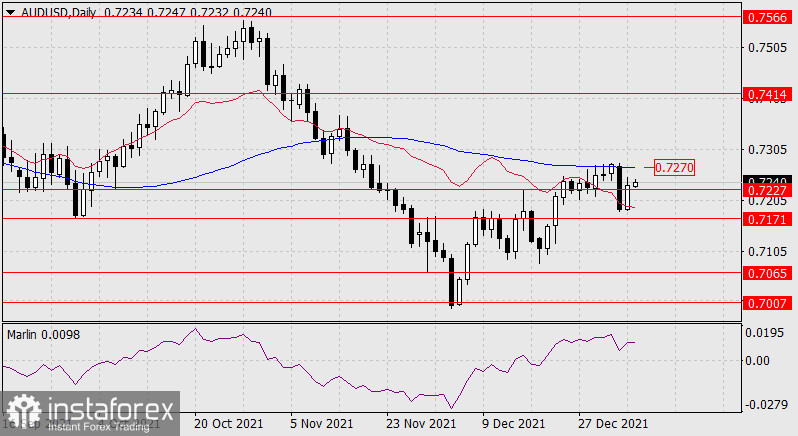

After the aussie's strong fall on Monday, it decided to rehabilitate on Tuesday - yesterday's growth was slightly less than 50 points, while the price went above the target level of 0.7227, which may indicate its intention to attack the daily MACD line at 0.7270. Consolidating above this line can seriously undermine the impending downward trend in the medium-term. The first condition that the market will not break the reversal pattern down is when the price returns to the area below the level of 0.7227. A decline below 0.7171 opens the 0.7065 target. And while this option remains the main one.

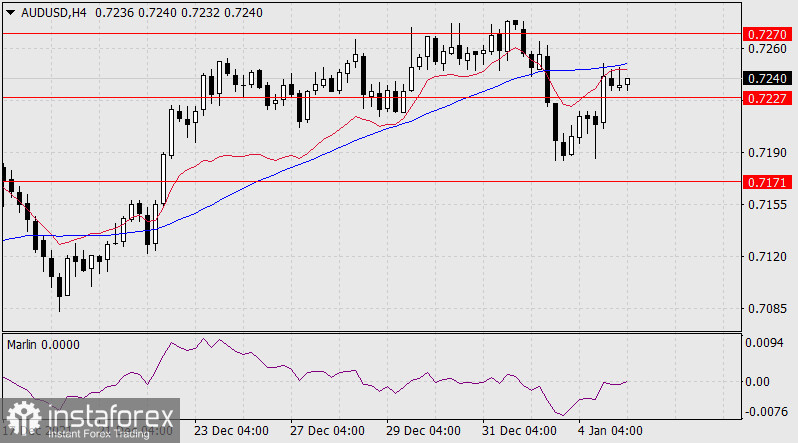

On the four-hour scale, the price, after rising above the level of 0.7272, met the balance (red) and MACD (blue) indicator lines. Consolidating above them will give the price an opportunity to attack the main resistance - the daily MACD line. Now the price is pondering - should it try to rise above the indicator lines of the H4 scale, if there is a complex obstacle in front of it with a thickness of more than 30 points? The Marlin Oscillator, which is currently struggling with the resistance of the zero neutral line, is in the same meditation. We are waiting for the development of events - either a return of the price under 0.7227 (the main variant), or an exit above 0.7270.