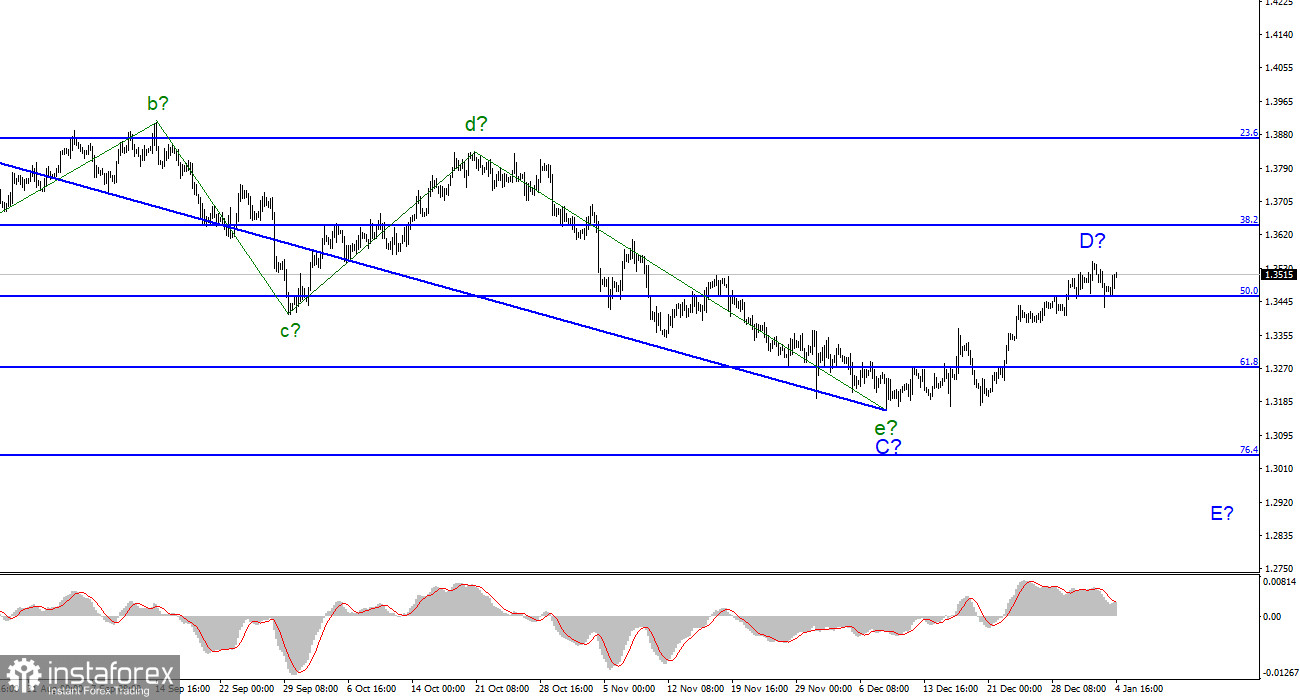

For the pound/dollar instrument, the wave markup continues to look quite convincing. In the last few weeks, the instrument has continued to build an upward wave, which is currently interpreted as wave D of the downward trend segment. If this assumption is correct, then the decline in quotes will resume after the completion of this wave, which may happen in the near future, given the size of the corrective wave B, which is visible in the picture below. Thus, the entire downward section of the trend may take an even longer form, and the GBP/USD instrument may continue to decline in the new year. At the same time, some confirmation of the intentions of the markets to resume sales of the British is required. Such confirmation can be a successful attempt to break through the 1.3456 mark, which corresponds to 50.0% Fibonacci. However, at the moment, an attempt to break through this mark is unsuccessful, and the internal wave structure of wave D can turn into a five-wave one. And this will mean that this wave will become impulsive and, accordingly, not D.

In the UK, they are dissatisfied with the results of Brexit.

The exchange rate of the pound/dollar instrument increased by 50 basis points during Tuesday. Thus, so far I cannot assume that the construction of the upward wave D is completed. In the UK today, the news background was extremely weak, so I cannot also say that British statistics caused an increase in demand for the pound sterling. Most likely, this is not the case. Judge for yourself: the most important report in Britain today was the business activity index for the manufacturing sector in December, which increased from 57.6 points to 57.9 points. Reports on the volume of net loans to individuals and the number of approved applications for mortgage loans also turned out to be higher than expected, but I do not remember when such data caused such a strong change in demand for foreign currency. And I want to remind you that the Briton has been in demand in recent weeks, even when there were no reports and news at all. Thus, I think that statistics have nothing to do with it at all. At the same time, a poll was conducted in Britain, the results of which, if not shocking, were unexpected. Most Britons believe that Brexit went much worse than expected and are dissatisfied with its results. The poll also showed that the majority of Britons who voted to leave the European Union in 2016 do not consider its outcome positive. 86% of Britons who voted to remain in the EU believe that Brexit eventually went much worse than they thought. Only 14% of respondents said that they were satisfied with the results of the rupture of relations with the European Union. Let me also remind you that there are currently many unresolved issues with the European Union, and Lord David Frost, who has been negotiating with Brussels in recent years, has resigned. Boris Johnson's ratings are falling.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the completion of the construction of the proposed wave D in the near future. Since this wave has not yet taken a five-wave form, I expect that a new descending wave E will be built. And it should begin in the very near future. Therefore, I advise you to sell the instrument with targets located near the calculated marks of 1.3271 and 1.3043, which corresponds to 61.8% and 76.4% by Fibonacci, if a successful attempt to break through the 1.3456 mark is made.