US stocks traded sluggishly on the last day of 2021. Treasury bonds, on the other hand, remained stable, while dollar showed a strong decline.

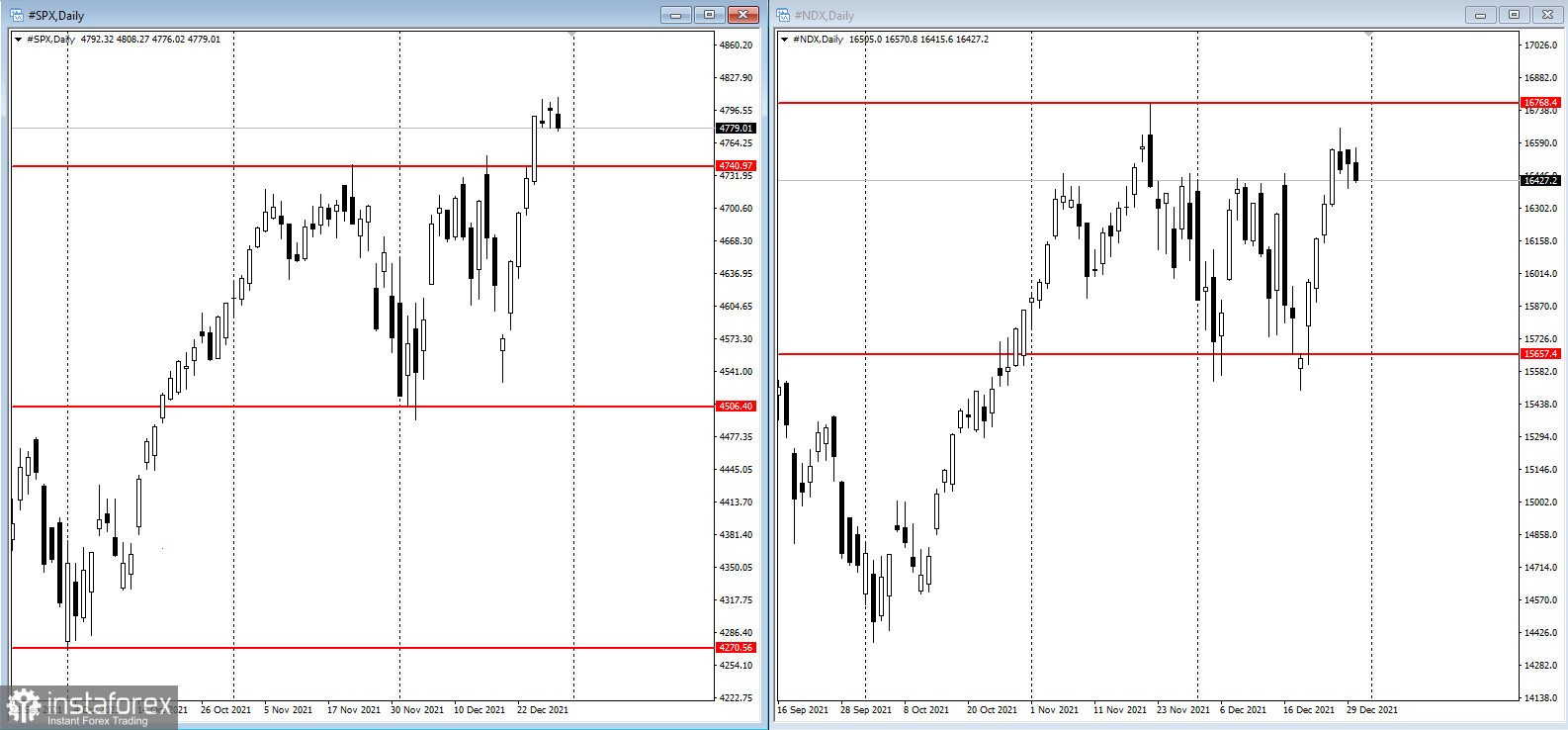

The S&P 500 fell amid rising industrial and consumer stocks. Moderate declines in Microsoft, Apple and Meta Platforms impacted the Nasdaq 100, but despite a weak session, it was a landmark year for stocks. Both the S&P 500 and Nasdaq 100, which rallied throughout the year, are up roughly 27% YTD.

Trading was slack because investors analyzed growth in global equities this year, thanks to the strong economic recovery. Meanwhile, bond investors are losing money because many central banks move to tighten policy in response to high inflation.

Brett Ryan of Deutsche Bank said: "If there is one thing that we have learned this year, it is that the US economy has proven to be resilient in the face of pandemic-related challenges. Although the omicron and fiscal uncertainties pose risks, the economy would still expand at a well-above-trend pace even if these risks are realized."

The S&P 500 rose significantly in 2021, surpassing even the most optimistic forecasts at the beginning of the year. Back then, the highest projection was 4.400 points, while the average of ratings was 4.074 points.

On a different note, traders continue to monitor China's struggling developers. A Chinese state-owned enterprise will receive a 29% stake in China South City Holdings Ltd., the latest sign that authorities are stepping up support for weak real estate firms.