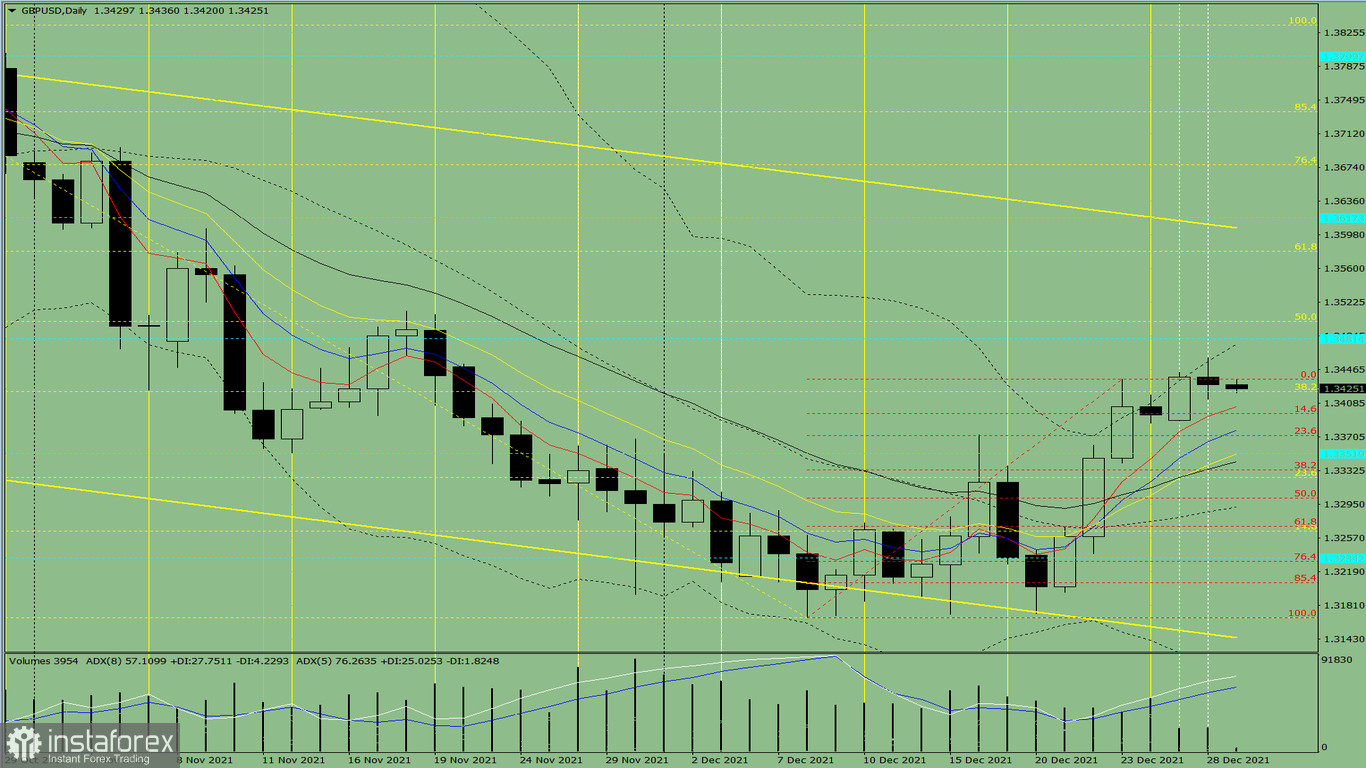

Trend analysis (Fig. 1).

The market may move down from the level of 1.3430 (closing of yesterday's daily candle) to reach the historical support level of 1.3352 (blue dotted line). In case of testing this level, the price may move upward to the target level of 1.3421, the 38.2% retracement level (yellow dotted line).

Fig. 1 (daily chart)

Comprehensive analysis:

- Indicator analysis - down;

- Fibonacci levels - down;

- Volumes - down;

- Candlestick analysis - down;

- Trend analysis - up;

- Weekly chart - up;

- Bollinger lines - down.

General conclusion:

The price may move down from the level of 1.3430 (closing of yesterday's daily candle) to reach the historical support level of 1.3352 (blue dotted line). In case of testing this level, the price may move upward to the target level of 1.3421, the 38.2% retracement level (yellow dotted line).

Alternative scenario: from the level of 1.3430 (closing of yesterday's daily candle), the price may move up to the historical resistance level of 1.3481 (blue dotted line). In case of testing this level, the price may continue to move upward to the target level of 1.3500, the 50.0% retracement level (yellow dotted line).