GBP/USD

Analysis:

The formation of the corrective stretching plane that began in November continues in the dominant bearish wave in the chart of the British pound since last February. Preliminary calculations allow traders to expect the rate to rise until the end of the correction up to the far resistance zone.

Outlook:

In the first half of the day, the pair could temporarily decline, not further than the calculated support. At the end of the day, a return to uptrend is expected. Breakout of the upper boundary of the nearest resistance is possible during the current day.

Potential reversal zones.

Resistance:

- 1.3670/1.3700

- 1.3560/1.3590

Support:

- 1.3480/1.3450

Recommendations:

Today, selling the British pound is extremely risky and may lead to losses. It is recommended not to enter the market during the upcoming decline and monitor buying signals around the support

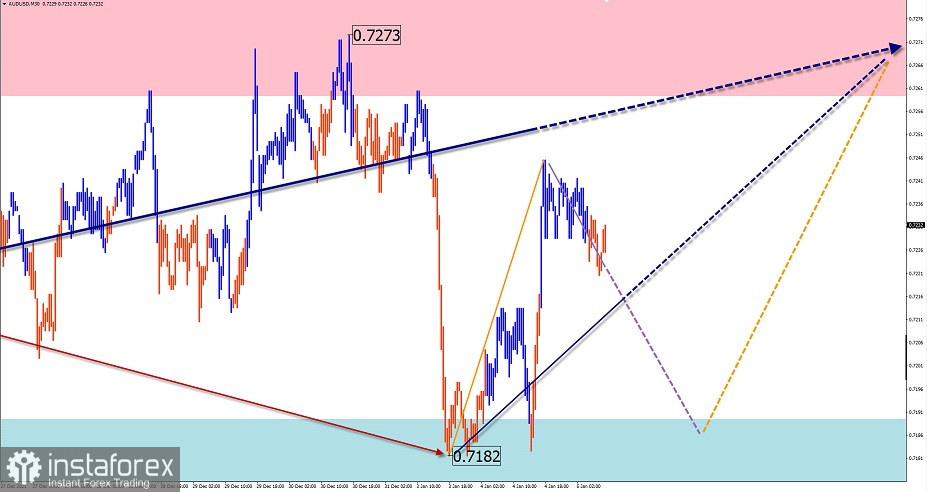

AUD/USD

Analysis:

In the chart of the Australian dollar, the bearish wave, setting the pair's main trend since last February, has recently ended. During recent weeks, the middle part (B) has been forming in a sideways flat in the upward wave that started on December 3.

Outlook:

A further general sideways sentiment can be expected in the next 24 hours. In the first half of the day, a downward vector with a decline in the price to the area of settlement support is most likely. At the end of the day, the probability of return to the main rate with the price growth to the resistance area is increasing.

Potential reversal zones.

Resistance:

- 0.7260/0.7290

Support:

- 0.7190/0.7160

Recommendations:

Today, trading the Australian dollar is possible only within individual sessions with a reduced lot. Buying from the support area is more promising.

USD/CHF

Analysis:

In the chart of the Swiss franc, the downward wave, formed last June, has not completed yet. Currently, the structure forms a shifting plane. The unfinished part dates back to November 24. The middle part of the wave (B), predominantly in the side plane, is drawing to a close within it.

Outlook:

Today, predominantly flat movement is expected on the pair's market. In the first half of the day, an upward vector with the price climbing to the resistance area is more likely. In the second half of the day, a reversal and a downward trend of the instrument is possible.

Potential reversal zones

Resistance:

- 0.9190/0.9220

Support:

- 0.9120/0.9090

Recommendations:

Today, trading the Swiss franc is possible only within the intraday trading session in a small lot. It is advisable not to buy, focusing on the sale of the instrument from the resistance area.

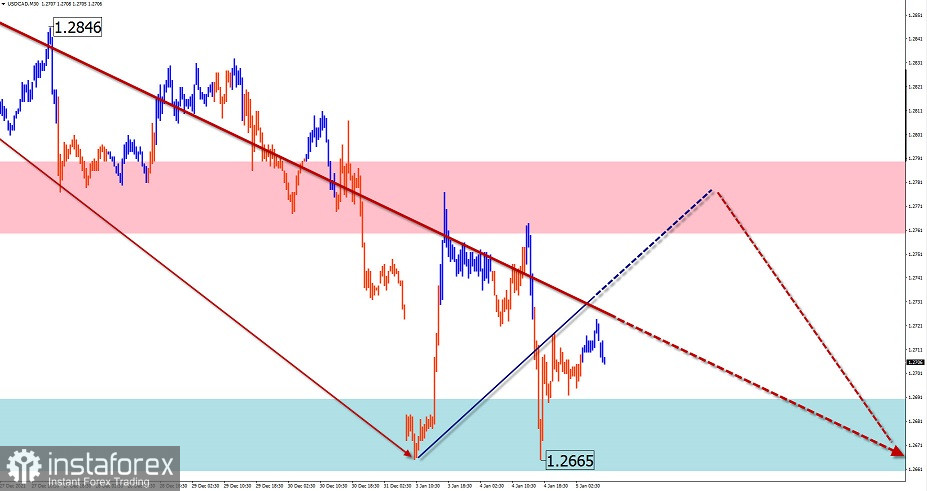

USD/CAD

Analysis:

The Canadian dollar has been forming an ascending wave since last May. It forms a correction in the weekly chart. Currently, the structure of the wave is not complete. The price has corrected downward over the past two weeks. The upward movement from January 3 has a reversal potential.

Outlook:

During the next 24 hours, the price is expected to move from the support zone to the levels of calculated resistance. With a trend reversal to the support area, a short-term piercing of the lower boundary of the price corridor is possible.

Potential reversal zones

Resistance:

- 1.2760/1.2790

Support:

- 1.2690/1.2660

Recommendations:

There are no conditions to sell the Canadian dollar today. It is recommended to monitor the emerging signals to buy the instrument in the area of calculated support.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!