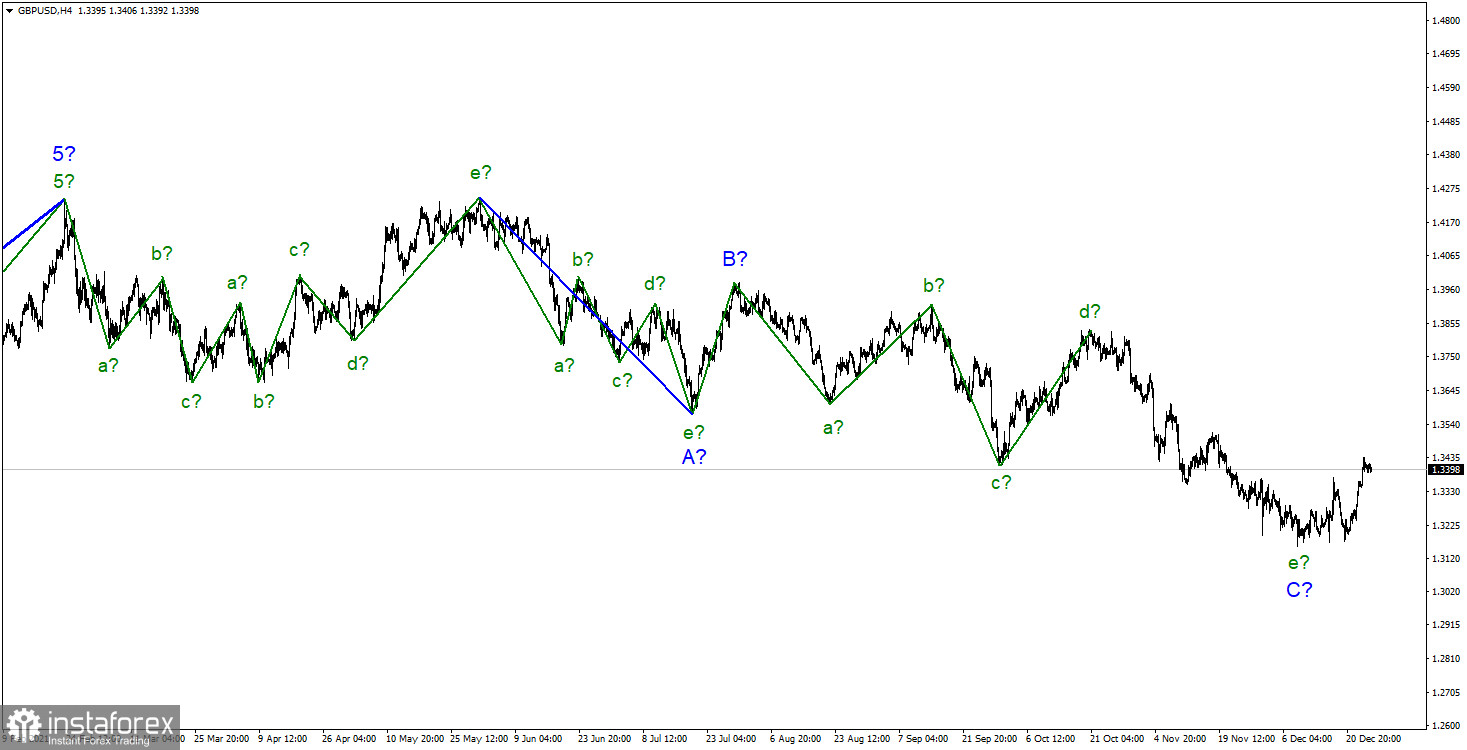

In the first part of 2021, the pound/dollar pair was forming downward and upward waves. When the formation was completed, the quote returned to the levels from which it began the decline. Then, the pair started the formation of a downward section of the trend, which now is becoming more complicated. Its correctional nature allows us to say that this section could be of almost any length. The internal wave structure could be of any complexity.

At the moment, it is quite possible that the formation of wave C is completed. This could be proved by five clear waves within wave C as well as the pair's increase from the recent lows in the last few days. However, the current growth in the instrument could be considered wave D. If the wave finishes its formation, the pound sterling may resume falling in the long term.

Thus, during the first week of the year, traders should find out within what wave the price is rising. The internal structure of wave D is turning into a correctional three-wave section. It is highly possible that the wave will end its formation in the near future. However, it is better to see where the wave ends and then take a trade decision. Notably, it could be rather long since all the previous correctional waves were quite strong.