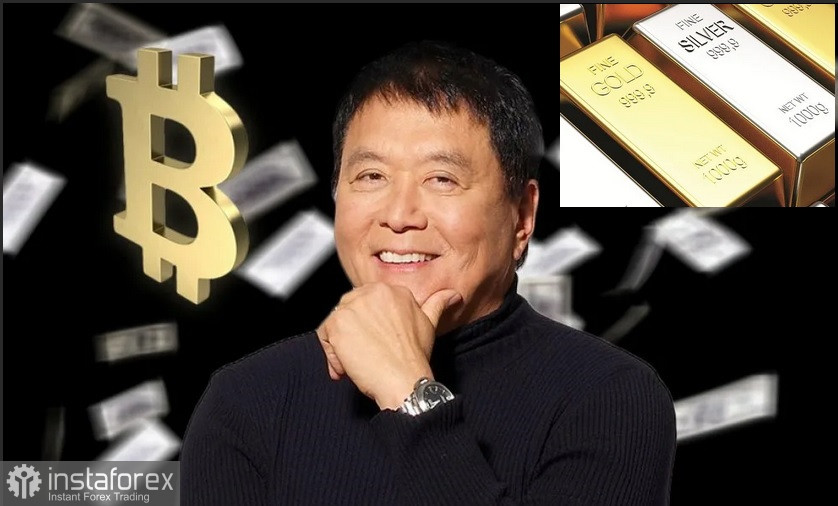

The three assets Robert Kiyosaki uses to preserve capital are gold, silver, and Bitcoin.

Kiyosaki first bought gold in 1972 when it cost $ 50 an ounce.

To date, the yellow metal is trading above $1,800 per ounce, and he still likes it.

In addition, Robert Kiyosaki noted that more than 35% of all existing US dollars were printed in 2020. Gold cannot be printed from scratch like paper money. Moreover, its value is largely unaffected by world economic events.

Due to the fact that the precious metal has safe-haven status, investors often rush to it during a crisis, making it an effective hedge.

There are many ways to invest: you can own gold bars, you can get access them through an ETF, or you can invest in gold mining companies.

If gold prices rise, miners will experience higher returns and profits, which will generally lead to higher stock prices.

For example, companies like Barrick Gold, Newmont, and Freeport-McMoRan tend to thrive in difficult times.

As for silver, this metal may not sound as exciting as gold but it may be the best investment given its price action.

The precious metal is still 50% below its historical high, which is also used in industry.

Like gold, silver can act as a means of saving. But it's more than just a safe haven asset.

Silver is widely used in the manufacture of solar panels. It is also an important component in the electrical control units of many vehicles. Industrial demand and the possibility of hedging make silver a very interesting asset class for investors.

It is possible to buy silver coins and bars. ETFs such as iShares Silver Trust provides another way to access the metal. There is also no doubt that a lot of mining companies – Pan American Silver, Wheaton Precious Metals, and First Majestic Silver should be a good starting point for some research.

With regard to Bitcoin, investing in cryptocurrency doesn't always go smoothly. Nonetheless, long-term holders, including Kiyosaki, are not complaining as the price of the world's largest cryptocurrency has surged more than 100% in the past 12 months.

Robert Kiyosaki bought Bitcoin for another $ 6,000.

Investors can buy the first world's cryptocurrency directly. Today, many exchanges charge up to 4% commissions just for buying and selling cryptocurrencies, but some investment apps charge 0%.

Companies that have tied themselves to the cryptocurrency market present another option to make money on the cryptocurrency boom.

For example, a MicroStrategy software developer has accumulated 122,478 bitcoins.

Electric car giant Tesla stores about 43,200 Bitcoins.

Although Robert Kiyosaki loves gold, silver, and bitcoin, he did not say that they are immune to market downturns.

In his opinion, there is another asset that has little correlation with the ups and downs of the stock or cryptocurrency market, and it is worth considering this is art.

For the last 25 years, contemporary art has outperformed the S&P 500 by 174%.

This is becoming a popular way to diversify because it is a real physical asset that has little correlation with the stock market.