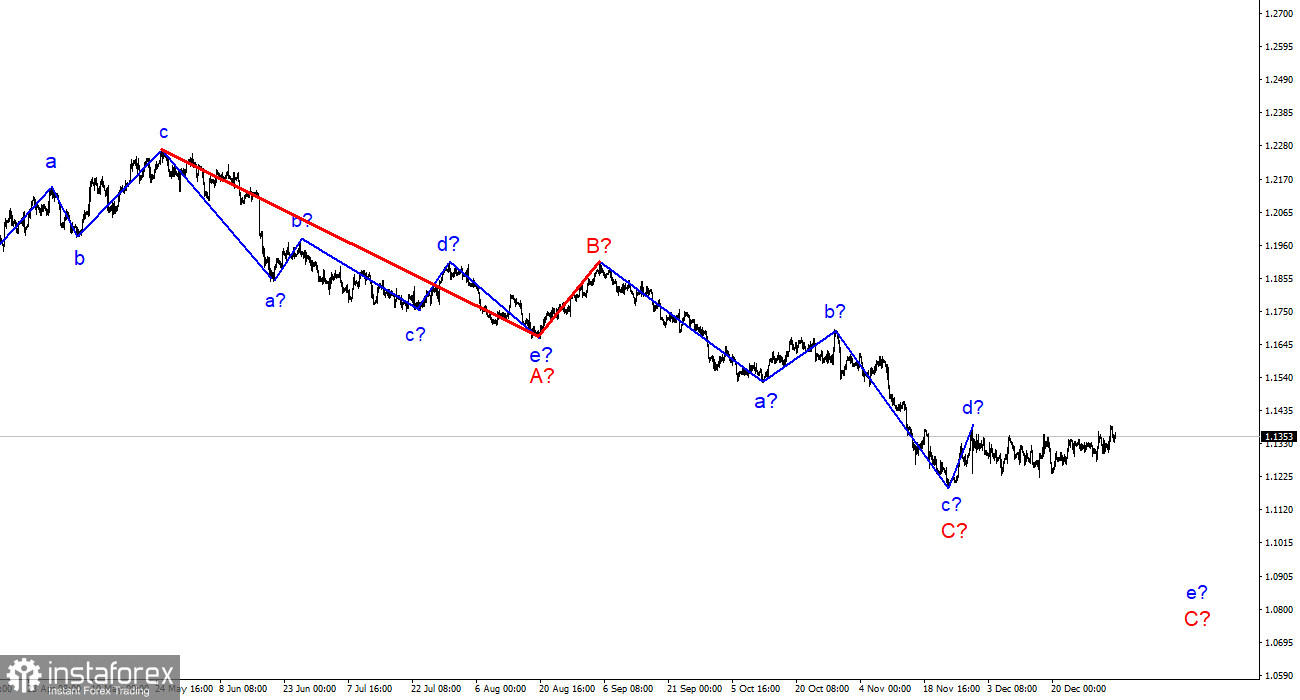

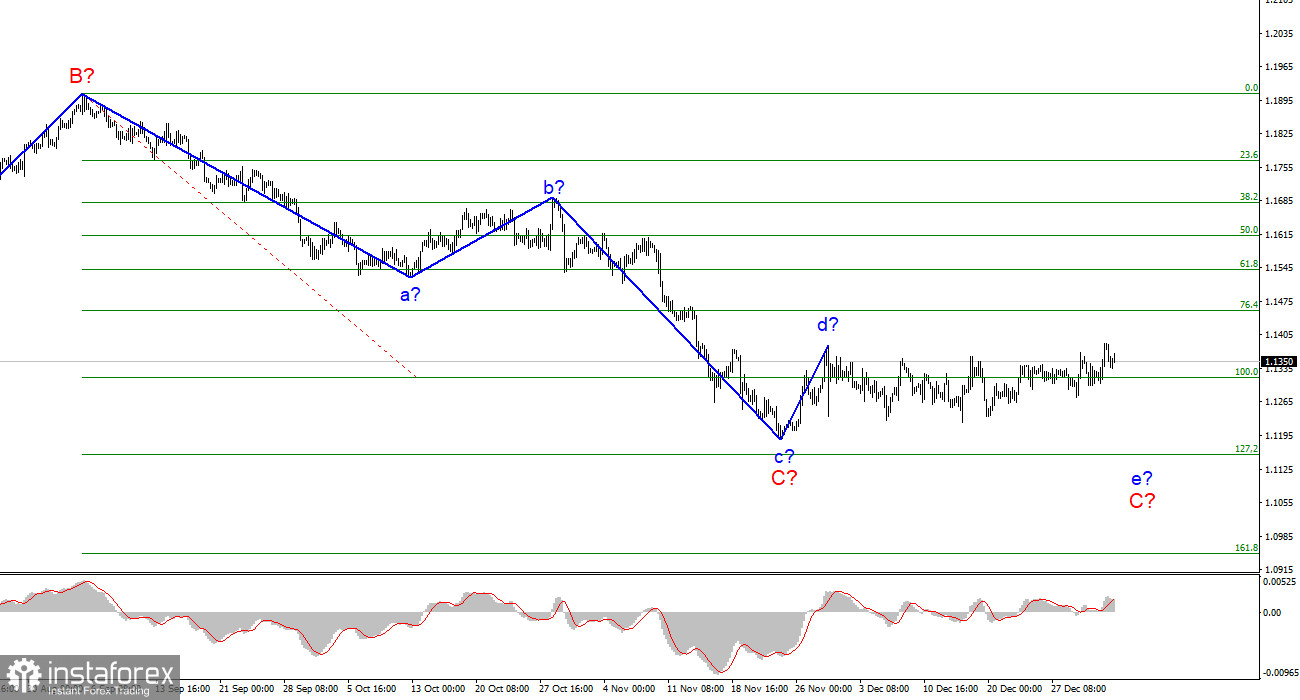

The wave marking of the 4-hour chart for the euro/dollar instrument has not changed for more than a month. The thing is that the horizontal movement has been going on all this month. And at the moment, it is not even possible to say for sure whether the construction of the proposed wave d has been completed or not. On the one hand, on the last day of last year, the instrument broke the peak of November 30. Thus, the entire section of the trend, originating on November 24, should be considered one wave. On the other hand, this is the problem of all correctional structures: they can constantly change and take almost any length. Therefore, the wave of November 24 may be both wave d, after which the construction of wave C will resume, and the first wave of a new upward trend segment. I am inclined to think that the construction of the downward trend section will resume – we have been seeing too uncertain an increase in quotes in recent weeks. After all, the news background was not absent for the whole month, but only in the last one and a half or two weeks.

The holidays are over, but the markets are still resting.

The euro/dollar instrument moved with an amplitude of about 25 basis points on Monday. Bearish sentiment prevailed in the market, although a successful attempt to break through the peak of November 30 should have contributed to a further increase in quotes. However, on the first day of 2022, when the markets were open, the movement was not very cheerful. There was absolutely nothing to count on during the day. Just a couple of business activity indices that came out during the day could not affect the instrument sufficiently. In Germany, business activity in the manufacturing sector decreased from 57.9 points to 57.4 points. In the European Union - remained unchanged in December - 58.0 points. In both cases, the changes were either insignificant or there were none at all. And such results in any case could not cause the movement of the instrument. Thus, the instrument continues to move in the "noise" mode. That is, there is no strong and trending movement now. The wave pattern of the last month is too confusing and it doesn't even make much sense to understand it, because even if you identify all the internal waves, it won't help with making trading decisions. Now we need to determine whether wave d is completed in C. And with the movements in the last month, it is very difficult to do even that. The topic of the Omicron strain also does not affect the European or American in any way now. Although in both the European Union and the United States, the number of diseases continues to grow, and the Omicron strain itself is becoming dominant in many countries. As you can see, vaccines save people only from the complex course of the disease, but not from infection with the virus itself. But all this is not too important, since the markets still do not react to this news.

General conclusions.

Based on the analysis, I conclude that the construction of the descending wave C can be completed. However, the internal wave structure of this wave still allows the construction of another downward, internal wave. Thus, I advise selling the instrument with targets located around the 1.1152 mark, for each MACD signal "down", until there is a successful attempt to break the peak of wave d. A restrictive order can be placed above the peak of wave d.