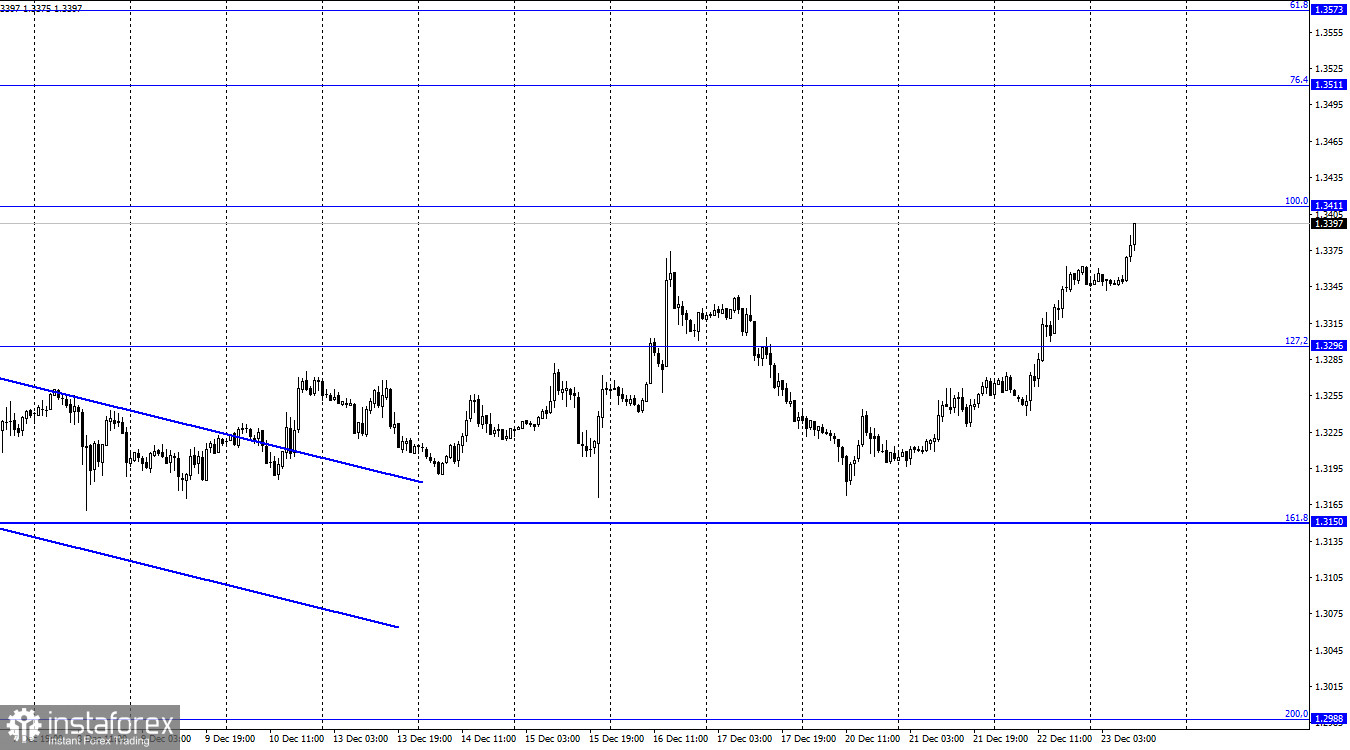

GBP/USD – 1H.

Hi, dear traders!

According to the 1H chart, GBP/USD continued to climb on Wednesday, closing above the retracement level of 127.2% (1.3296). Today, it reached the Fibonacci level of 100.0% (1.3411). A bounce off this level would lead to a downward reversal towards the 127.2% retracement level. If the pair closes above 1.3411 today, it could continue to rise towards the next Fibonacci retracement level of 76.4% (1.3511). Yesterday's UK GDP data for the third quarter did not meet market expectations - the UK economy grew only by 1.1% quarter-over-quarter. However, it did not discourage bullish traders that continue to open long positions, as winter holidays approach. The euro's movement remains limited.

Traders did not pay much attention to yesterday's reports from the US. The pound sterling found support in Boris Johnson's recent statement - the UK prime minister said there would be no lockdown before Christmas. Recently, US president Biden hinted at the same thing. It is unclear what is pushing GBP up. Bearish traders possibly began to leave the market after failing to push the closing price below 1.3173, which can be seen on the H4 chart. Also, the Bank of England raised the interest rate before the Federal Reserve, which could have affected the British currency. The pound sterling could rise by about 100-200 pips before going into a correction.

GBP/USD – 4H.

According to the 4H chart, the pair settled above the 61.8% Fibonacci retracement level (1.3274) and is now continuing to rise towards the next Fibonacci level of 50.0% (1.3457). A bounce off the 50.0% level could lead to a downward reversal. If GBP/USD settles above it, it could continue its upwards movement towards the next Fibonacci level of 38.2% (1.3642). There are no emerging divergences today.

