The Japanese yen, which has won the right to be called a safe-haven currency in recent decades, continues to weaken against the US dollar.

The USD/JPY pair traded at a local low of 102.60 exactly a year ago, receiving support amid the proposed massive stimulus measures of the US President Biden to help the national economy and the population in the face of successive COVID-19 waves. Putting out economic problems and the situation around COVID-19 with money led to a massive dollar supply in the financial market. In these conditions, it was difficult to expect any other dynamics from the US currency, except for a downward one.

But around autumn, the outlook on the currency markets began to change noticeably in view of sharp inflation growth in those countries that actively used the so-called "helicopter money". Of course, the United States was at the forefront with its unprecedented measures of stimulation and support. Inflationary pressures rose to 6.8% by the end of the year, and the Fed started talking about the need to start raising interest rates, which was heard in the markets. In this regard, no news about the new COVID-19 strain "Omicron" could put pressure on the USD/JPY pair, which continued to slowly and confidently rise.

What is the global reason for the pair's growth and will it continue in 2022?

There is no doubt that the main reason for the strengthening of the US dollar against the Japanese yen is the growing expectation of the Fed raising interest rates next year. As a result of the December meeting of the Central Bank, it became clear that it plans to raise rates in 2022 3 times, and then a couple more times in 2023 and 2024.

At the same time, the US dollar began to receive additional support in the wake of rising Treasury yields. Here, the yield of the benchmark of 10-year Treasuries from this summer to October rose sharply from a local low of 1.127% to a high of 1.705%. Only the subsequent vague rhetoric of Fed Chairman J. Powell about the real timing of the start of rate hikes and the aggravation of the situation with the coronavirus pandemic restrained the resumption of sales of government bonds.

Currently, the uncertainty factor regarding the actual timing of the start of the rate hike process is holding back the US dollar's strong growth. It seems that the Fed does not specifically report this, as it wants to control the situation by marking time in anticipation of a victory over COVID-19 with the subsequent recovery of the country's economy amid low rates. However, the yen remains at a disadvantage even in these conditions of vague prospects, which allows us to assume that it will further weaken in the new year will and that this will cause the growth of the USD/JPY pair to the maximum values of the summer of 2015. In the meantime, the pair will most likely smoothly rise until the end of this year.

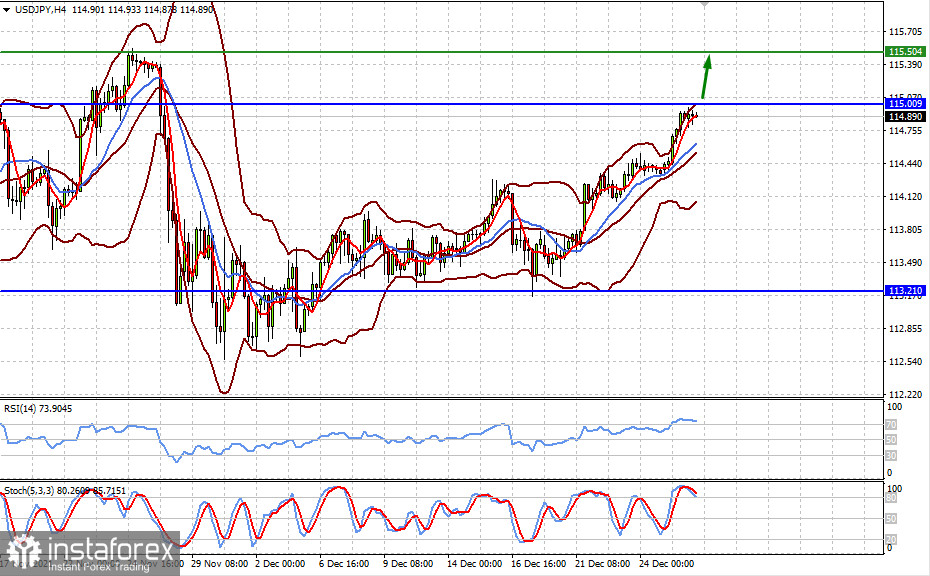

Forecast of the day:

The USD/JPY pair may further rise to the level of 115.50 after rising and consolidating above the level of 115.00.

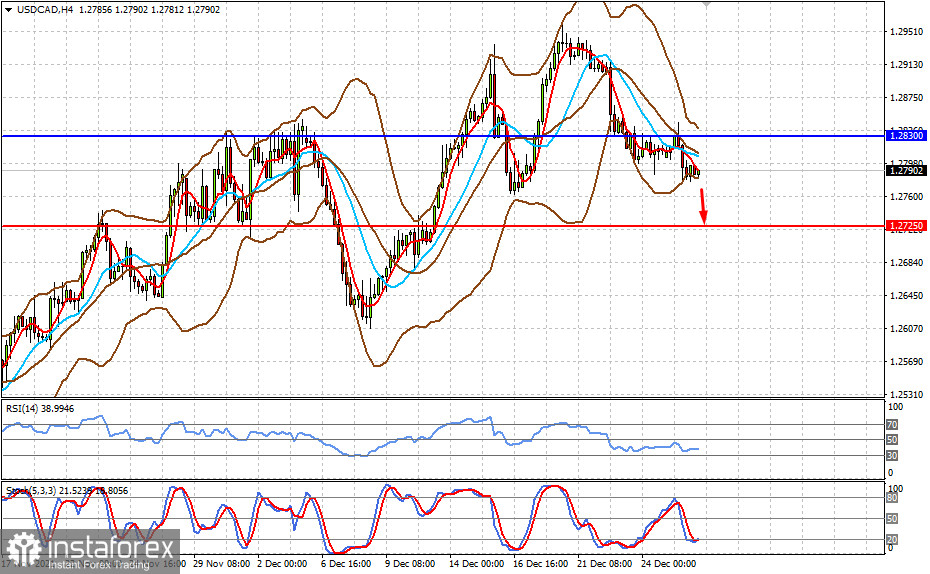

The USD/CAD pair is consolidating below the level of 1.2800. The continuation of growth in oil prices may lead to the pair's further decline to 1.2725.