Today, on the last day of the outgoing year, we will try to summarize the main currency pair of the Forex market and start with the fundamental component. As many of you can well imagine, the US economy is demonstrating a faster pace of recovery from the negative consequences of the COVID-19 pandemic, the peak of which I consider to have already passed. The US Federal Reserve System (FRS) has taken tougher and earlier steps to support its national economy. Following the Fed, other leading world central banks have also reached out in this direction, which is not surprising, because most of the other leading world central banks are equal to the steps of the Fed in monetary policy. So the European Central Bank (ECB) launched a program to stimulate the region's economy, but a little later, the situation with the spread of COVID-19 in Europe was very difficult, and at times just critical. However, the United States was also in the lead in the number of daily coronavirus diseases. The current situation with COVID-19, in my personal opinion, is already much calmer than it was about a year ago. The last strain of the virus called "Omicron", according to most virologists, is not as dangerous in terms of the degree of influence and tolerability by the human body as the Delta strain. Nevertheless, as they say, it's too early to relax. However, I want to hope that in the new year the world will be able to cope and overcome the hated COVID.

If we return to the two leading world central banks representing the EUR/USD currency pair, the ECB is primarily remembered for the vague speeches and comments of President Christine Lagarde. Often, the market simply ignored her comments, or the reaction to them was extremely weak. However, it is worth adding to the asset of the European Central Bank that, although with some delay, it still made the necessary adjustments for economic support. Regarding the Fed, it is worth noting the re-election of Jerome Powell for a second term as chairman of the Federal Reserve, as well as decisive steps to stimulate economic growth. It is also necessary to pay attention to the fact that by the end of the outgoing year, the Fed's rhetoric was becoming more and more "hawkish", and the number of Fed leaders who spoke in favor of starting tightening monetary policy was steadily increasing. The appointment of Finance Minister Janet Yellen, who led the Fed before Powell, can also be attributed to a very competent step by the administration of US President Joe Biden. In my personal opinion, Janet Yellen is a very competent financier, and with a lot of experience.

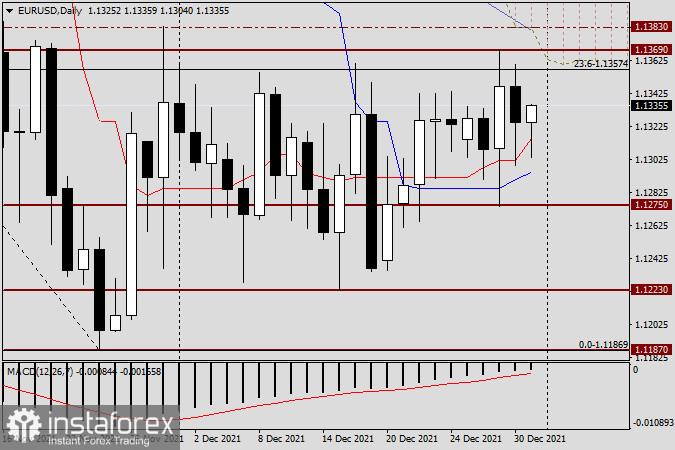

Daily

If we turn to the consideration of the technical picture for the euro/dollar, then there has not been, and there is no significant progress. At yesterday's auction, the quote showed a decline, and the pair was again saved from a more significant downward trend by the red Tenkan line and the blue Kijun line of the Ichimoku indicator. It is also worth noting that, despite the decline, yesterday's trading on EUR/USD again closed above the most important technical level of 1.1300. At the end of the article, the pair is actively leveling the morning decline, and the current daily candle already has a rather big lower shadow and a bullish body. Dear colleagues, today, on the last day of weekly and annual trading, I do not consider it appropriate to give any trading recommendations for opening fresh positions. But I strongly recommend closing open transactions. As long-term experience shows, after the new year, and on the first of January, the market is closed, trading opens with fairly large price gaps, that is, gaps. Please keep this in mind.