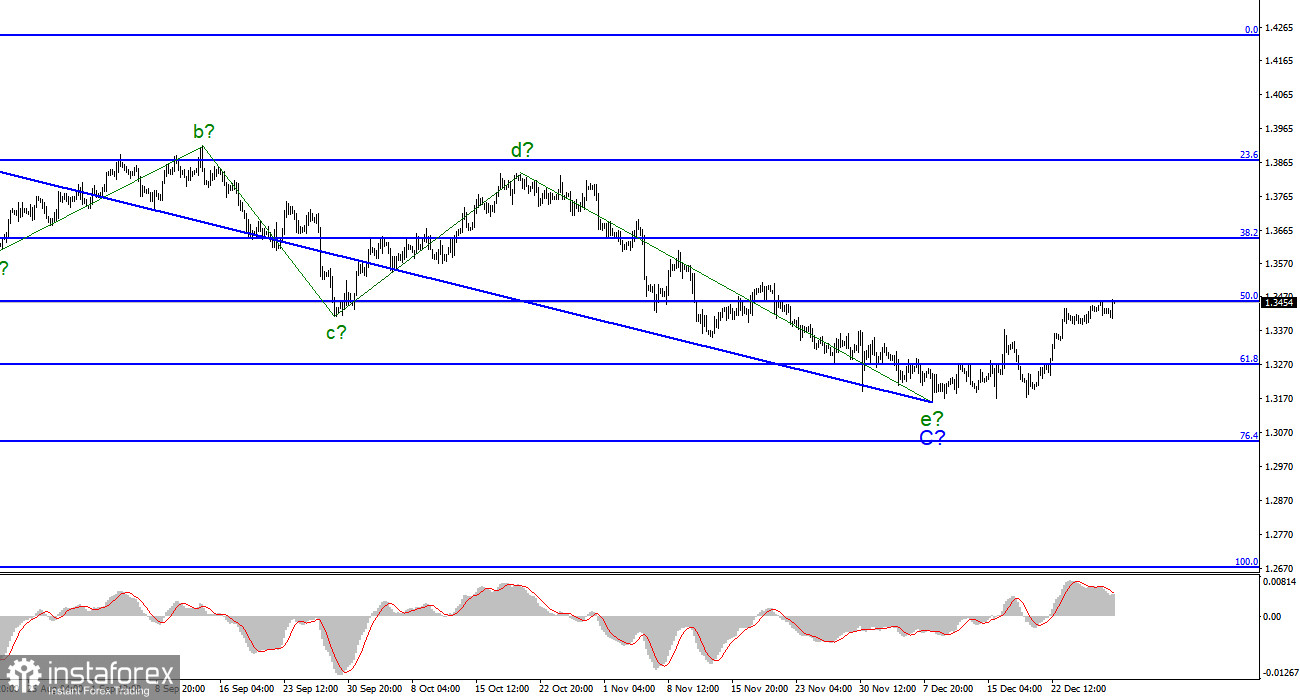

.For the pound/dollar pair, the wave markup continues to look quite comprehensive. The increase in the quotes in recent weeks indicates the construction of wave D. However, the current upward movement may also signal the construction of the first wave of a new upward trend segment. A three-wave structure is already visible inside this wave. If it is wave D, then the pound sterling may lose momentum in the near future. If not, it may climb to the target levels located around 36 and 38 patterns. An unsuccessful attempt to break through the 50.0% Fibonacci retracement level will indicate that investors are unwilling to open new long positions. The likelihood that the construction of the proposed wave D is completed is high. If so, then the construction of a new downward wave E may begin with the target levels located much lower than the lows of wave C. It may be even lower than the 31 patterns.

The UK sees a surge in Omicron cases

The pound/dollar pair moved rather sluggishly during Wednesday. Trading activity was quite buoyant again in the afternoon following the release of US macroeconomic reports, though not the important ones. Demand for the US dollar decreased slightly and the pound sterling added 50 pips. The economic calendar for the UK remains empty today. Market participants are focused on the Omicron news, namely the death toll, load on the healthcare system, as well as the government's response. Policymakers decided not to introduce quarantine restrictions until the new year. Boris Johnson did not make any comments. Sajid Javid, the Secretary of State for Health and Social Care, said that the government would not tighten quarantine restrictions to contain the Omicron spread in the coming week. Analysts monitor the curve that reflects the new virus cases. They may only guess how the situation will unfold in 2022. So far, none of the European countries has announced a drop in the cases. The EU and UK authorities have repeatedly stated that 80-90% of the population have been vaccinated. It seems that vaccines provide no protection against Omicron. Therefore, the wave marking is now very important because investors pay zero attention to the news. It is recommended to monitor the pair's movement near the 50.0% Fibonacci retracement level. An upward wave may complete the construction near this level.

