The US trading session kicked off with the rapid rise of the single currency and the pound sterling amid coronavirus woes. The US reported a record high number of new cases in one day. In addition, the number of children who caught the virus surged by one and a half times. The US dollar dropped following this negative news. Given that the economic calendar is empty, it has no other fundamental drivers. However, even if there were some, they would hardly alter the situation.

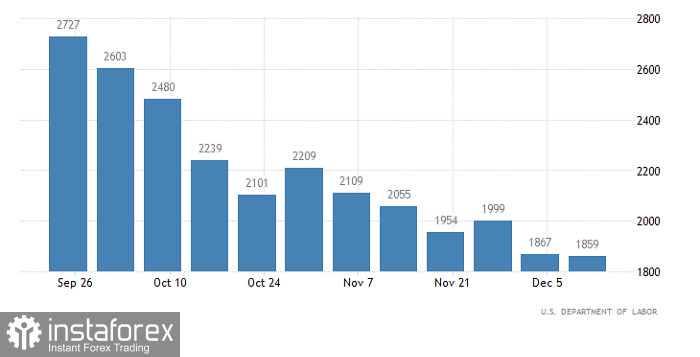

Naturally, the epidemiological situation in the United States will be the main topic of today's trading day. Market participants are waiting for some kind of reaction from the Biden administration. It is quite possible that right before the celebration of the New Year, some quarantine measures will be introduced. Many investors are sure that this scenario will come true. If so, the greenback will fall even more. Otherwise, the US currency is likely to close the last trading day of the year with a rise. For this reason, the upcoming initial jobless claims report is unlikely to somehow affect the market sentiment. The number of first-time and continuing claims may add only 5,000 each, reflecting just a subtle difference. This is why traders are sure to ignore this data.

US Continuing Jobless Claims:

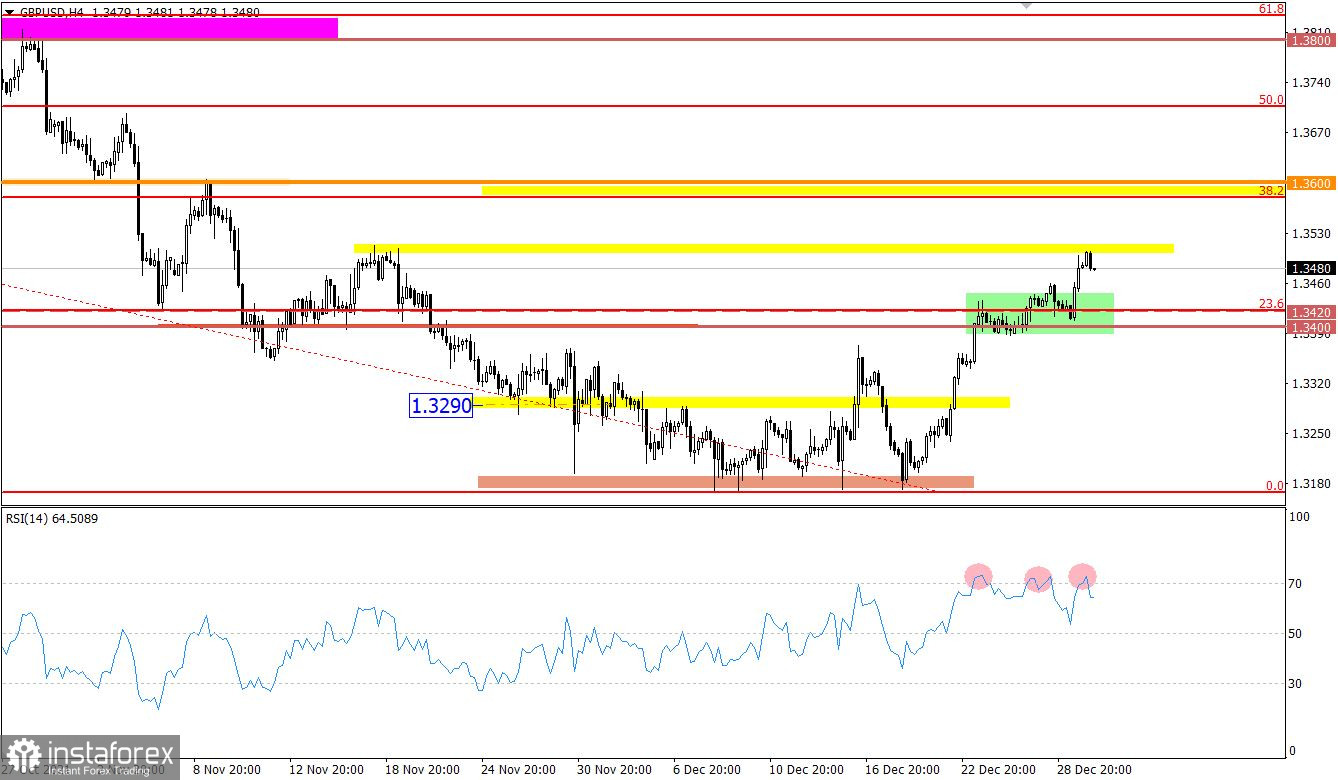

The GBP/USD pair resumed its upward movement after a short stagnation. It triggered a correction to the high of November 18. Taking into account that the pound sterling is overbought, traders took notice of a rapid jump. As a result, the bullish momentum was replaced by stagnation.

On the daily chart, there is a corrective movement from the pivot point of 1.3170. Despite a significant rise, the trend is still downward

Outlook:

Judging by the overbought status and the resistance area of 1.3500/1.3510, the price may escae the narrow range and start recovering. Therefore, an upward reversal to 1.3400/1.3420 looks likely.

If trading volumes remain high and the quotes consolidate above the 1.3520 level on the 4H chart, the inertial movement to the 1.3600 level may occur.

The complex indicator analysis gives a buy signal on short-term and intraday charts given the recent rally. In the near future, technical indicators are likely to give sell signals amid the price rebound.