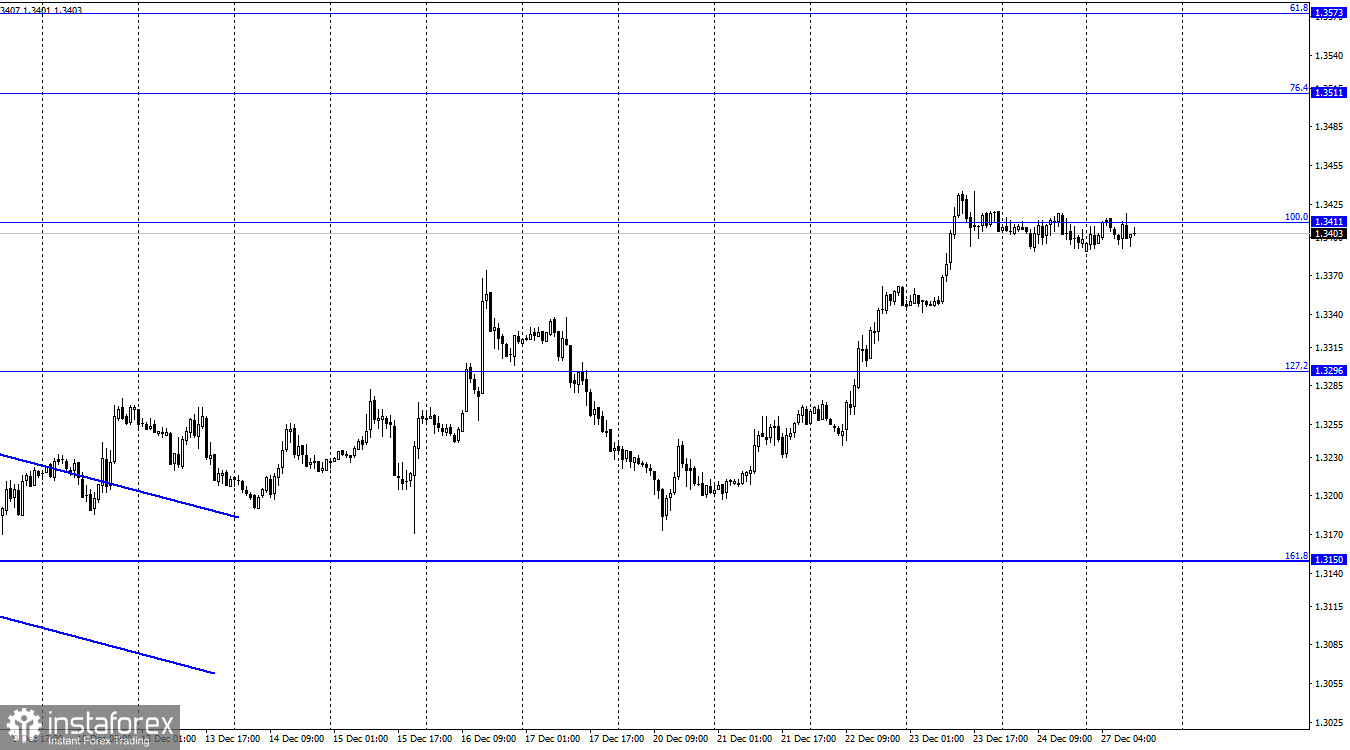

GBP/USD – H1.

Hello, dear traders! The GBP/USD pair spent Friday trading in a narrow range on the hourly chart. In fact, the quotes were drifting below the 100.0% Fibonacci retracement, the level of 1.3411. At the moment, there are no active signals as most traders are out of the market. Accordingly, even if the pair consolidates above or fixes below this level, it will mean nothing. The macroeconomic calendar is also bereft of any important releases that could have a severe impact on the pair's dynamics. Moreover, it will be empty throughout the current week. Therefore, the market may well remain thin until 2022.

The UK is now having a difficult time caused by the pandemic, in particular, the new Omicron strain. However, British traders are in no hurry to respond to a surge in coronavirus cases in both Britain and the United States. According to the latest data, the number of hospitalized cases related to the new strain is very small. Scientists in South Africa say that the latest wave of the pandemic is waning. This gives hope for a similar outcome in the United States and Europe. In general, traders are not yet worried about the Omicron variant. We hope that the situation will not worsen after the holidays. Indeed, in light of the New Year and Christmas holidays, team gatherings could lead to new infections.

GBP/USD – H4.

On the 4-hour chart, the pair has consolidated above the 61.8% Fibonacci retracement, the level of 1.3274. Thus, the pair may well extend gains, heading for the next Fibo level of 50.0% - 1.3457. A rebound from the 50.0% level will support the US currency and lead to a fall in the quotes, while consolidation above this level will most likely result in the pair's continued growth towards the next Fibonacci retracement of 38.2% - 1.3642. However, all these movements may occur as early as next year. None of the indicators are signaling maturing divergences.

