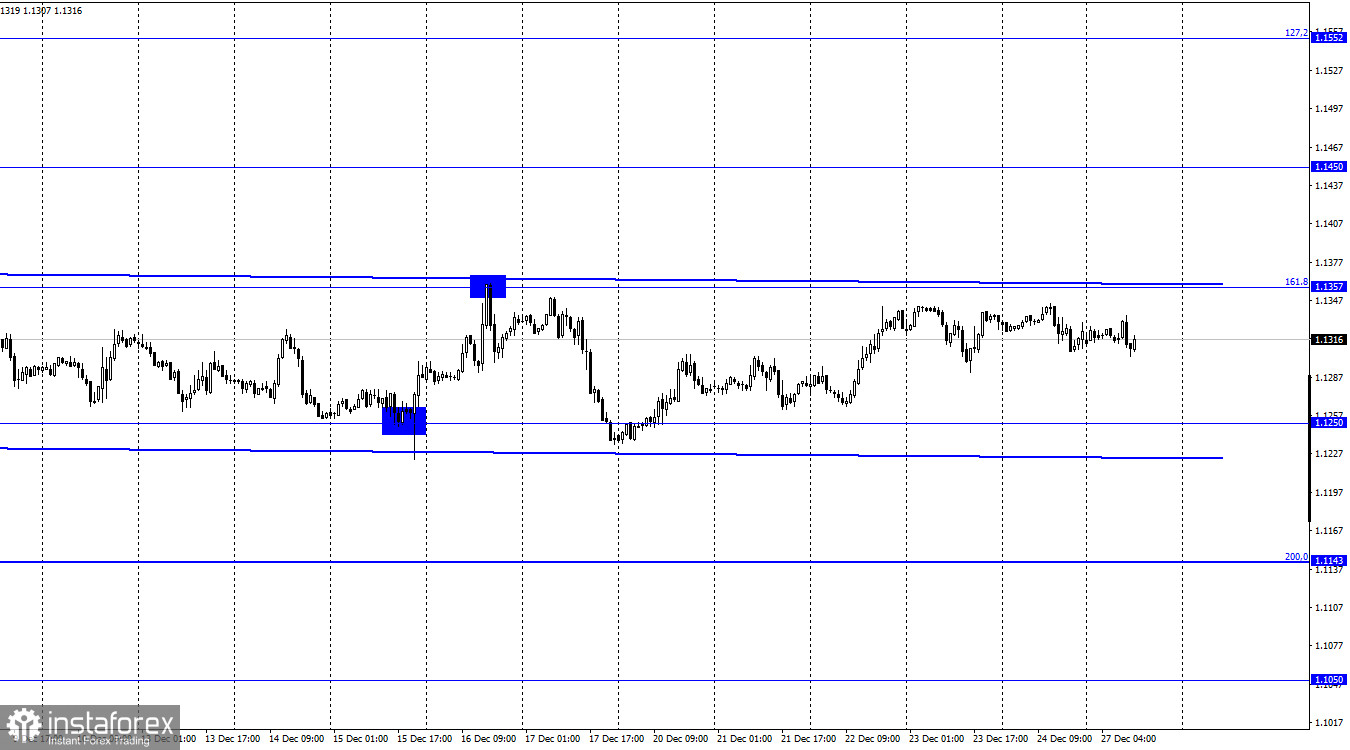

EUR/USD – 1H.

The EUR/USD pair performed a small drop inside the sideways corridor on Friday, but overall, the chart did not change at all. The most important thing to note is that bull traders were unable to reach the retracement level of 161.8% (1.1357), a rebound from which would have allowed the selling of the Euro. The pair can change its direction several times a day, but there are no signals. It is not enough that the pair is in a sideways corridor, but there are no signals. In addition, there is no informational background. Therefore, traders can only pay attention to the news reports about the coronavirus around the world. But they don't even do that, based on the pair's movements.

In many EU countries, the number of new cases of coronavirus is increasing every day. Some countries have already entered a new lockdown and some countries are about to switch to these measures. However, all this news has no effect on sentiment. Thus, I believe that this week could be absolutely unremarkable. Traders are unlikely to find grounds for active trading, so there is no reason to expect strong moves. However, no one is expecting them to do so on the eve of the New Year. A consolidation above the sideways corridor will allow for some upside in the Euro currency towards 1.1450, but first, the pair needs to perform this consolidation. It has not been able to do so for a month.

