In yesterday's trading, the GBP/USD currency pair declined slightly, forming a Doji Star reversal candlestick pattern. It is unclear whether it will become relevant in the thin pre-New Year's market. In general, it should be noted that the market has been quite unpredictable recently. The modest rise in the British currency following the Bank of England's interest rate hike is a typical example. To be honest, given the emergence of the new Omicron strain COVID-19 and its ambiguous impact on the rise of the coronavirus, the English Central Bank's timing for raising the key interest rate was not appropriate. Notably, other leading central banks are not planning a tightening of their monetary policy until the middle of next year. Meanwhile, the situation with the spread of Omicron in the UK is far from ideal. It is possible that the Prime Minister may still have to impose restrictions that the British people do not like so much. This factor is certainly affecting market sentiment and could put considerable pressure on the British pound sterling.

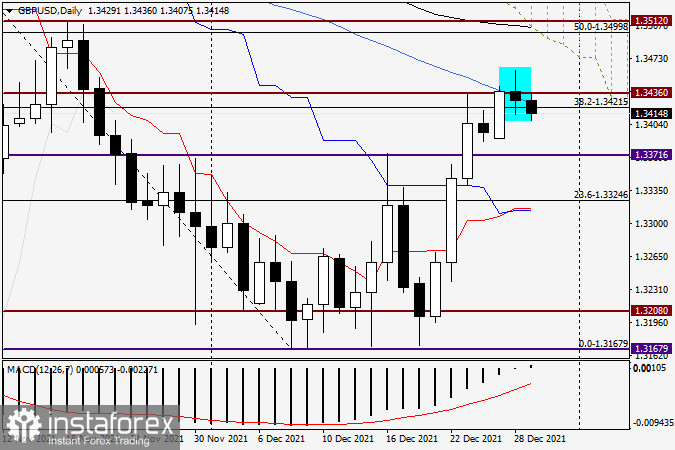

Daily

Yesterday's highlighted candle on the daily chart can certainly be interpreted as a reversal signal. As can be seen, after the rally shown in the December 27 trading, the pair failed to continue the upward trend and returned under the resistance level of 1.3436, which can now be considered as a false-break. GBP/USD is on a downward trend. If the decline continues, the pound could fall to 1.3370, which is the best-case scenario. It is too early to indicate longer targets for a possible decline in GBP/USD.

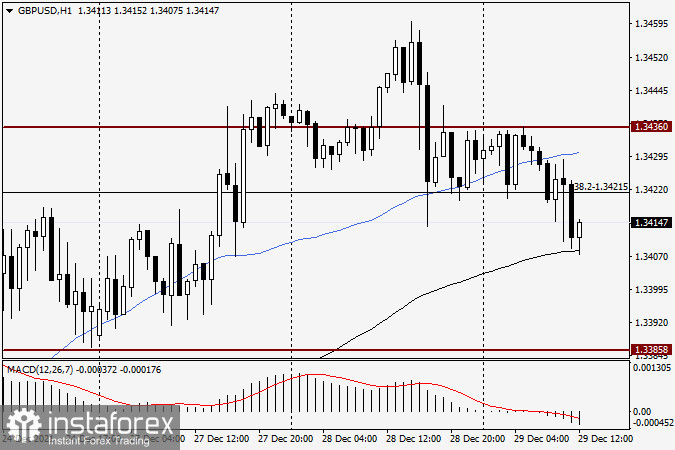

H1

As we can see on the hourly chart of the pair, downside scenario is possible. However, this would require a true breakout of the black 89-exponential moving average and a consolidation below it. If this happens, on a pullback to the 89-EMA, options to open sell trades could be considered. I recommend to open short positions at higher prices in case of an uptrend to the level of 1.3430, where there is also a 50-slip moving average, which can provide serious resistance to a possible rise. As for buying the British currency, I recommend to follow the price movement around the support at 1.3385-1.3370. If bullish reversal candlestick patterns appear on this or the 4-hour chart, this will be a reason for potential buying. As the pre-New Year's economic calendar is empty, the GBP/USD pair will be mainly influenced by the technical and market sentiment.