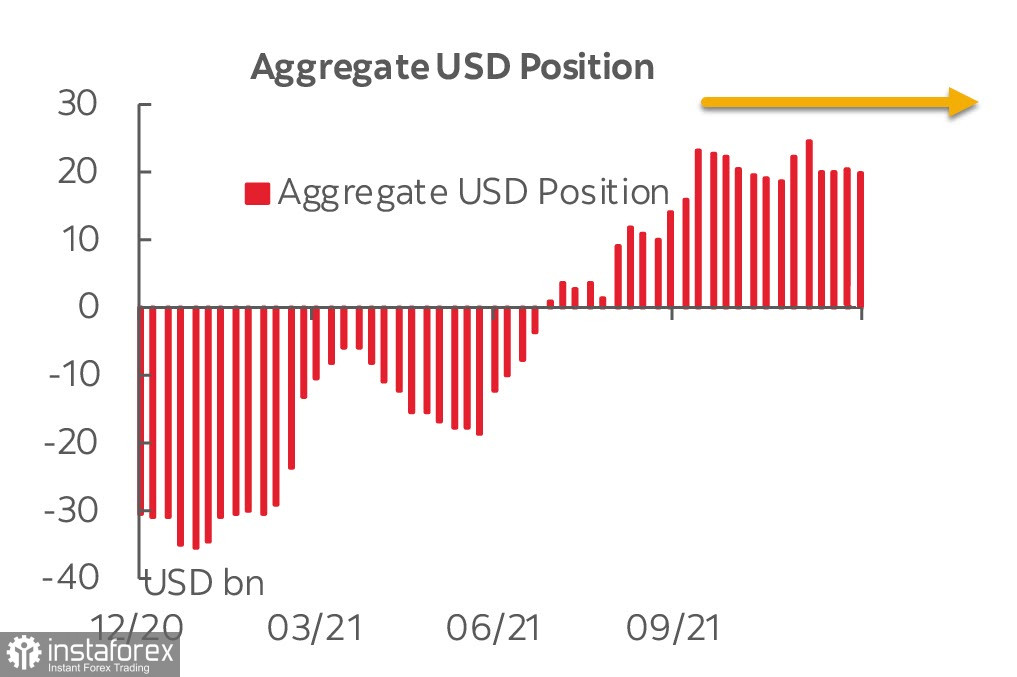

The CFTC report was published late on Monday due to the holidays. The aggregate position on the US dollar somewhat changed. At the same time, commodity currencies are still losing a little bit, but the euro, yen, and franc are slightly higher, which indicates no signs of a reversal in risky assets.

At the same time, it should be noted that the cautious purchases of oil (the short position decreased) and the growth of the long position in gold, indirectly indicate a correction in expectations for the US dollar or a slight weakening of the impulse for this currency.

The first week of 2022 is expected to have weak dynamics. The US dollar is still the main favorite, and the balance of demand for risk has no direction yet.

On January 5, the minutes of the FOMC's December 15 meeting will be published, which adopted the accelerated exit plan from QE. It is possible that it will provide additional information on what criteria FOMC members intend to pay attention to when assessing their readiness to start a rate hike. On January 7, the employment report will be published. There is a little less attention to it since before the Fed's March meeting, two more reports will be published in February and March, which may completely change market expectations.

It is also necessary to note the ISM reports, which will be released on Tuesday, the EIA report on oil and petroleum products reserves on Wednesday, and the ADP report on employment in the private sector on Thursday. A meeting of OPEC+ ministers will also take place today, at which the position on the gradual increase in oil production will be confirmed.

