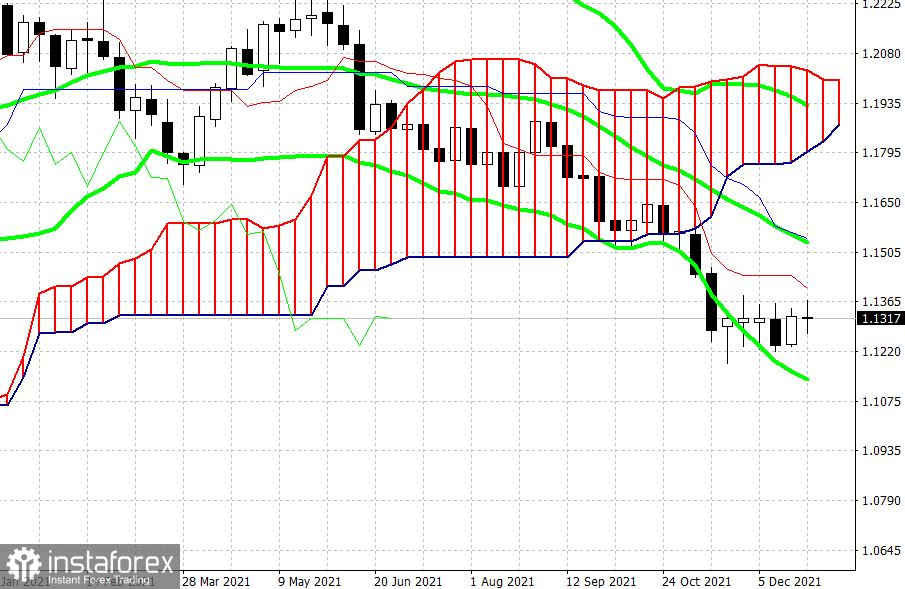

Some results in the context of the EUR/USD pair can be summed up on the penultimate trading day of the week, month, and year. In general, the year 2021 turned out to be on the bears' side, primarily due to the strengthening of the US currency. 12 months ago, traders started the current year at the level of 1.2239 and marked the annual high at 1.2350 in the same month (that is, in January). This was the first and last entry into the 1.23 area this year, as all subsequent growth will break off much lower.

Buyers of EUR/USD were able to prove themselves once more in the spring – in April and May. The pair consistently grew, rising 500 points up. In the last month of spring, EUR/USD bulls reached the level of 1.2266, after which they turned down. Since then, the pair has only declined: despite the upward pullbacks and flat periods, the downward trend still dominated in the second half of 2021. The battle during the spring was the last one this year: and EUR/USD buyers failed to win.

It can be recalled here why the pair rose during the two spring months and what caused it to decline over the next 7 months. Spoiler alert: It's all about the divergence of the positions of the Fed and the ECB. Let's reminisce the spring optimism that was hovering among the buyers of the pair: representatives of the "hawkish" wing of the ECB focused their attention on the recovery of the eurozone economy, the vaccination campaign in Europe was gaining momentum, the epidemiological situation in the European Union was improving, and quarantine restrictions were easing everywhere. There was a split in the camp of the European Central Bank at that time – the "dovish" wing was opposed by the "hawks" who insisted on slowing down the pace of bond purchases.

It is worth noting that the Fed's "dovish" position at that time was more massive compared with the European Central Bank. Despite the relatively hawkish statements of some Fed officials, most Fed members did not share their point of view. They argued that the growth of inflation indicators was due to the low base of the last year, and, therefore, it is early and inappropriate to talk about the early withdrawal of QE. At that time, no one spoke at all about the rate hike, even in a hypothetical context.

Against the background of this uncorrelation of the Central Bank's positions, EUR/USD buyers tried to take revenge, reaching the level of 1.2266 in May (second price high of the year after the January high of 1.2350). However, the "hot summer of 2021" came. The US inflation showed record growth, and Nonfarm data reflected the recovery of the labor market in the United States. Since June, the balance of power for the EUR/USD pair has changed dramatically. Fed's "hawkish" signals began to sound more insistent, while ECB President Christine Lagarde categorically denied the likelihood of an early end to QE.

In addition, the world got acquainted with the Delta during the summer. This strain of coronavirus exerted significant pressure on the pair. It turned out that Delta is twice and a half times more likely to lead to hospitalization, and the risk of resuscitation in case of infection increases almost two times. Some European countries have begun to return the canceled quarantine restrictions, and the rhetoric of ECB representatives has noticeably softened.

The uncorrelation of the positions of the ECB and the Fed in favor of the Fed has become stronger – and this fact has served and will continue to serve as the main anchor for EUR/USD. From June to December, the pair declined by more than a thousand points (the June high was fixed at 1.2254, the November low at 1.1186). The downward movement was caused by a record increase in American inflation (recent releases have updated 40-year records) and a tightening of the position of the Fed, which still decided to curtail QE ahead of schedule and raise the interest rate (at least once) next year.

Today, the main intrigue lies in the degree of aggressiveness of the Fed. Will it fulfill the maximum program by raising the rate three times, or will it be satisfied with the implementation of the minimum program? There is no consensus on this on the market, so traders took profits at the end of the year and froze in anticipation, thereby provoking the consolidation of EUR/USD in the range of 1.1260-1.1360.

We believe that that the pair's downward trend is not yet over. The Fed's aggressive behavior (early closing of QE, "hawkish" point forecast) and the ECB's passive-wait-and-see behavior ("strengthening" of the APP, open date of completion of this program, and the wait-and-see position regarding the rate) are on the side of the US dollar.

At the moment, EUR/USD is traditionally hanging out in the flat, waiting for the end of the Christmas-New Year parade. This is the logical behavior of the pair in a narrow market. This flat should not be perceived in any other way (for example, as preparation for a trend reversal). As soon as the Fed confirms its readiness to tighten monetary policy, the divergence of the positions of the ECB and the Fed will increase pressure on the pair. Therefore, if we talk about the long-term prospects of EUR/USD, then short positions with the main long-term target of 1.1000 will continue to be in priority here.