Conclusion

The wave pattern of the pound/dollar pair t looks quite comprehensive now. Wave C has completed its construction but wave D could have already done it. Thus, now I would recommend selling the pair with the target levels located near 1.3272 and 1.3043 for each MACD downward signal. It also corresponds to 61.8% and 76.4% by Fibonacci retracement levels. It is necessary to pay attention to the construction of wave E. A successful attempt to break through the 50.0% Fibonacci level will indicate the readiness of traders to open new long potions and cancel the opposite scenario.

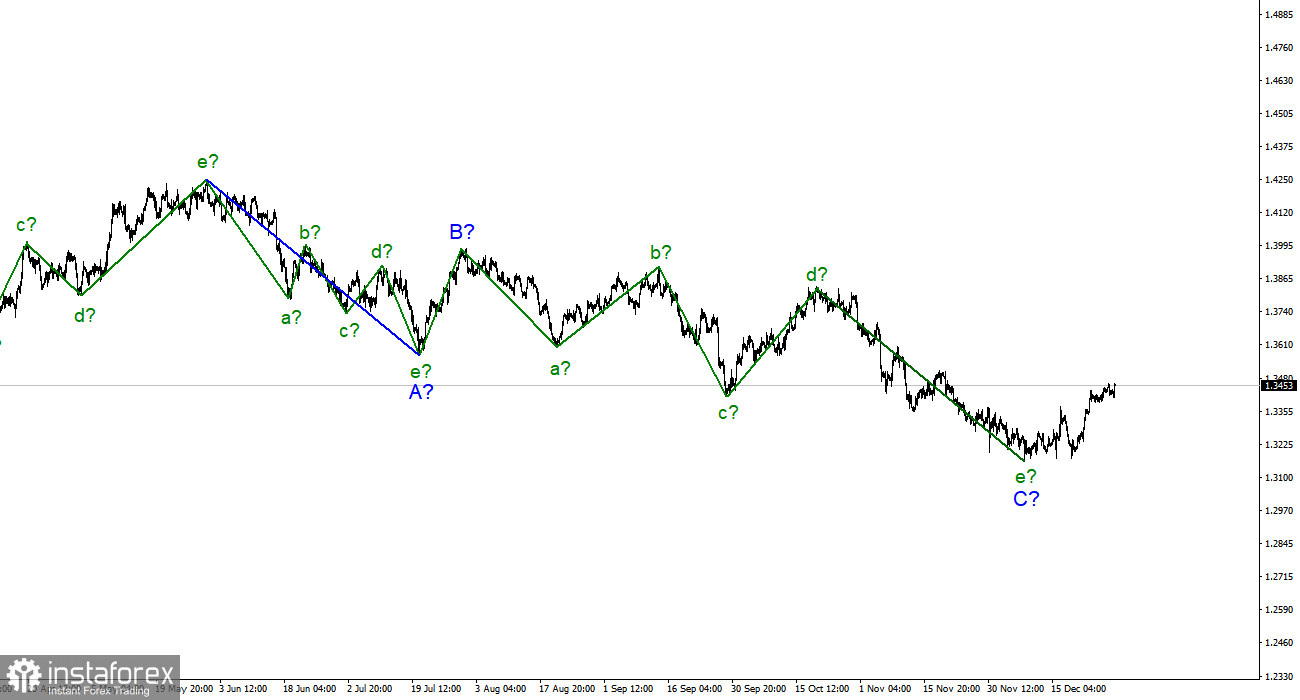

Large time frame

Starting from January 6, a downward trend section has been building, which may turn out to be almost any size and any length. At this time, the wave C may be nearing its completion (or completed). However, the entire downward section of the trend may extend and take the five-wave form A-B-C-D-E.