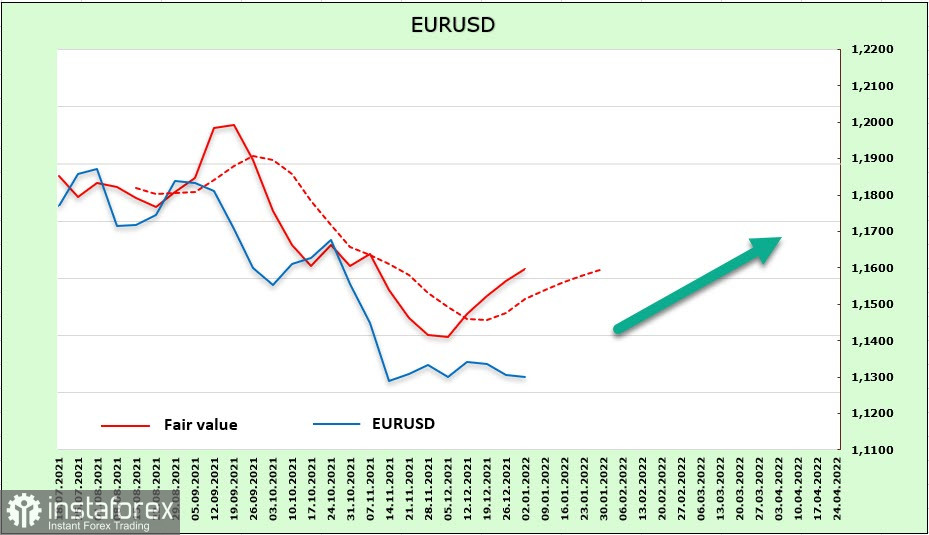

EUR/USD

The euro continues to consolidate within the limits of the bearish channel. Attempts of upward correction failed, but they can be continued since the global positioning in favor of the US dollar is currently undergoing correction. As follows from the CFTC reports, the liquidation of the long position in the euro was completed back in October. There has been no increase in the dollar's preponderance for more than two months, which is somewhat strange against the background of the FOMC's hawkish plans.

The estimated price is directed upward. This is due to the fact that, despite the ECB's cautious position, the yields of European bonds are growing in sync with the UST, and should have lagged if the markets were guided exclusively by the rhetoric of central banks. In any case, traders considered some additional factors.

The border of the channel is getting closer. The corrective growth will receive resistance around the 1.1400/20 zone, after which a downward reversal is more likely. However, it will be possible to speak confidently about this only when the estimated price shows signs of a reversal, which will mean a change in investor mood.

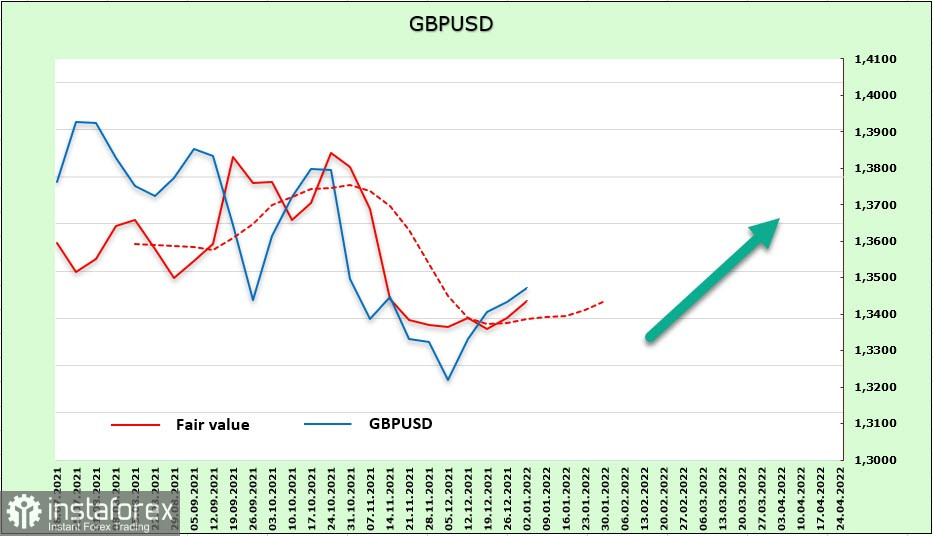

GBP/USD

The inflation growth in November forced NIESR to consider scenarios, in which inflation in 2022 will remain substantially above the target set by the Bank of England. According to this scenario, inflation will exceed 6% by April 2022 and remain at this level until October. In fact, the implementation of these expectations will mean a complete failure of the Bank of England's inflation targeting policy, the threat of loss of confidence, and the forced need to raise the rate when the economy is not ready for such a step at all.

The probability of this scenario developing looks high, which means that the BoE may raise the rate in sync with the Fed or even faster. This uncertainty has the character of a bullish factor for the pound and pushes it up.

The pound has corrected slightly higher than the euro. The target price is directed upwards, so the chances of continued upward correction remain high.

At the same time, there is still no exit beyond the borders of the bearish channel, and technically, the chances are small, since the short-term bullish momentum does not look strong. The border of the channel is around the zone of 1.3570/80, which is still the main target. Given the dynamics of the estimated price, it can be assumed that the chances of getting to this zone are not bad. It is too early to sell, but there is no reason to predict the exit from the channel to the upside yet. Information about the results of the 4th quarter, which can adjust the plans of the Bank of England, is needed.