News calendar for the US and Britain:

Today's macroeconomic calendar does not include any reports from Britain and the US. Thus, fundamental factors will have no impact on market sentiment.

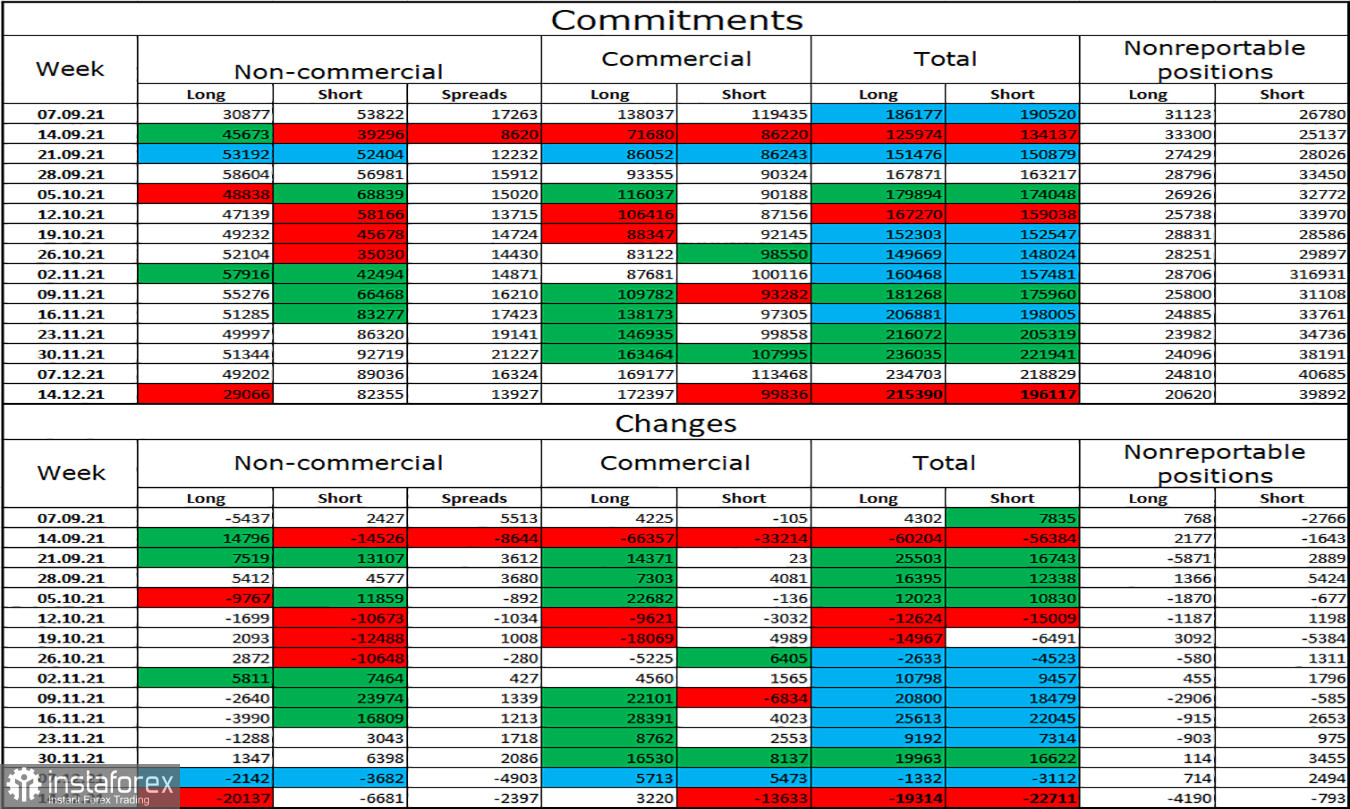

COT (Commitments of traders) report:

The latest COT report posted on December 14 showed that the sentiment of major players had changed dramatically. To be more precise, it became much more bearish as the "Non-commercial" category closed 20,000 long contracts at once. Market sentiment has become increasingly bearish for the last two months. Over the reporting week, speculators also closed 6,681 short contracts. The total number of short contracts in the "Non-commercial" category of traders is now more than twice as high as the number of long contracts: 82,000 versus 29,000. Thus, I cannot conclude that the situation for the pound sterling has improved. The British currency continues to suffer losses.

GBP/USD forecast and trading recommendations:

Long positions on the British pound can be considered in case of a rebound from the level of 1.3171 on the hourly chart, with a view to reaching the target levels of 1.3296 and 1.3411. The pair has failed to close above the level of 1.3411. Therefore, long positions can be closed. I do not recommend going short yet. There is no clear sell signal, and the pair's dynamics may be very subdued this week.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private and large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy a currency not to obtain speculative profit but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.