4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

On Wednesday, the EUR/USD currency pair continued trading inside the side channel between the Murray levels "0/8" - 1.1230 and "2/8" - 1.1353. In principle, it was possible to start absolutely every article for the last month, because the pair has been moving inside the side channel for more than four weeks. This is seen in the illustration of the 4-hour timeframe. Thus, it is possible to trade the pair now only for a rebound or for overcoming the upper or lower limit of this channel. Unfortunately, even these levels (or lines) are not always fulfilled by the price. For example, in the last few days, it was getting close to them, but it never reached the Murray level of "2/8". Thus, the situation is now extremely unfavorable for trade. There are no signals, volatility is weak, traders left the market and went to celebrate Christmas first, and now the New Year. Thus, the euro/dollar pair fully follows the scenario we announced a couple of weeks ago. We can only hope that the flat will end at the beginning of next year, and not the last half of January. Recall that the flat did not start when the time was approaching the Christmas and New Year holidays. Even during the publication of the results of the Fed and ECB meetings in mid-December, the pair was already inside the side channel. And even these two most important events in December could not force the pair to leave it. Therefore, theoretically, the flat may continue in January. At least a couple of weeks. It is possible that after the New Year, traders will "swing" for a while. Thus, the general trend remains downward, which is signaled by the senior linear regression channel. The junior channel is directed sideways, which indicates the possible emergence of a new upward trend, but, to be honest, so far the movement of the pair does not look like the beginning of a new trend.

Europe continues to suffer from the "coronavirus". The situation is getting worse.

What can I say now about the fundamental background? It's gone. Of course, you can always find or come up with a couple of topics that can be tied to the current situation in the foreign exchange market. However, we try not to do this but pay attention only to those factors that affect the price movement. There are none now. Otherwise, the pair would not have been in the 130-point channel for more than a month. The only hot topic was and remains "coronavirus". And, to be more precise, the new strain "omicron". Unfortunately, there is no positive news right now. The epidemiological situation continues to deteriorate both in Europe and in the USA. In many European countries, anti-records of morbidity are updated almost every day, and in the first place, of course, the United Kingdom again. However, a strong deterioration of the situation is also noted in France, Germany, Portugal, Italy, and other countries. Things are no better overseas. The number of people who get sick every day is already measured in hundreds of thousands. Thus, slowly and very reluctantly, countries will have to tighten quarantine measures. Germany, the Netherlands, and France have already announced stricter restrictions. In particular, nightclubs, gyms, fitness centers, and other places where a large number of people gather will be closed. It seems that this is the minimum measure that can at least stop the increase in the number of diseases. But it is unlikely that it will stop. "Omicron" is very contagious and it is unlikely that it is transmitted only in gyms and nightclubs. Thus, from our point of view, after the New Year in many countries, it will again be about "lockdowns". We have already talked about the fact that even if most of the sick will carry the virus very easily, they still go to self-isolation, get sick. Therefore, they are not working at this time. And the more sick people there are (and their number is growing at a terrifying pace), the more the economy of each country will stop. Experts have already estimated that the economy will slow down in the fourth quarter of 2021 and the first quarter of 2022.

Neither the euro nor the dollar is responding to these messages in any way yet, but they can start doing this after the New Year, when "lockdowns" begin and macroeconomic statistics will appear, which indicates a drop in indicators.

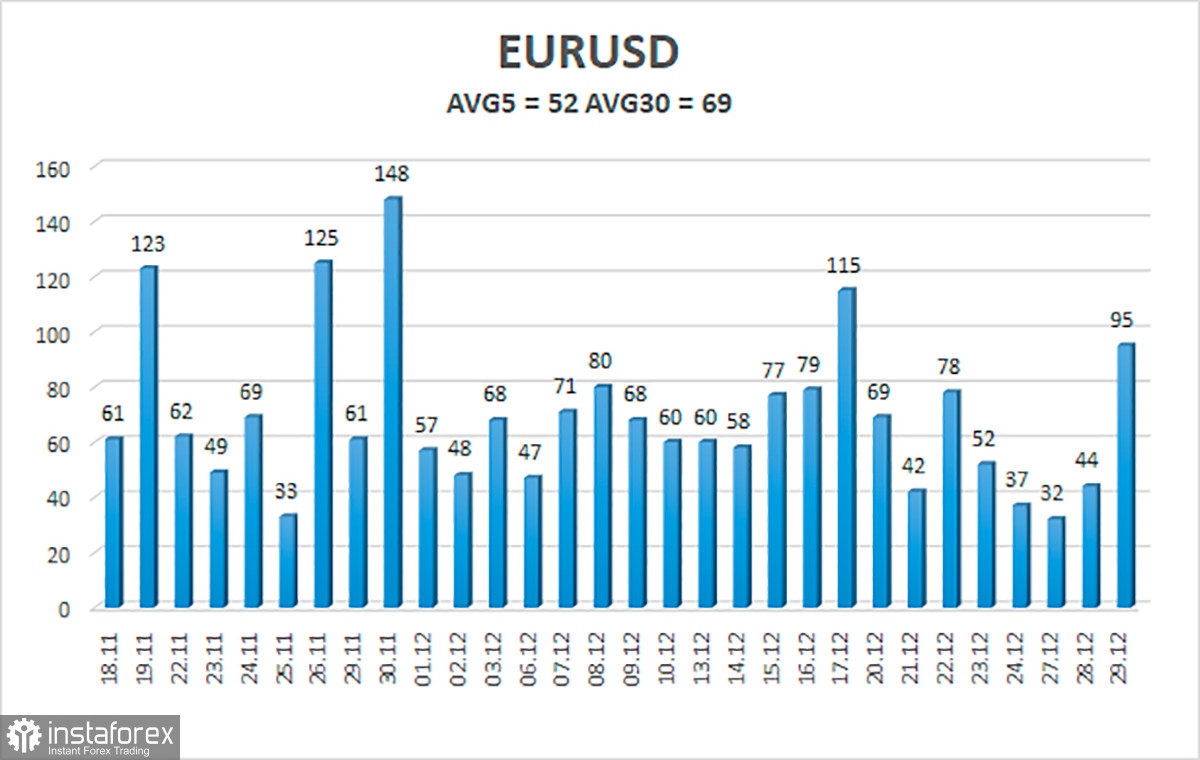

The volatility of the euro/dollar currency pair as of December 30 is 52 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1285 and 1.1389. The reversal of the Heiken Ashi indicator back down will signal a new round of downward movement in the side channel 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230-1.1353 side channel. Thus, you can continue to trade for a rebound from the upper or lower border of this channel with the goal of the opposite border. However, it should be remembered that we are talking about a flat, and volatility can be low during the holidays.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.