What is needed to open long positions on GBP/USD:

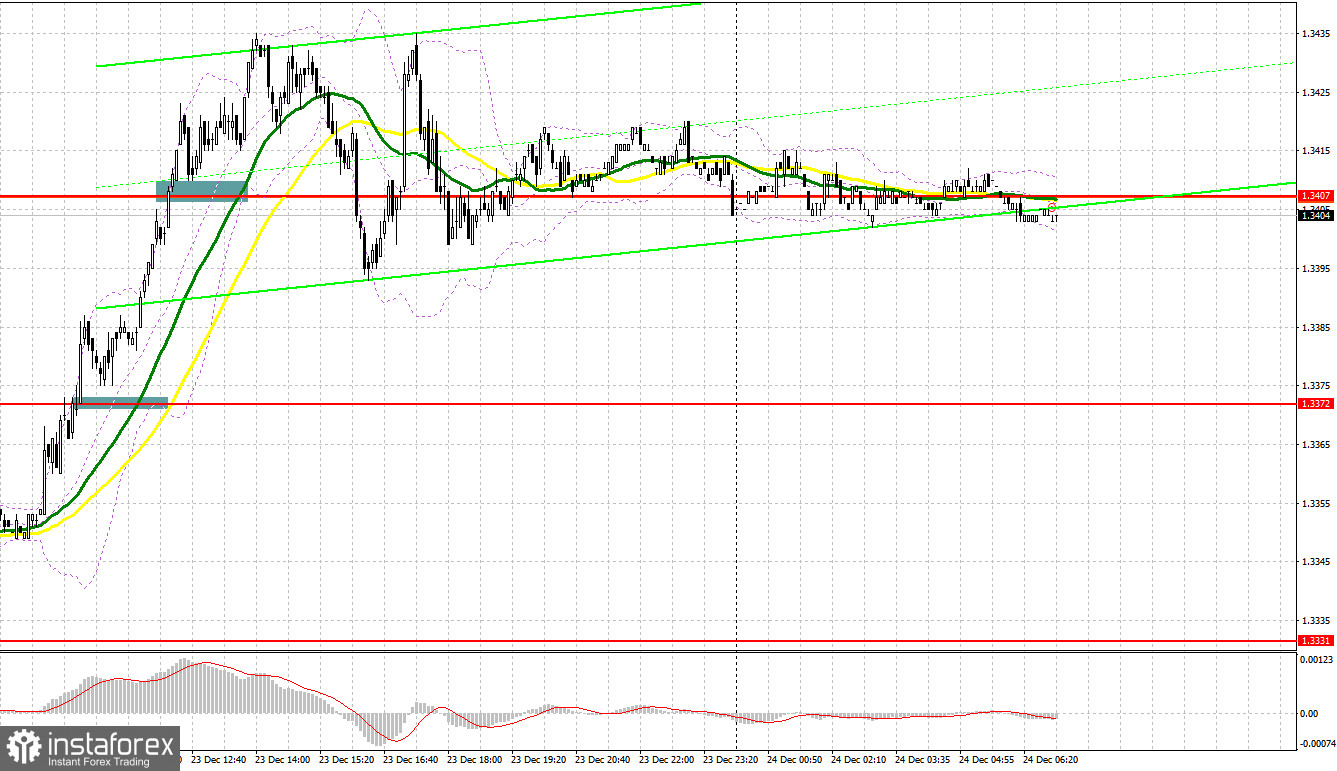

Yesterday, there were several signals to enter the market. Let's look at the 5M chart and figure out the entry points. In my morning forecast, I paid attention to the level of 1.3372 and recommended making decisions on entering the market with this level in focus. Long signals were formed after the breakout and consolidation of the price above this level. It took place in the first half of the day followed by a downward. As a result, the pound sterling resumed the upward movement. The price tested the resistance level of 1.3407 in the first half of the day. The profit totaled about 30 pips. In the forecast for the US session, I recommended buying the pound sterling after its breakout and consolidation above 1.3407. Later, this scenario came true. The downward test of this level gave an additional entry point into long positions. After that, the pair grew by another 30 pips.

