Hi, dear traders!

With no important macroeconomic data and the New Year's Eve approaching, EUR/USD is in a sideways trend with very weak movement. The stock market and the oil market are under the influence of a Santa Claus rally, fuelled by increased risk appetite of investors. Increased risk sentiment has pushed some cross pairs such as EUR/JPY upwards. The Omicron strain of COVID-19 has led to 700 flights being cancelled in the US due to infections among pilots and flight crews. Yesterday's economic calendar was completely empty, with the exception of some early data from Japan. Later today, a batch of US real estate market data will be released, followed by the Fed Richmond economic activity index report.

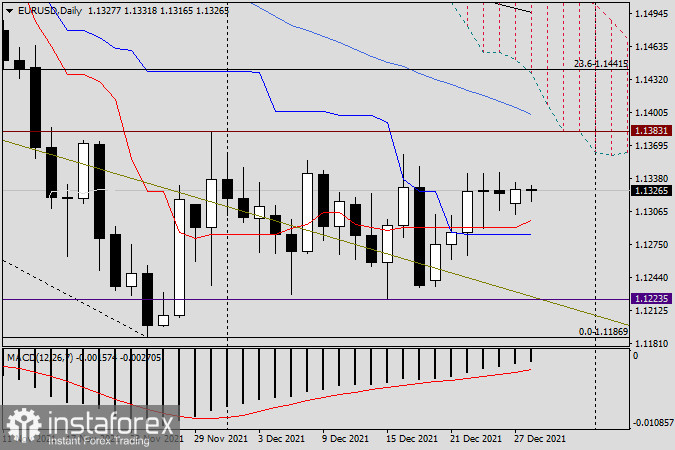

Daily

According to the daily chart, EUR/USD slightly rose yesterday, but it did not affect the current situation much. The pair remains above the Tenkan-Sen and Kijun-Sen lines of the Ichimoku cloud. EUR/USD seem to be consolidating before a strong directed move. If USD continues to slide down amid growing risk appetite, the pair could shoot upward and try to break through the key resistance level of 1.1383. Then, it could test 1.1400, above which lies the 50-day SMA line. If EUR/USD goes down instead, breaking below the Tenkan-Sen and Kijun-Sen line would be the main goal for bearish traders. Afterwards, the support at 1.1223 can be tested. Further trajectory of the pair would depend on how successful all these efforts are.

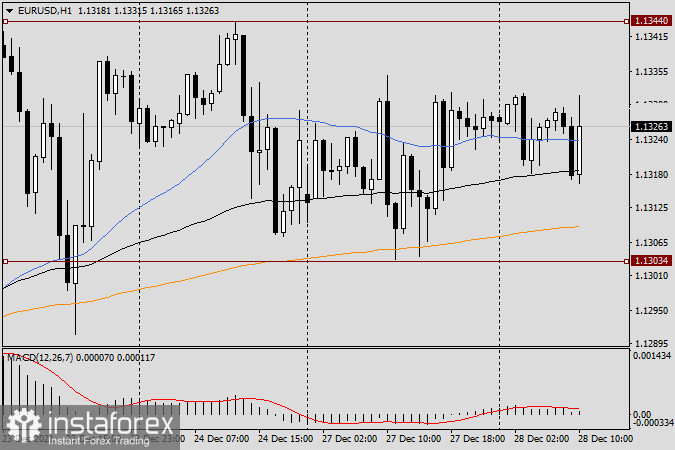

H1

The pair's sideways movement can be clearly seen on the H1 chart. EUR/USD is trading in a narrow range of 1.1344-1.1303. There are two possible trading options here. First is trading within this range - opening long positions near 1.1300 and short positions near 1.1340. However, traders are advised to do so only if there are corresponding signals. The second option, which is rather risky, is opening long positions once the pair breaks through 1.1383 or rebounds towards it. Short positions should be opened after EUR/USD breaks through 1.1300. In the current thin market, false breakouts are possible. Staying out of the market entirely could also be prudent.

Good luck!