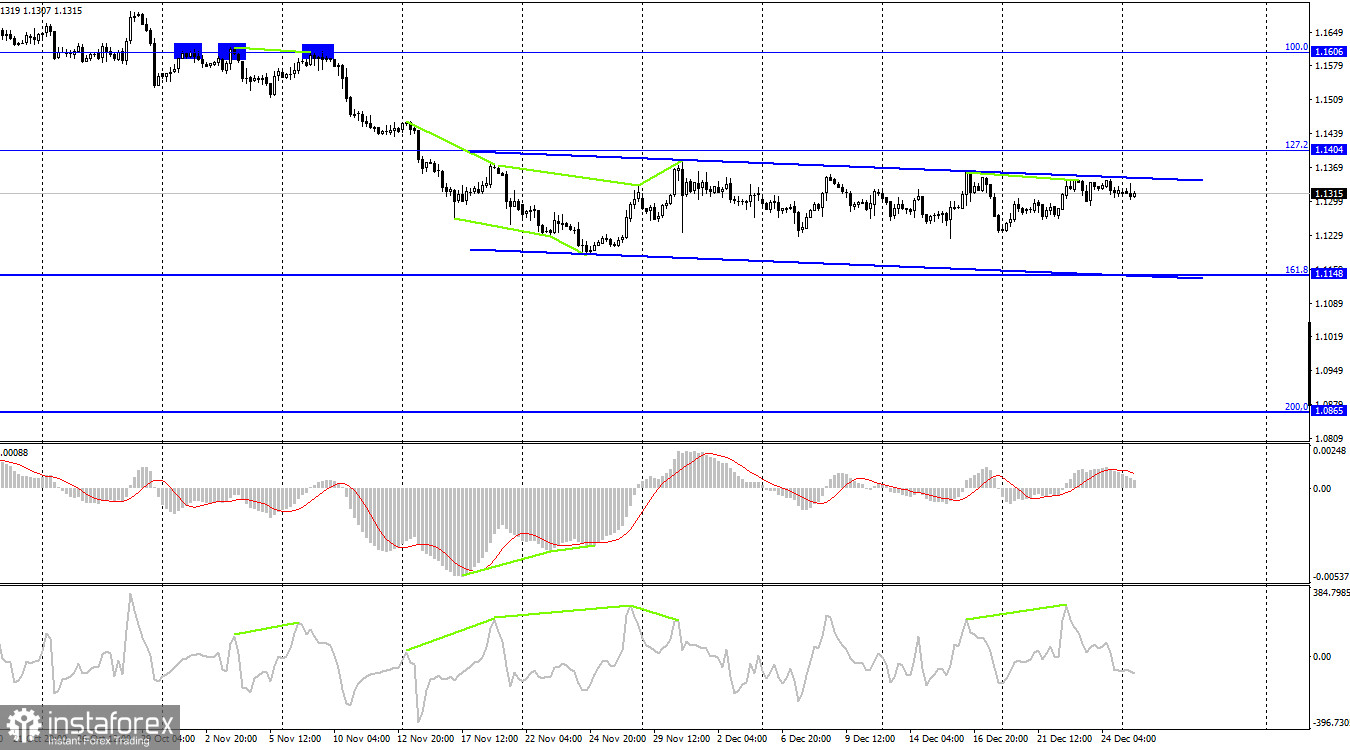

EUR/USD – 4H

On the 4-hour chart, the pair has completed the rally towards the upper border of the downward trend channel, which can just as well be called sideways. The bearish divergence formed by the CCI indicator allows us to expect a reversal in favor of the US currency and a slight fall in the direction of the correction level of 161.8% (1.1148). The situation on the hourly chart is almost identical. The closure of the pair above the corridor will allow us to expect further growth of the euro in the direction of the 100.0% Fibo level (1.1606).

News calendar for US and EU:

On December 27, there will be no important economic events in the EU and the US. Thus, there will be no information background today.