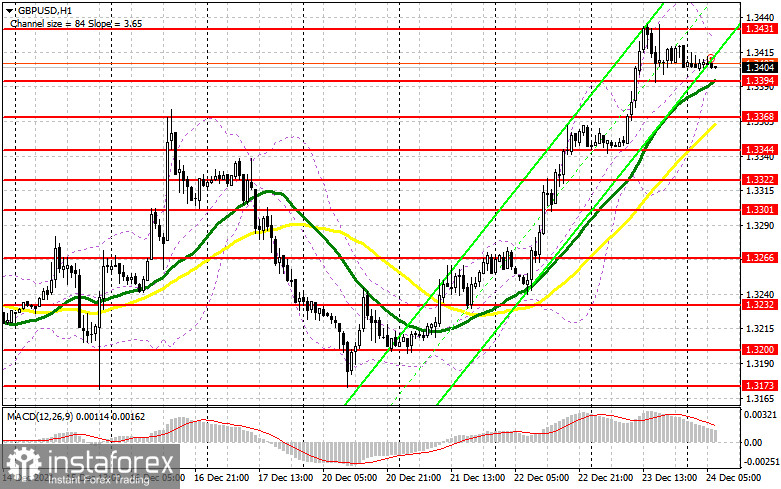

Today, the economic calendar for the UK is empty. Additionally, many markets will be closed in anticipation of Christmas or will work for shortened hours. Bulls need to protect the support level of 1.3394. The moving average is located slightly below this level. This is an important physiological level. So, its breakout may trigger profit-taking at the end of the week and to a more significant fall in the pound sterling. The entry points for long positions could appear only after the formation of a false breakout at 1.3394. If this scenario comes true, the pair may retain its bullish momentum, heading for the resistance level of 1.3431. A breakout and test of this level will give an additional entry point. If bulls assert strength, the pair may rise to the highs of 1.3472 and 1.3506. If the pound sterling declines during the European session and the level of 1.3394 is not broken, it is best to refrain from opening long positions to the level of 1.3368. Only the formation of a false breakout will give an entry point to open long positions on the pound sterling amid expectations of the continuation of the bullish momentum. It is recommended to open long trades on GBP/USD immediately after a bounce off 1.3344 or from 1.3322, bearing in mind a 20-25 pip intraday correction.

What is needed to open short positions on GBP/USD:

Bears are now monitoring the market. However, they may return to the market if the pair fails to reach 1.3394. Bears will try to protect the resistance level of 1.3431. In case of a false breakout at this level, the first entry point into short positions will appear, followed by a decline in the pair to the area of 1.3394. A breakout of 1.3394 and an upward test will increase pressure on the pound, dragging it down to the next support level of 1.3368. It is will not be an easy task to push the pair below this level, given the low trading activity and low volatility today. Only the consolidation and the upwards test of 1.3368 will give a new entry point into short positions with the prospect of a decline to 1.3344. I recommend locking in profits at this level. If the pair grows during the European session and bulls fail to push it to 1.3431, it is best to refrain from opening short positions to the resistance level of 1.3472. I also recommend traders open short positions only in case of a false breakout. The most sensible solution to sell the pair would be selling straight after a drop off the highs at 1.3506 or even higher from 1.3560. Don't forget to allow for a 20-25 pip intraday correction.

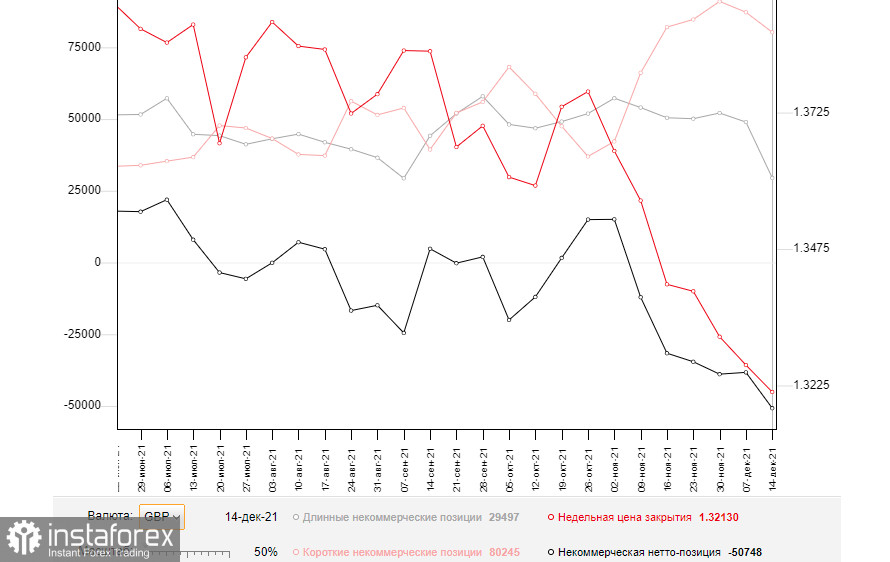

The COT report (Commitment of Traders) for December 14 showed a drop in both short and long positions. Long positions declined by almost half. It led to significant changes in the negative delta. However, this report did not take into account the results of the FED and ECB meetings. However, the prospects for the pound sterling are rather pessimistic. After the Bank of England's decision to raise the interest rate, the GBP/USD pair soared bit the following day, it faced a massive sell-off. It came as an unpleasant surprise for many market participants betting on at the end of the bearish trend. Demand for the US dollar is likely to remain high amid uncertainty over the new strain of the omicron strain, which is spreading rapidly. This is why traders are cautious and stay away from the market. They do not want to buy an overbought dollar but a cheap pound sterling is also not a very attractive asset. The pound sterling is unlikely to recover until the situation with coronavirus normalizes. However, high inflation remains the main reason why the Bank of England will continue to raise the interest rate next year, which is bullish the British sterling. The COT report for December 14 showed that the number of long non-commercial positions fell to 29,497 from 48,950, while the number of short non-commercial positions declined to 80,245 from 87,227. This led to an increase in the number of negative non-commercial net positions to 50,748 from 38,277. The weekly closing price sank to 1.3213 from 1.3262.

Signals of technical indicators

Moving averages

GBP/USD is trading above 30- and 50-period moving averages. It means that the pit is likely to rise higher.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper border at about 1.3431 will trigger a new bullish wave. Alternatively, a breakout of the lower border at about 1.3394 will escalate pressure on GBP/USD.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.