The EUR/USD pair rallied in the short term as the Dollar Index resumed its downside movement. DXY's larger drop could force the USD to lose more ground versus its rivals. Now it is trading at 1.0065 below today's high of 1.0080.

The index extended its upside movement after the CB Consumer Confidence was reported at 102.5 points far below the 105.9 expected yesterday. Today, the Euro-zone and US data came in mixed. The US New Home Sales and Prelim Wholesale Inventories came in better than expected, while Goods Trade Balance reported worse than expected data.

Tomorrow, the ECB is seen as a high-impact event. The Main Refinancing Rate could be increased from 1.25% to 2.00%. Also, the US Advance GDP is expected at 2.3% versus 0.6% in the previous reporting period.

EUR/USD 1.0090 As Resistance!

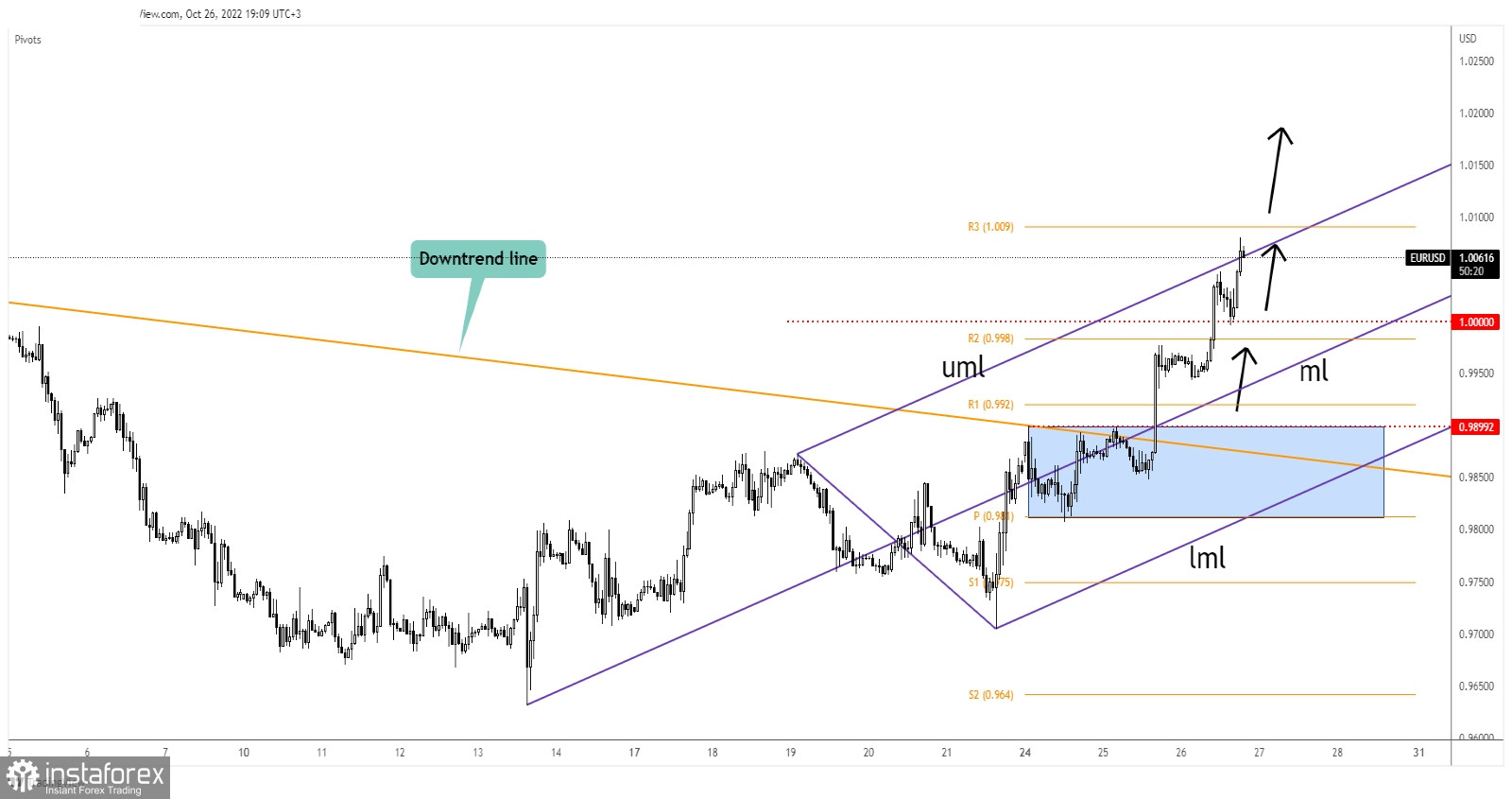

As you can see on the H1 chart, the price registered a valid breakout through the 1.0000 psychological level signaling further growth. Now, it challenges the ascending pitchfork's upper median line (uml) which represents an upside obstacle.

The weekly R3 (1.0090) represents an upside obstacle as well. In the short term, EUR/USD is strongly bullish, further growth is in cards.

EUR/USD Outlook!

Staying above the broken upper median line (uml) and making a valid breakout above the R3 (1.0090) activates further growth and brings new long opportunities. 1.0150 and 1.0200 are seen as near-term targets.