US and UK economic calendar:

US - Durable goods orders data (13-30 UTC)

US - Personal spending data (13-30 UTC)

US - Initial and continuing jobless claims data (13-30 UTC)

US - UoM consumer sentiment index report (15-00 UTC)

There are no economic events in the UK today. The data releases in the US are unlikely to influence traders.

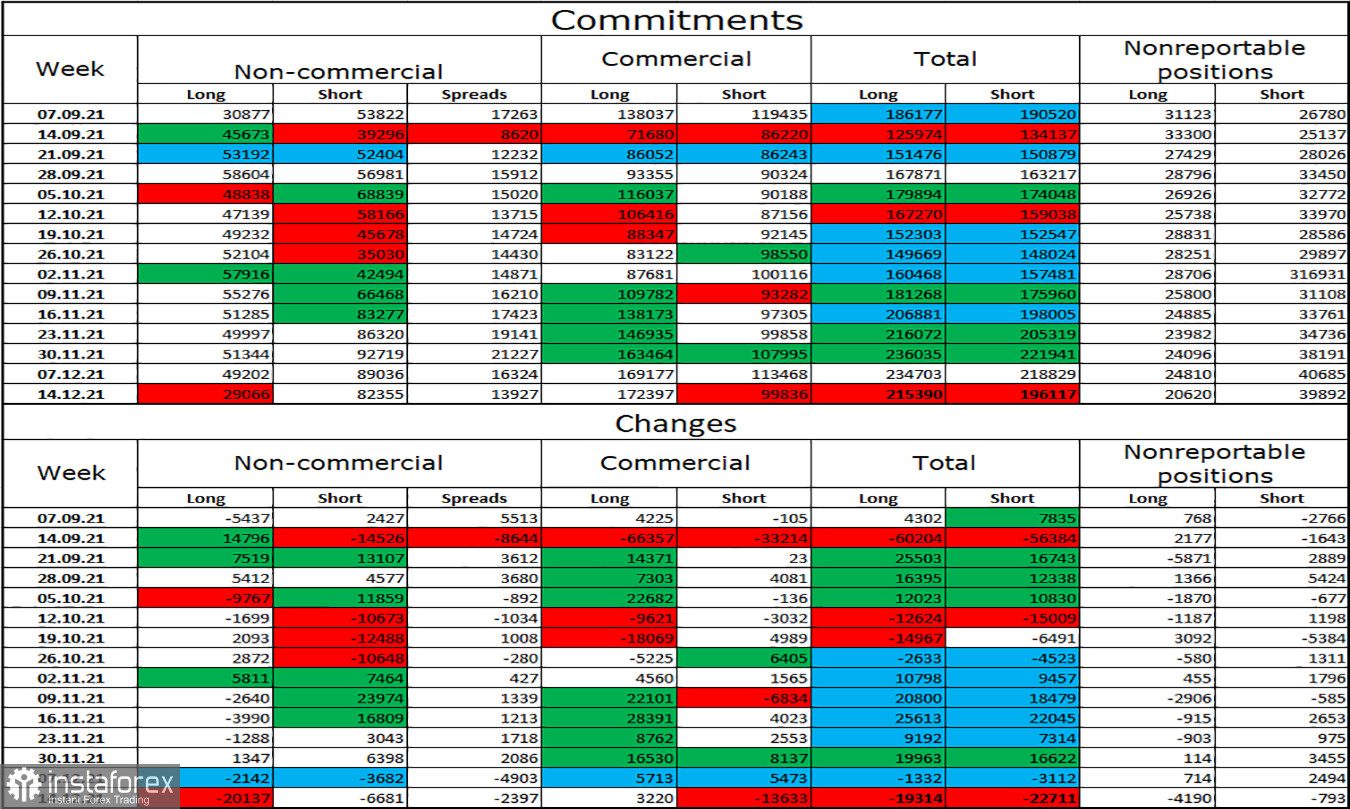

COT (Commitments of traders) report:

The latest COT report as of December 14 indicates that bearish sentiment among market players has significantly increased. Non-commercial traders closed 20,000 Long positions. This bearish trend has been going on for the past two months. During the week covered by the COT report, traders closed 6,881 Short positions. The total amount of Short positions exceeds the amount of Long positions twofold: 82,000 vs. 29,000. The situation has no signs of improvement, and the pair could continue to fall.

Outlook for GBP/USD:

Traders are recommended to open long positions if the pair bounces off 1.3171, targeting 1.3296. GBP/USD has already surpassed 1.3296 and could rise above 1.3411. Long positions can be held with the target being 1.3511. Due to the current strong upside movement, traders are not recommended to open short positions.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.