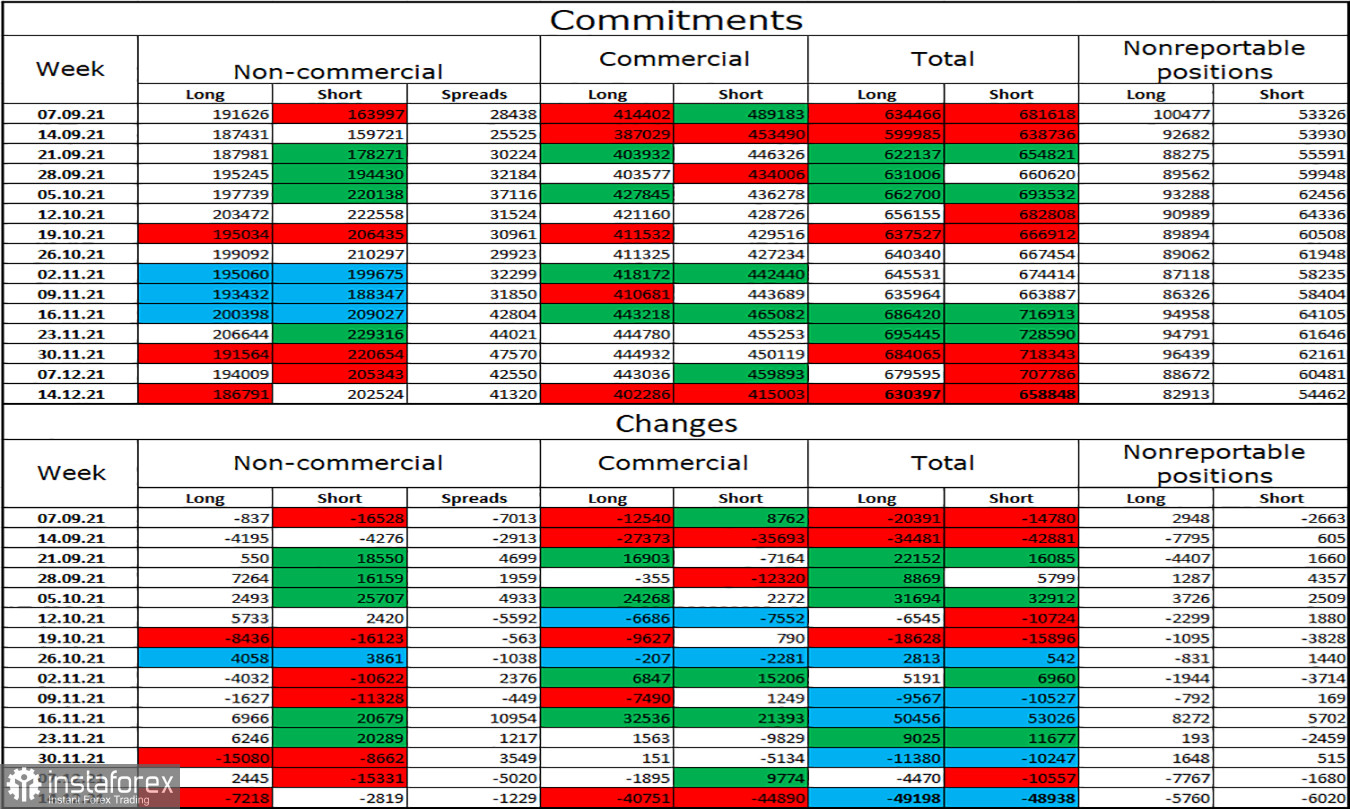

COT (Commitments of Traders) report:

A new COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders became more bearish. Speculators got rid of both longs and shorts. In total, 7218 long contracts on the euro currency and 2819 short contracts were closed. Thus, the total number of long contracts in the hands of speculators decreased to 186 thousand, and the total number of short contracts - to 202 thousand. The "bearish" mood among the most important category of traders remains. The most interesting changes were observed among traders of the "Commercial" category, who closed 40-45 thousand contracts of both types. In total, during the reporting week, about 100 thousand contracts on the euro currency were closed.

EUR/USD outlook and tips for traders:

Selling will be possible in case of a rebound from the 1.1357 level on the hourly chart with the target at 1.1250. I recommended buying the euro when the rebound from the level of 1.1250 with the target of 1.1357. They can already be closed. I recommend new purchases if the pair closes above the sideways channel on the hourly chart with the target at 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.