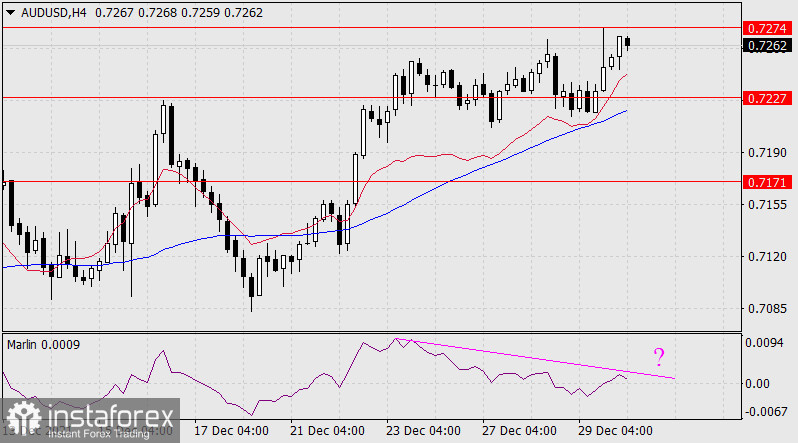

On Wednesday, the Australian dollar made another upward surge and nevertheless it worked out by touching the MACD indicator line. Statistically, after similar difficulties related to the development of the MACD line, a price reversal occurs from it in 70% of cases. It is difficult to predict how this will happen at the turn of the New Year, but the purely technical situation does not create an obvious alternative. The main scenario is still a downward one - the price consolidating below the level of 0.7227, then a decline to 0.7171 and then to 0.7065.

A reversal divergence with the Marlin Oscillator begins to form on the four-hour chart. The oscillator itself intends to return to the negative zone. The 0.7227 level coincides with the MACD line, which means the level is strong and will give a high-quality signal to the bears if the price surpasses it.